We have already examined some of the factors that caused the UK economy to fail. In this article, Cashfloat, a trusted short term loan direct lender, will zero in on credit card debt and its effect on the UK economy.

Story highlights

- Prior to September 2012, consumers were paying back more than was being borrowed.

- The banks and the government have said that lessons have been learned from the financial crisis.

Most economies rely on consumer spending to create growth. This was certainly true during the early 2000s. Although responsible spending can help with economic growth, too much credit card debt that people can’t repay harms the economy. When people overspend recklessly, they have to cut back drastically to compensate. This sudden drop in spending causes the economy to shrink. Businesses suffer because consumers aren’t buying, and companies start to lay off workers they no longer need. Unemployment rates rise, and citizens tighten their budgets further, buying only the very essentials.

The Rise in Credit Card Debt in the UK

When people use credit cards for everyday living expenses, it is a sign of a failing economy. Credit cards come with high interest rates which make them unsuitable for paying bills or even buying groceries. When people spend so much that they can’t pay back their credit card debt they need to drastically reduce their standard of living. Unfortunately, this can only result in a depression in the economy.

The Effect of Credit Cards on the Economy

Credit cards played a major role in the UK financial crisis. Newspapers cited numerous cases of unsustainable credit card debt in the UK. Additionally, debt counselling agencies formed to help people with serious debt problems. Experts point to credit cards as one of the main factors in the UK financial collapse.

Following the great credit crunch, there have been some major changes in how credit cards are issued. Banking regulators are much stricter in credit card approvals and spending limits. Many feel that this was the appropriate response to the unsustainable credit card debt that drove the economy into the ground. On the flip side, however, these regulations made credit much less available to UK consumers who really needed it. This pushed many UK citizens to apply for payday loans online.

Will Credit Card Debt Levels Rise Again in the UK?

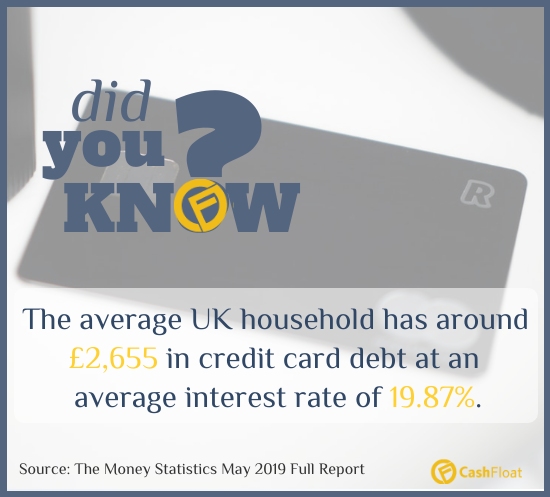

Will UK consumers learn from past mistakes? Or will credit card debt rise to dangerous levels once again in the UK? Sadly, it seems that we have quickly forgotten the consequences of overspending credit. More and more UK citizens are maxing out their credit cards and the level of average household debt in the UK is rising to record-breaking numbers.

As we explained before, the economy depends on consumer spending in order to thrive. So, in the short term, this increased spending actually boosts the economy. However, if most consumers are overspending credit and don’t have the means to pay it back, this growth is very short-lived.

The Bank of England has been issuing warnings about the number of ordinary people who are relying on credit. Once again, a wave of ‘deals’ for 0% credit on balance transfers is tempting unwary consumers to spend more than they can afford. Aggressive marketing tactics and “keeping up with the Jones'” means that more consumers are turning to unsecured borrowing than ever before.

Before September 2012, consumers were paying back more than they were borrowing. Since that time, however, there has been a reverse in trends, with borrowing increasing every month. Government sources claim that low earnings have resulted in more consumers covering the gap between wages and bills by using credit cards. As austerity measures begin to bite, more ordinary people will turn to unsecured credit to fill the new gap in their finances.

The banks and the government state that the UK has learned its lesson from the financial crisis. However, as more UK citizens rely heavily on credit cards and unsecured borrowing, there is a real danger that credit cards could lead to more financial problems for the most vulnerable people in our society.

A Summary of the Effect of Credit Cards on the Economy

The magnitude of the financial crisis of 2008 was something that no one could have predicted. Many point to the United States and blame them for starting the domino effect that collapsed the world economy. However, loose monetary policy and unsustainable mortgages were also to blame.

One of the most notable factors leading up to the financial crisis was the effect of credit card overuse and debt in the UK. The impact of millions of consumers overspending credit was one of the final blows to the already shaky economy.