There were many global effects of the credit crunch – and it isn’t just low-interest rates. Cashfloat, a direct lender, explores the international repercussions of the crisis.

Story highlights

- The global effects of the credit crunch

- How lenders dealt with bad debt

What were the global effects of the credit crunch?

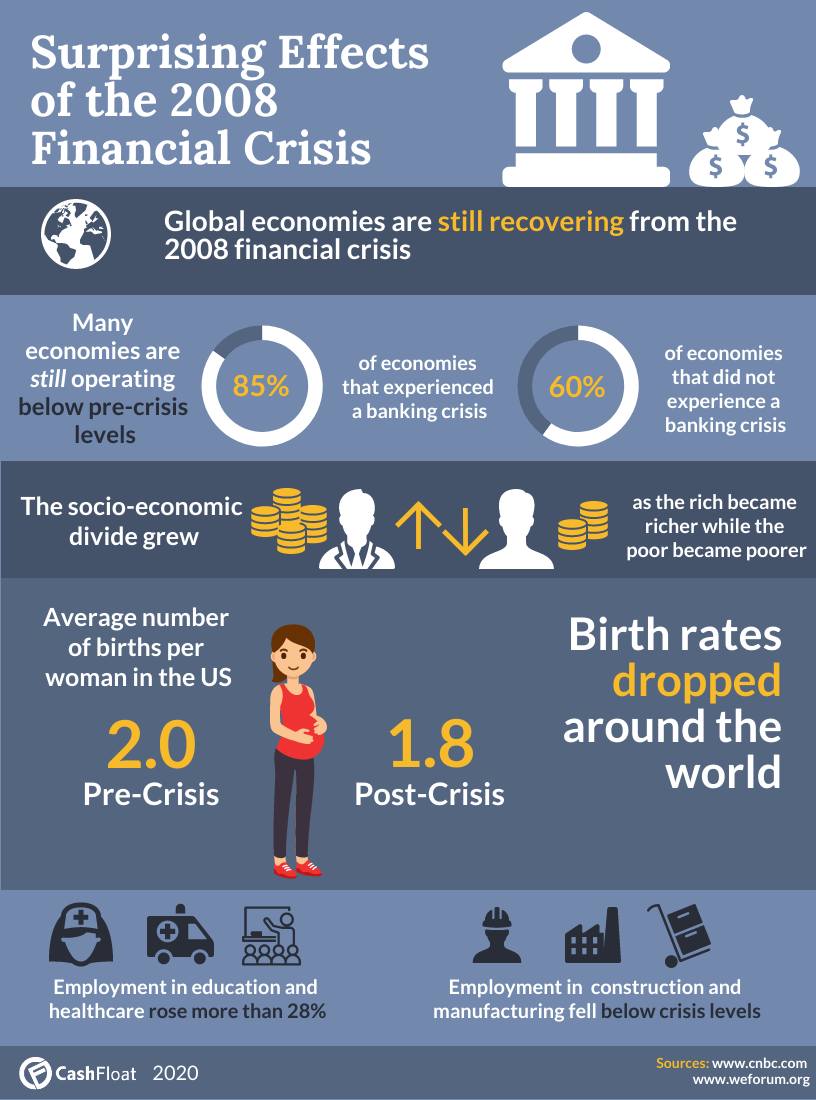

In the aftermath of the financial collapse, the far-reaching global effects of the credit crunch began to emerge. The easy credit scenario involving all kinds of financial institutions fell in a fantastic domino effect that spread throughout the western world. Excessive sub-prime mortgage lending had fueled a false rise in house prices. This dangerous lending cycle created an economic model that was doomed to fail. When the bubble finally burst, the ripple-effect reached every corner of the globe.

