TransUnion is an America-based credit reference agency (CRA) that operates in the UK. If you apply for credit in the UK, such as through a loan or credit card, the lender might look at your credit file and credit score on TransUnion. If they do, they’ll use the information they find to make a decision about whether they think you’ll be a good borrower or not.

In this article, find out who TransUnion are, what information they have about people and what financial companies use that information for.

For guide main page, click here:

The History of Transunion

TransUnion was originally founded in 1968 as a holding company, which is a company that buys shares in other companies. Nowadays, however, TransUnion is one of the three biggest credit reference agencies in the world. Their modern day headquarters are in Chicago, Illinois, and TransUnion has operations all over the world. They also have an annual revenue of billions of dollars and are critical to credit-related activities all over the world.

As well as providing information to lenders about prospective borrowers, Transunion also does a lot to make credit reports directly available to consumers. By helping people find out about their credit histories, TransUnion enables people to improve their credit scores and manage their money better.

You can check your Transunion credit score and get information about your report for free with Credit Karma.

What information do TransUnion have about people?

TransUnion gather information from financial institutions, utilities service providers, local authorities, courts and insolvency services. The company receives billions of updates on people every month and stores information on a billion people, globally. If you’re an adult in the UK and you’ve ever taken out credit, then there’s a very good chance that TransUnion have a made a credit file for you and gathered information about you.

Here’s the information TransUnion keep about people:

TransUnion uses your identifying information, such as your name, date of birth or account information, to allow businesses to verify your identity when they deal with you. They also use it to make sure other information they keep about you is accurate.

In the USA the employment information in a TransUnion report shows who a person’s current employer is and how long they’ve been at that company. They may also gather salary information. The amount of money a person makes in comparison to how much they spend has an impact on their credit score. This employment information has not yet been introduced in the UK yet. However, it may be in the near future.

TransUnion provides information about accounts you have, such as current accounts, credit cards and loan accounts. This includes information about payments you make towards creditors. Matters such as whether you have failed to make payments, made late payments or had any similar problems repaying money are all recorded.

Court-related documents and statements are often given in credit reports from TransUnion. These include reports on bankruptcies, court judgments, claims against a person’s property and more.

This includes financial ties you’ve had to other people, such as through a joint mortgage. As well as this, connections you’ve had to previous addresses and other names you’ve been known by are reported.

Records of any organisations that have requested to see a copy of your credit report within the last two years will be on your file. This can happen for various reasons. However, it often happens when someone applies for credit. One useful thing to know is that if you make a number of applications for credit, this will show up on your credit report and could be taken as a sign that you’re struggling financially.

Some points about TransUnion credit scores

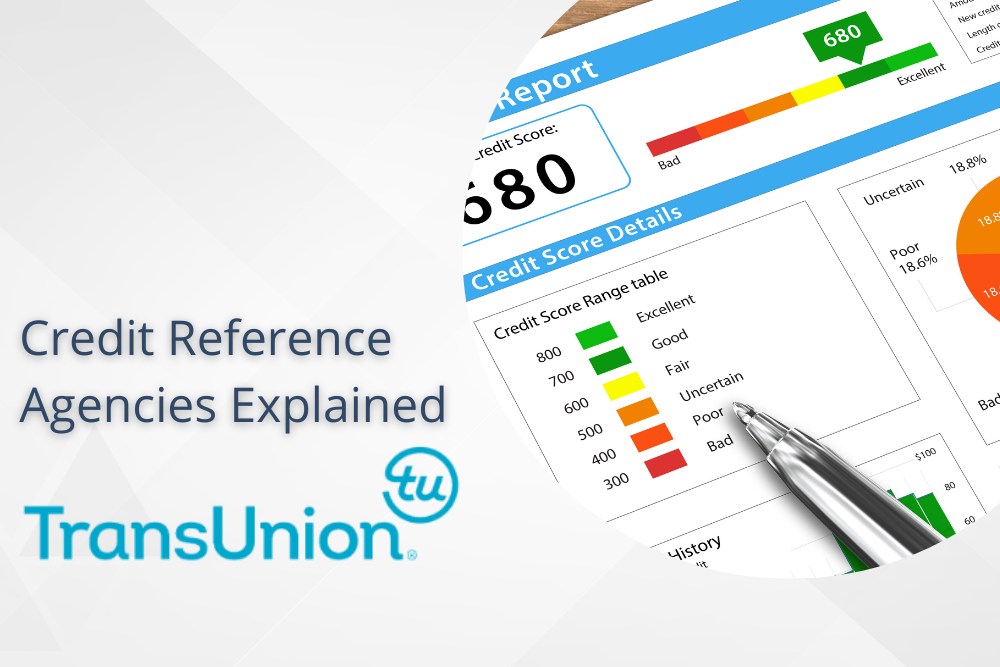

TransUnion uses a scoring system that gives scores for people in a range of 300 to 850.

