Has your laptop just failed on you again? You don’t have the money right now to replace it or pay for repairs. Cashfloat have you covered with our simple and easy DIY laptop repairs.

Not the DIY type, but don’t have spare money until payday? Get the money you need today for your laptop repairs.

I don’t need a loan, I’d rather read more about DIY laptop repairs.

- Many problems with laptops are easy and safe to fix yourself.

- Your laptop still has a chance of survival if you spill liquid over the keyboard.

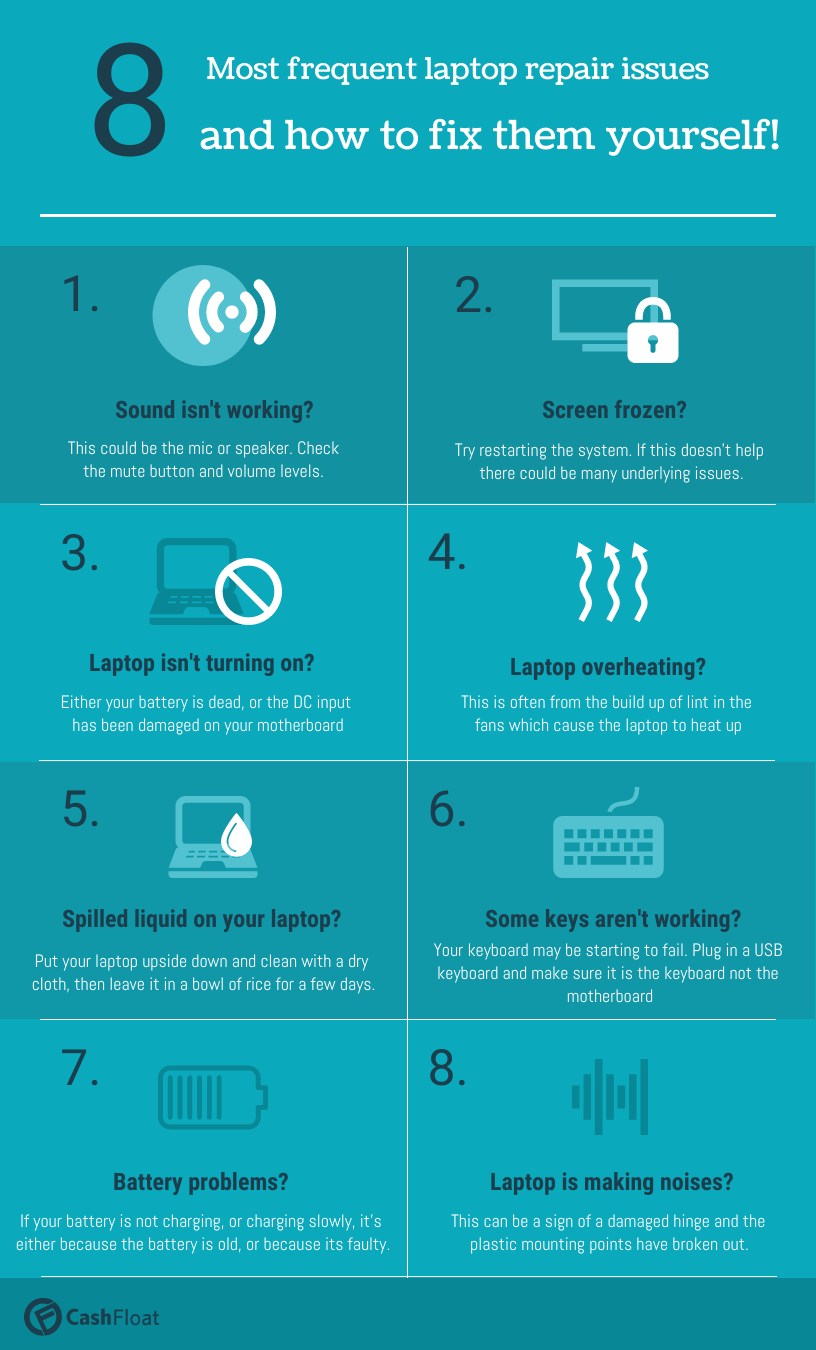

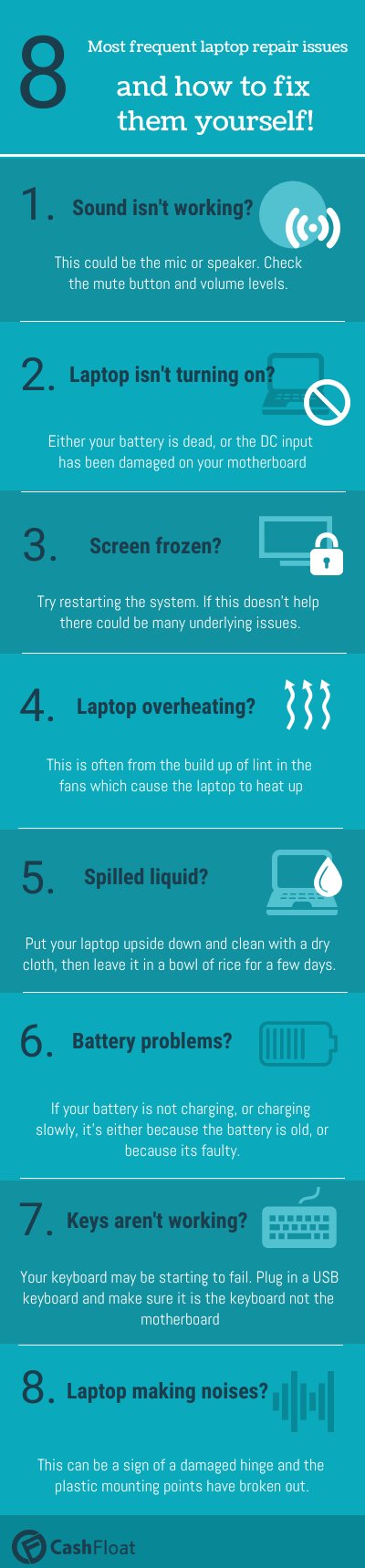

Oh no, is it your laptop making those strange noises again? Not sure how you are going to finance the repair? Why not try to solve your problem yourself and get your laptop back up and running again in no time and at no cost at all! Cashfloat cover all broken laptop scenarios and a clear step by step guidance for you to make the repair yourself – of course this is if the repair is safe for you to do. Read on to find out how.

