Full Guide to Managing Family Finances – Chapter 13

Look ahead towards your most financially successful year yet. Read on with Cashfloat and learn how to make a budget with these great budgeting tips and look towards a more financial and healthy year in 2024.

- Reflecting on the previous year’s budgeting

- Writing down your budget

- Tracking your income and expenditure

- Accounting for the small and unexpected items

- Including something in your budget to save for

How to plan a budget in the New Year

Reflecting on your previous year’s budgeting is essential to figure out where you might have gone wrong and what aspect of your budgeting needs improving. By reflecting, you can also see where you have gone right in your budgeting and do the same this time around. Here are 5 essential steps for setting up a new budget:

- Write Down Your Budget

- Track Your Income and Expenditure

- By creating and sticking to a budget, you can add to savings

- Tackle your debts

- Look Over Your Budget Regularly

- Am I managing to pay my bills on time?

- Do I have money left at the end of the month that I could put towards savings?

- How can I save more?

Many people say they don’t have time to work out how to make a budget and when they do try to budget, they think in their head how they will go about it without writing it down. This is no use. It is pointless. Budgeting must be done with a spreadsheet or pen and paper. Moreover, you may find it suits you to use a bullet journal and budget in there. ou can find a useful budget planner online at The Money Advice Service. Your budgeting sheet should be clear to use, and you should be able to refer back to it weekly.

Keeping track of how you spend your money is a great habit. But it’s not easy. You may consider using a smartphone app to track your spending. Some banks and banking facilities have these services as part of their product. There are many budgeting and money saving apps available for example cleo, and they enable you to track every transaction as you make it. You can record it in both the account and the category so you can stick to your budget and recognize your spending weaknesses.

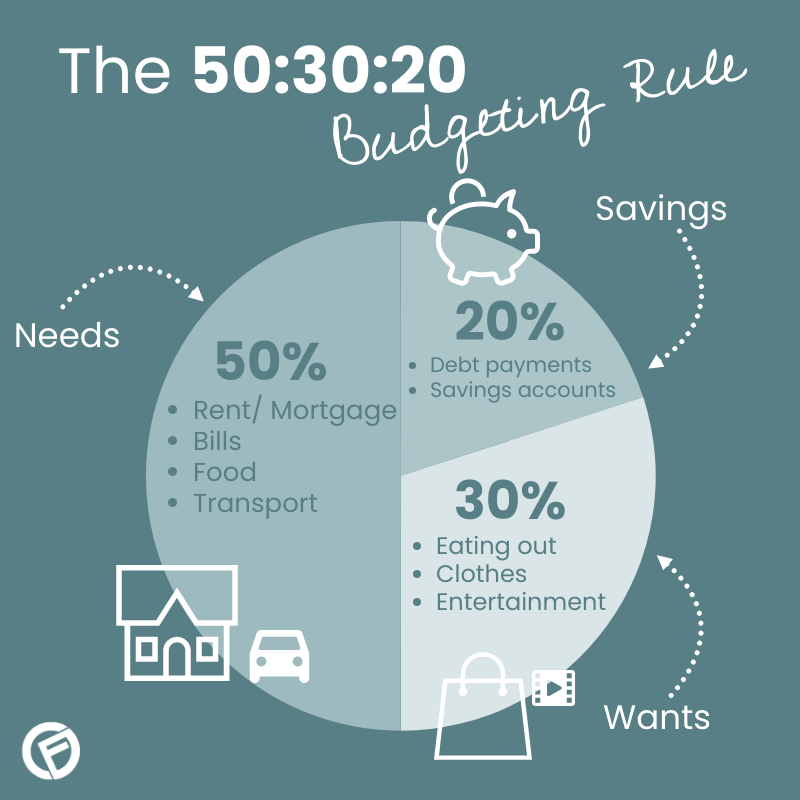

Expenditure is all the ways your money is spent. This includes rent, travel, bills, food, gas and car payments, child care, internet and TV and loans and credit cards you need to pay off. Additionally, write down your weekly, monthly and yearly expenditure in separate columns.