Within the scoring range, scores are banded into the following categories: very poor (300 – 600), poor (601 – 660), fair (661 – 720), good (721 – 780) and excellent (781 – 850).

TransUnion calculate their scores by taking several factors into account:

- Payment history – This is a crucial part of your TransUnion credit score. Payment history is also important to all credit scoring agencies. If you’ve been good at making payments in the past, you’ll be scored higher. If you have a history of failing to make payments, you’ll have a lower score.

- The age and mix of types of credit you have – The age of the credit accounts you have and the types of accounts you have is measured. The older and more mixed your accounts are, the better. If you have any old accounts you’d like to close, it may actually be wise to keep them open. They could be helping your credit score.

- Your credit utilisation – This is the amount of available credit you have that you’re actually using. If you are using a large amount of your available credit, this will have a negative impact on your score. It’s a good idea to aim to only use up to 35% of your available credit if you need to improve your credit score.

- The total balance owed on your accounts – This is simply the total amount you owe in credit. The more you owe, the more likely you are to struggle to pay off new debt. Your score will be lower as a result.

- The amount of new credit you have – If you’ve recently taken on new credit, your credit score will be negatively impacted for a short time.

- Total credit available to you – Generally speaking, the more credit you have available to you, the better. What is often more important, however, is credit utilisation. Having a large amount of available credit often helps to reduce a person’s credit score just by decreasing their credit utilisation.

The way that TransUnion generates credit scores is based on the VantageScore® 3.0 scoring system. This system uses a weighted formula that takes into account the above information as it applies to every person to produce an individual credit score.

Overall, TransUnion generates credit scores in a similar way to other credit reference agencies. Other agencies might give more importance to certain things in their equations or use different information. However, they use very similar processes.

Read about what makes a good TranUnion credit score here.

What businesses get from TransUnion

Banks, credit unions, short term loan providers and other financial institutions use TransUnion’s credit report services to help them do business. The key things credit reference agencies help these businesses to understand are who they’re doing business with, what they can responsibly lend to an applicant and how they can better target their efforts to meet consumer demands.