DIY laptop repairs that can save you money

Laptop repairs can be a bit hit and miss. If the laptop is more than two years old it may not be worth repairing. This is true especially if you need it for work and require fast and efficient hardware. These kinds of appliances have a short lifespan and soon become outdated. However, some simple problems can be fixed. Unfortunately, the motherboard is not one.

How to diagnose laptop problems

Problems with the motherboard on a laptop are expensive and difficult to fix. Most problems are caused by overheating so try to make sure that you have your laptop in the best possible location where it will not overheat. You can buy a stand with a built in fan which helps to prevent overheating.

You have switched on the laptop, and it sounds fine. The display looks normal, but it won’t boot up. In this situation there are ten steps you can take to see if your computer is undergoing common software problems. There could be a problem with the OS.

Run Windows in safe mode to diagnose whether or not there is a fault with the driver or registry. The easiest solution is to reinstall the OS. There is plenty of advice online how to go about this workaround.

The data on a laptop is stored in the hard drive. There are a number of warning signs before this fails. If the screen is frequently freezing or the laptop is running very slowly, or if you hear strange sounds, these are all warnings that something could be about to go very wrong.

If the hard drive is about to fail it is important to back up all files and data before it all disappears. A laptop that is over three years old is going to be very outdated and is probably not worth repairing. The best option is to buy a new device and install all your files from the back up. New laptops are now relatively cheap compared with those purchased five years ago. You could be pleasantly surprised at the cost of a replacement model.

Something as simple as a broken cable can cause a laptop to stop working so check these before anything else. A cable does not cost much to replace. But, a laptop battery is something else. The battery is simple to replace but is quite costly so it is better to research whether a new laptop would be a better option. Some laptop batteries can cost £80. You can buy a new cheap laptop for £199, so this is something to think about before replacing the battery.

The RAM is the short term memory storage on a laptop. If you have problems with random crashing, or the machine does not reboot, the RAM may be faulty. You can test this by running a memory test using an app that is available online.

Laptop screen repair

A broken laptop screen can be replaced. Again, you can look up how to do this yourself by searching online for a tutorial. But if you choose to go to an expert it will cost around £105.

As you can see, there are lots of problems that can occur with a laptop. But, the simple ones can be fixed quite cheaply. Just having the knowledge of how to fix your laptop yourself can save you from taking out a short term loan to finance the repair or replacement.

Spilled liquid on a laptop

One of the most common problems that occur with laptops is a spilled drink over the keyboard. If this happens, then keep calm and assess the damage. If you can still see images on the screen and no sparks are flying around, immediately unplug the device. Do not touch with wet hands as this can cause an electric shock even after the power has been cut off.

Remove the battery and then leave the device alone for at least half an hour. If there is no sign of a burning smell or smouldering, then it is probably safe to assume that the laptop is not going to burst into flames. You can now assess how much damage has been done. If your laptop has been damaged beyond repair and you are in need of an urgent replacement but won’t have the funds until the next payday, you can click here to apply for an affordable loan from Cashfloat.

What spilled on your laptop?

If you spilled water on a laptop, there is more chance of the laptop being only slightly damaged. But, if the liquid was coffee or tea with sugar then you may require an expert to look at the machine.

When everything is dry you can try turning on the machine to see what happens. But, if there are any flames or smoke you should make sure that you disconnect the machine at the wall. Do not touch the power cords as this can be extremely dangerous. There are also chemicals inside a laptop. These can cause problems with breathing when a fire breaks out. So, don’t take any chances.

A laptop that has been drained of liquid and dried out may not work again, but you may be able to recover the files. This is a job for an expert. Costs vary, but if there is no significant damage, then a drying out repair is around £45. You can try to immerse your laptop in rice as the rice sucks out any water. It is likely that your laptop may work again after sitting in a bowl of rice for a few days.

Decided to repair? Finding laptop repairs near me

If you have chosen to repair your laptop over replacing it, you will want to find an engineer that is close by. This will help you to get the repair done fast, and if you are unhappy with the repair, the engineer is more likely to return. Follow these tips below to fining a reliable engineer.

Ask friends and family: The first place to start looking for a reputable engineer is amongst friends and family. They may be able to recommend someone that they have used or heard of someone that has a good reputation.

Search through the local press: You can find good engineer companies from advertisements in the local press. Finding a local engineer makes it far easier to ask them to return if you are not happy with the repair.

Online Search: Conduct a localised Google search for laptop repair companies or independent technicians. You can also use trusted websites that list local appliance repairs. You might have to fill in a form on the website to state the problem.

ConclusionIf your laptop is over 3 years most engineers would recommend you to replace the appliance and not invest in a repair. Tried everything to save your laptop, but you are unable to repair it? You don’t have the means to replace your laptop? You can borrow a small loan for bad credit from £500 to £1000 with Cashfloat today!