Low Interest Rates in the UK

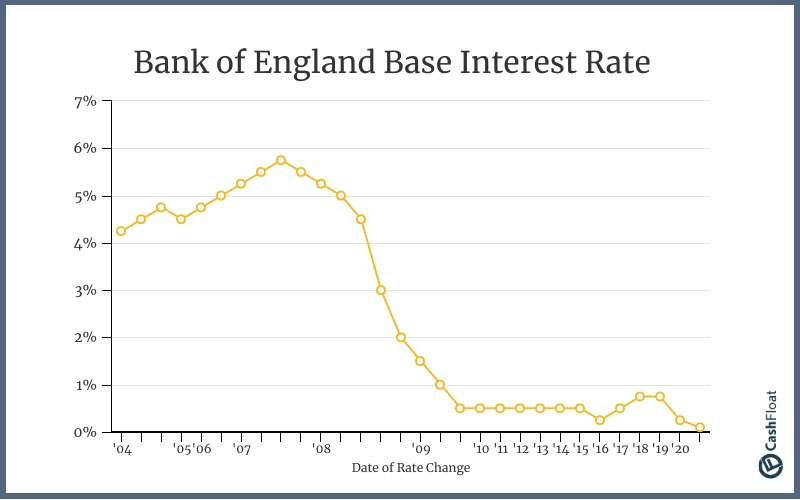

In an effort to boost the post-crash economy in the UK, the Bank of England lowered the base interest rate to unprecedented levels, dropping it from 5.5% in 2007 to 2% in December 2008. They further lowered the rate to 0.5% in 2009, which remained the base rate for nearly ten years. In 2018, the base rate rose to 0.75%, but in 2020 dropped to 0.25% and again to 0.1% due to the coronavirus pandemic. Significantly lowering interest rates along with the government’s strategy of QE helped the UK economy benefit from some growth.

The Effect on Housing

The housing market was one of the hardest-hit in the financial collapse. One of the significant global effects of the credit crunch was home value dropping by nearly 20% both in the US and the UK. Many people who had taken out 100% value mortgages before the crash were left in negative equity. They, therefore, could not downsize or re-mortgage to get a better deal.

Lowering Debt

During the years since the financial crisis, ultra-low interest rates have still not enabled the average family to lower their total debts. Eventually, the base interest rate will rise. When rates do increase, it will mean:

- Higher mortgage repayments,

- Higher credit card repayments,

- No chance of getting out from the burden of debt for many years to come.

This is the underlying problem hidden by the very low interest rates since 2008. This may bring another round of house repossessions and poor credit ratings that will have a severe impact on many UK families for years to come.

Lack of Available Credit

Once borrowers started to default and house prices began to fall, the available credit throughout the US and the western world ran dry. People were concerned about the far-reaching effects of the bank run in the UK. These included a large bailout for the big banks in the UK, the failure of Lehman’s and the propping up of the financial giants of Fannie Mae and Freddie Mac in the US.

Banks published their losses causing a drop in reserves. Many household bank names like Citibank, Morgan Stanley and Merrill Lynch were declaring no dividends for shareholders. The era of cheap and plentiful credit had reached its end. The colossal debt became too large to sustain, but the consequences were more significant and lasted longer than anyone could have foreseen.

Lenders Cope with Bad Debt

The major difference between this credit crisis and those of previous years was the sheer scale of bad debt that lenders held. As much as banks had securitised their debt, i.e. sold off to other institutions, no one was exactly sure who owed what to whom. The problem with securitisation is that banks sold the same debt too many times. This created a situation in which several banks reproduced the value of the finance.

The number of times that banks sold the original debt became known as ‘slicing and dicing’. Banks thought this would help downsize the risk of debts going bad and having an impact on any one financial institution. However, this repeated transferring of bad debts caused confusion in the financial world. After the credit crunch, every financial transaction became suspect.

The uncertainty of the situation motivated banks to freeze all credit availability. They sought to hold on to any remaining reserves so their balance sheets would look better. Lending between banks halted as even those banks with assets became wary of lending to other banks who could turn insolvent.

How Did This Situation Evolve?

Two main factors led to the easy-access credit scenario before the crunch. One factor was the rise of Eastern economies like India, China and other Asian countries with a boom in production and exports. Conversely, in the West, growth had been characterised by consumerism built on credit and the rise in property values.

Western countries, including the UK, the US and the EU, proved durable. However, the steady economic growth came from an unsubstantial credit and housing bubble. Globalisation had reached the East. China invested heavily in the US, which helped keep interest rates low. Low rates encouraged banks to invest in subprime mortgages as a good way to make quick money.

The global effects of the credit crunch took a toll on housing and interest rates, as well as personal, busniness and national debt. The UK economy has come a long way since 2008, but in some ways, we are still recovering.

Chapter 7:

How Interest Rates Were Impacted By the Crisis

Chapter 9:

Winners and Losers of the UK Financial Crisis