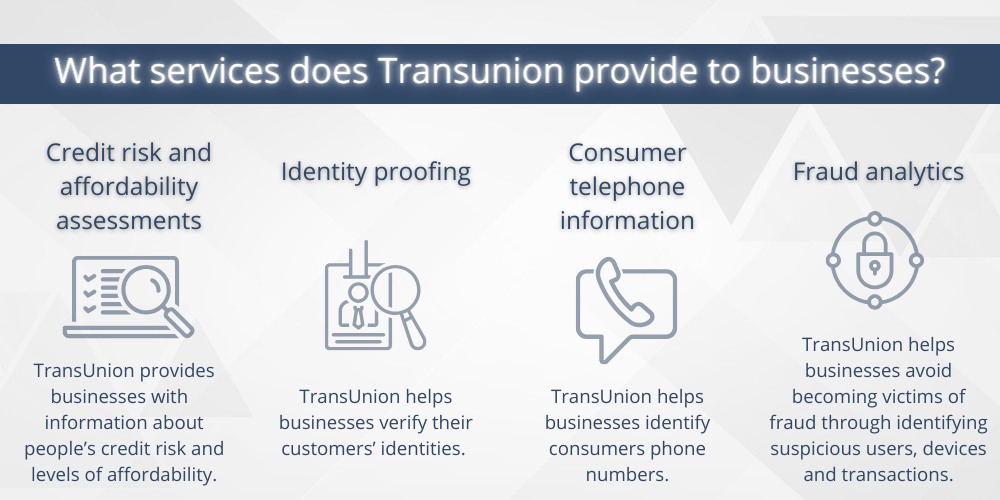

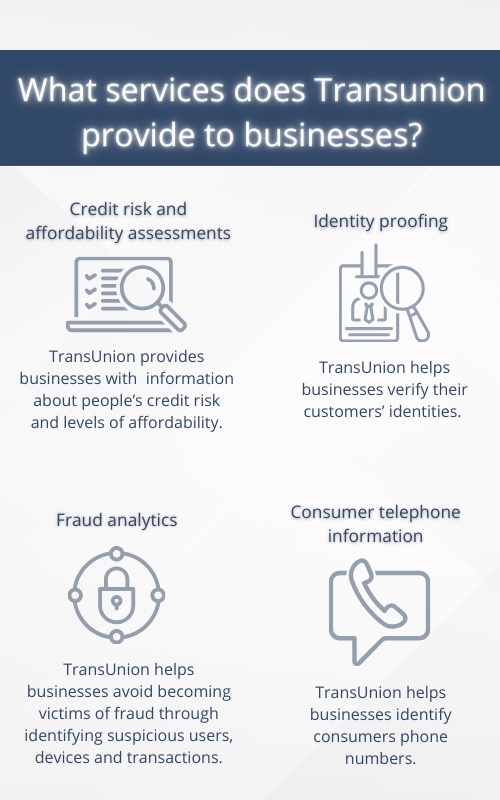

The services TransUnion provide include:

- Credit risk and affordability assessments – The main service that TransUnion provides is information about people’s credit risk and levels of affordability. If you apply for a payday loan or another form of credit, the lender might go to TransUnion. They’ll get information about how much of a credit risk you are and what level of affordability you have.

- Identity proofing – Businesses can verify their customers’ identities through TransUnion. This helps them to do business with more confidence and to avoid becoming victims of fraud.

- Consumer telephone information – TransUnion help to identify consumer telephone numbers for lenders so they know how to get in touch with their customers. As well as this, TransUnion also offer analytical services that help businesses target consumer contacts more effectively.

- Fraud analytics – TransUnion help businesses to avoid becoming victims of fraud. Using sophisticated analytical techniques, TransUnion are able to identify suspicious users, devices and transactions.

All the services that TransUnion provide help financial businesses to operate more effectively. In turn, consumers are able to get the best loans, credit cards and other financial products.

Predicting peoples’ actions

Businesses that lend money to people, such as banks and short term lenders, use TransUnion’s information to pre-screen customers before giving them credit. The idea is to try and predict what the likelihood is of a potential borrower repaying money if they lend it to them. This is an important and sometimes difficult thing that lenders need to do, and they go to credit reference agencies like TransUnion for help.

The more detailed the information is that lenders can get, the easier it is for them to make decisions.

With the information TransUnion provide, lenders can review potential consumers based on their borrowing history and their current financial situation. Banks and other lenders can then improve their success rates, run their businesses more successfully and give the right loans to the right people.

As well as helping lenders to decide if they will lend money at all, the information also helps these businesses to decide how much they can lend and under what conditions. On some occasions, businesses can also use information from credit reference agencies to better understand how to market their services and solutions. They might also use information to decide how to interact with customers as well.

One interesting thing to know about TransUnion is that lenders that use them can get daily updates on anything that could affect their borrowers’ ability to repay credit. Experian and Equifax, on the other hand, only update information on consumers every 30 days.

Information from Citizens Advice about how lenders use the information on your credit report is available here.

Fico risk scores and other TransUnion risk scores

The standard credit scores that TransUnion provides are based on the VantageScore® 3.0 scoring system. As well as giving these scores, TransUnion can provide financial businesses, such as credit unions and payday loan providers, with FICO risk scores for potential borrowers. A Fico risk score is an alternative credit score that focuses on establishing what the likelihood is of a borrower failing to repay a loan.

TransUnion provides Fico scores based on the Fico Score 9 risk scoring model. As with a VantageScore® 3.0, factors such as a person’s payment history, credit usage and credit types are taken into account. Information about bankruptcies or other judgements are also taken into account. The score looks closely at the potential risk a lender faces from a person who wants to borrow money from them.

Other TransUnion risk scores

Here are some of the other risk scores that TransUnion provide to lenders:

- Bankruptcy score – A TransUnion bankruptcy score is used to assess the risk of a person making a bankruptcy declaration within the next 12 months. It includes information such as payment ratios (i.e. monthly income compared to monthly debt payments), total balances and shifts in credit utilisation. Although bankruptcy scores have been around for a long time, few people actually know about them.

- HELOC score – A HELOC score reviews home equity lines and loans that people hold based on factors such as how they originated and how they’ve been paid off. This score identifies people who are more likely to open new home equity accounts. The aim is to help lenders to target their marketing better.

- Recovery scores– These are used to determine which accounts someone who owes money is more likely to repay. Lenders use the information in a recovery score to decide which accounts to pursue first and what the most cost effective way to approach a debtor will be.

Risk models are used by credit unions, payday lenders, banks and other similar institutions to assess how reliable potential borrowers are and to make other decisions. Lending money is obviously a serious business, and so lenders are always keen to take advantage of opportunities to improve the way they operate with techniques like mathematical modelling.