Also keep track of your income. Think about all your income including your partner’s income (if you have one). Income includes any benefits you may be receiving. Do not include any bonuses you may receive at work or presents you may get.

Once you have written down all your income and expenditure calculate them both to ensure that the income is more than your outgoings.

Plan For small but unexpected expenses

Everyone has unexpected expenses that crop up from time to time. There is no reason to have to go for a loan for bad credit when a small unexpected expense comes up. Therefore, when drawing up a budget, you should think about these small expenses and account for them. A lot of these expenses are not truly unforeseen. Everyone knows that holiday gifts for your kid’s teachers will need to be given and you will need to buy costumes for Halloween, so these items should be on the list of your yearly expenses to avoid having to take out an instant loan when these expenses crop up.

Sticking to your budget is often tricky, but once you have set yourself a monthly spending limit, and one you start tracking your transactions, sticking to your budget will become a lot easier. The goal is that you will start spending less than you earn and the surplus you should be able to put into savings.

Most of us can save. Saving money and being careful with your spending is a mindset. Regularly putting money away in a savings account can be part of your budget. Saving up for the future can be easier if you have something you are saving up for. Many people have something they wish they could buy. Having something in mind can become an incentive for you to put money away regularly. In this way you won’t require the services of short term lenders.

You should be saving at least 10% of your earnings. This money will accumulate quicker than you think. If you can, you should also consider saving this amount in addition to your pension contributions if you can afford it. By establishing a savings habit now, you are creating big opportunities for what you can do during your retirement years.

| Here are some examples of short-term and long-term things to save for: | |

|

|

|

|

|

|

|

|

|

|

|

|

Getting out of debt can be tough but it’s another key step to taking control of your finances. Begin with your highest-interest accounts, while also paying the monthly minimums on accounts. By really focusing on getting out of debt you can reduce the amount you pay in interest, and you can put the money you’d otherwise put toward debt payments somewhere else. Making a debt payment plan and then making a commitment to stick to it all year long will make a big difference to your financial future. Being debt-free again will feel great. You will have more freedom to spend money on the things you want and more peace of mind. While it may take some sacrifice to make it happen, it is worth the effort.

Everyone has some items they can do without. Your job is to identify these non-essentials and try and do without them. In addition to this, every time you go shopping think of 1-2 items you will manage without. In this way, you won’t need to take out a small loan UK, and you will learn how to make a budget in a healthier way.

This is one of the essential aspects of budgeting. At the end of every month, sit down and see how well you are doing. You may need to adjust your budget according to your growing needs and income changes. Additionally, there are some questions you can ask yourself when reviewing your budget:

New Year budgeting tips

Here we present you with some top tips to help you follow through on your resolutions!

- Establish incentives – It is very important to reward yourself with something once you have fulfilled a target. Regardless of what the payoff is, incentivising to accomplish an aim is an excellent way to be sure you follow along with your financial settlements!

- Involve other people – Keeping yourself answerable is sometimes insufficient. Let family and friends know your New Year resolutions and financial goals, and they’ll also hold it. This may give you the excess reinforcement required to be successful!

- Make it a habit – As soon as you receive your systems set up, turn them into a habit. For example, make it a habit to verify your invoices or make a minimum payment on a particular date. After a person forms a habit, it is difficult to break!

- Set up automate and reminders – To make sure you don’t overlook obligations and financing, set automate and reminders. In case you have reminders set up, they will be pretty difficult to dismiss. The same is true for automatic payments, which you may set on credit cards or cards to minimise the danger of missing a payment or destroying your credit rating.

Conclusion

Writing a budget entails time and effort. However, as you can see, there are numerous benefits to it. Always begin your budgeting for the year by reflecting on the year before and noticing how well you have managed your money. Pat yourself on your back when you have managed to put away a nice amount of money into your savings. On the other hand, living on a budget doesn’t mean you should feel lacking. On the contrary, you will be happy you are able to manage with less and know where your hard earned money is going.

Chapter 12:

What do people spend their household budget on?

Conclusion:

Everything else you should know about family finance