Want to clear a debt management plan fast? Here are some ideas to get you to the finish line quicker. Read on with Cashfloat.

- You may be able to finish your DMP earlier than predicted by increasing your monthly payment.

- You may be able to make a full and final settlement agreement, and have any remaining debt written off.

Western Circle Ltd trades as Cashfloat to provide short term loans in the UK. As well as helping people overcome short term financial difficulty with our loans, we try to help people to understand a range of financial issues through our blog.

In this article, which is part of our guide to debt management plans, we will discuss whether there are any ways to speed up a debt management plan.

Is it Possible to Clear a Debt Management Plan Early?

Being on a debt management plan (DMP) can be difficult. The restraints that they put on people’s budgets often leaves them wanting to finish their DMP as soon as possible and many people ask if there is anything they can do to finish their plan more quickly.

It is only possible to finish a plan more quickly by increasing the amount that you pay. This can either be done by increasing monthly payments or, when a lump sum of cash becomes available, by making a lump sum payment. In some cases it is possible, with a lump sum, to pay less than the full amount that you owe if you are able to reach a full and final settlement agreement with a creditor. Read on to find out more.

Increase Your Monthly Payments

Where a lump sum of cash is not available, it is only possible to finish a debt management plan more quickly by finding ways to increase your monthly payments. This can either be done by increasing your income or by spending less money, so that you can allocate more to your debts.

Make Savings

If you are able to spend less money on your living expenses, you will be able to make larger payments towards your debt management plan. When you budget yourself for a DMP, with the help of your DMP provider, you will work out how much money you need to spend on your priority debts and living expenses before you make payments towards your debts. All of your spare money will go towards your debts. If it is possible to cut back on the amount that you keep for living expenses this will help you to clear your debts more quickly.

It may be possible to make savings by carefully monitoring how much your household spends and finding ways to spend less money. Common ways to save money are by:

- Taking cheaper options, e.g. cooking at home rather than having a takeaway

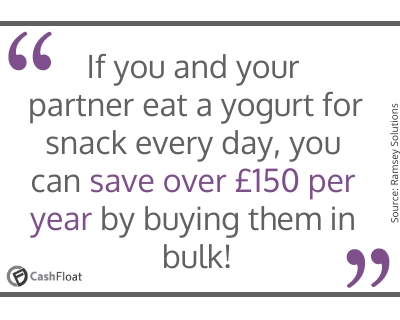

- Bulk buying household goods

- Cancelling unused subscriptions

- Shopping around for cheaper deals

For more information on what it is like to live on a debt management plan and for some other suggestions about how to save money, go to Chapter 15 of this guide. While it is possible to budget yourself more effectively and to allocate more money to your debts, it is advisable not to push yourself too hard.

Don’t Budget Too Hard and Remember to Keep Some Emergency Money

While it may be tempting to save as much as possible and to try and clear a debt management plan as fast as possible, it is often wise to make sure that you are not too restrictive in how much money you keep for your living expenses. It is still worth making sure that you have a reasonable quality of life and that you are not pushing yourself too hard. This is particularly true if you have a family, as living overly frugally may be something that other family members do not expect.

Remembering to save some money for emergencies and for purchases that you only make infrequently, such as car repairs, is also essential. If you forget to save money for a broken down car or a faulty central heating boiler it could cause you problems.

Increase Your Income

The other obvious way to increase your monthly DMP payments is by increasing the amount that you earn. If your income is unlikely to increase through promotion or by another means, it may be possible to work longer hours in order to earn more money. As with budgeting yourself tightly it may be tempting to work very long hours in order to clear a debt. While extra income will always help, it is a good idea not to push yourself too hard.

Make a One-Off Payment to Your Debt Management Plan

One way that a debt management plan can be cleared quickly is when a lump sum of cash becomes available. Redundancy payments, bonuses, donations from family and friends and a variety of other things can give someone access to a lump sum of cash. It’s possible to raise a lump sum by selling assets of yours if you have any available. If you do have a lump sum available, then you should speak to your DMP provider and see what they recommend is the best thing to do. In some cases, people are able to clear a debt without paying the full amount through a full and final settlement offer.

Repay Debts in Full

Some people are lucky and come into enough money to be able to repay their debts in full. While it is uncommon, this does occasionally happen. In some situations, the lump sum which is available may be enough to pay off one or some creditors in full, but not all of them. It is possible that favouring some creditors by repaying them in full, while not paying more to other creditors, will cause problems. This is because the creditors who do not receive anything will expect to do so. While it is possible to repay an individual debt, it is always a good idea to see what your debt management plan provider suggests. Often, in this situation, it will either be better to distribute the money fairly among your creditors or attempt to make full and final settlement offers.

Make a Payment Into Your Debt Management Plan

Where the lump sum is not big enough to clear your debts, as we just mentioned, your DMP provider may suggest distributing it among your creditors. This is likely to be the case if you do not have enough to make any full and final settlement offers either or if they are likely to be rejected for any reason. After you make a lump sum payment to your debt management plan provider, they will distribute your money fairly among your creditors. While this will not finish your debt management plan, it will reduce the amount of time that it will run for.

Make a Full and Final Settlement Offer

Under a full and final settlement offer you will offer a lump sum that is less than the full amount that you owe to a creditor on the condition that they write off the rest of the debt. In order for a creditor to accept a full and final settlement offer, you will normally need to prove to your creditor that what you are offering is all that you can afford. Creditors will often be prepared to accept less than the full amount, as long as what you are offering is reasonable.

As with repaying debts in full, it is possible that using a lump sum to clear one debt while you make no extra contributions to other debts may cause problems. Full and final settlement offers can be a great way to simplify your debts and will get you closer to the end of your DMP, however, it is worth checking with your DMP provider before you decide to make any full and final settlement offers.

A Word of Warning… Avoid Making Small One-Off Payments

One of the downsides to debt management plans is that they are an informal (non legally binding) agreement. Creditors are allowed to contact debtors outside of the plan as there is no legal requirement for them not to do so. On some occasions, creditors continue to contact debtors while a DMP is in place and make requests for payment outside of the plan. It is important that you do not bow to this kind of pressure and only make increased payments through your DMP when you are sure that you can do it regularly or if a lump sum of cash becomes available. Once you give in to pressure to make small payments, it is likely that creditors will continue to apply more pressure. On top of this, they may believe that you have more money available and request that you make higher payments into your debt management plan.

In Summary…

Being on a debt management plan can be difficult and the constraints they impose on people’s budgets can leave them desperate for them to end. While it is possible to speed up a DMP by making higher payments, if you are either able to cut back on expenditure or increase your income, it is wise not to push yourself too hard to get to the end of your debt management plan. Payment commitments made over-eagerly may prove difficult to sustain in the long run. People who come into a lump sum of cash can use this money to shorten the length of their DMP or, in some cases, to finish it. If you do have a lump sum available it is worth exploring your options and discussing your situation with your DMP provider.

Chapter 19:

Everyday Living With a Debt management Plan

Chapter 21:

How to Get Free Debt Advice in the UK