Unsure what the Workplace Pension reforms mean for you? Read this article from Cashfloat to learn what the changes are and what else you can get.

- Workplace pensions are arranged by your employer. Normally, you, your employer and the government make contributions.

- These pensions provide an income in your retirement, on top of the State Pension.

You can read the first part of this chapter here. It discusses the new State Pension, the basic State Pension, Additional State Pension and Pension Credit. These are the main types of support that the government offer to pensioners in the UK. This part of the chapter discusses workplace pensions and other benefits for people of pension age.

Workplace Pensions

First, we’ll take a look at workplace pensions. We’ll explain why they were introduced, how they work and what changes the government has made to them in recent years.

- While workplace pensions have been around for a long time, the government has now made it mandatory for companies to offer these pensions to their employees.

- Contributions are normally made by you, your employer and the government.

- Your employer may decide which scheme they will offer to you. However, many people are enrolled into the National Employment Savings Trust scheme.

- There are rules about the minimum amount of pension plan payments deducted from your earnings.

- It is possible to opt out of workplace pensions.

How Workplace Pensions Work

Workplace pensions are a type of pension, arranged by employers, which you have outside of your State Pension. These can be either occupational pensions, group personal pensions or stakeholder pensions. Different pension schemes have different rules about how you pay into them, how they manage your money and what you will receive at the end.

These pensions have been in existence for a long time. While self-employed people have not had access to workplace pensions, they have been able to join their own private pension schemes. If you have a workplace pension, then you will pay into your scheme and receive a pension when you retire. Normally, your employer and the government will also make contributions towards your pension.

The Introduction of Mandatory Workplace Pensions

Previously, workplace pensions were only provided by employers who chose to offer them to their employees. However, as the UK population has aged, the burden put on the state by pensioners has increased.

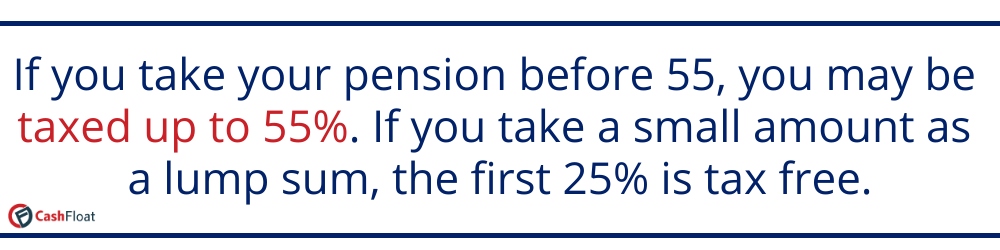

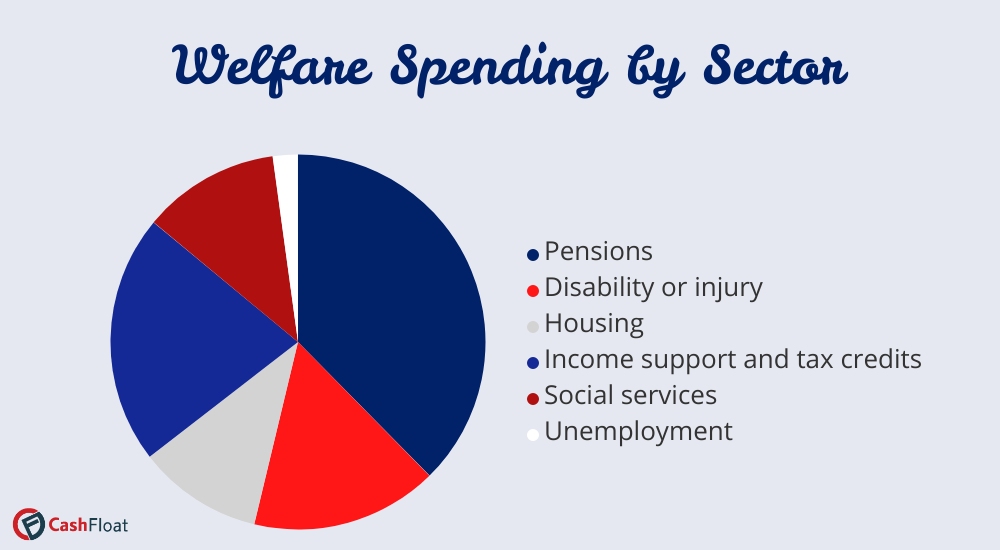

According to a BBC report in 2019, a large portion of the £220 billion spent on welfare in 2019 was used to provide for pensioners, as shown in the image below.

To tackle this problem, the government made changes to workplace pensions in the Pensions Act 2008 and the Pensions Act 2011. Part of these changes was to make it mandatory for employers to provide a workplace pension to their employees. The government hope that with more people having workplace pensions, the burden on the state made by pensioners will decrease.

Automatic Enrolment

The major change in workplace pensions has been that it is now mandatory for all employers in the UK to provide their employees with a workplace pension. It is now also compulsory for employers to actually enrol their employees into a scheme if they meet some basic requirements. While it is possible to opt-out of having a workplace pension, it is becoming normal for people to have a workplace pension plan in place. In future, this will give people more money in their retirement.

Except in certain circumstances, you will be automatically enrolled into a workplace pension when you begin a new job if you:

- are between 22 and the State Pension age

- earn at least £10,000 per year

- are classed as a worker.

If you are already employed, then your employer should have already enrolled you in a workplace pension.

Your employer will inform you of the starting date of the scheme, what type of scheme it is and who runs it. You will also be informed how much you, your employer and the government will contribute and how to leave if you wish to do so. Your employer is not allowed to encourage you to leave the scheme or to discriminate against you for being in the scheme.

The workplace pension scheme that employers provide has to meet certain requirements, as set out by the government. The National Employment Savings Trust (NEST) scheme is an example of one such pension scheme that many people will be familiar with.

What You will Pay Into the Scheme

For most schemes, you, your employer and the government will contribute towards your pension.

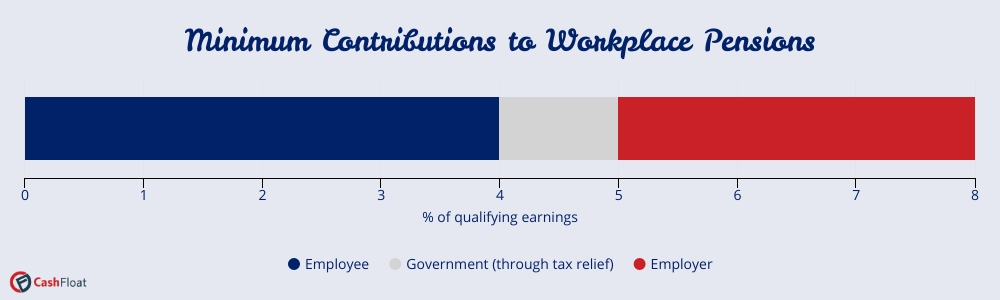

The amount you and your employer pay into your pensions depends on the type of scheme you are enrolled in. You and your employer will need to pay a percentage of your ‘qualifying earnings’ into your pension scheme. In general, qualifying earnings count as anything between £6,240 and £50,270. What percentage you pay depends on the scheme that you are in.

There are rules about the minimum percentage for payments into workplace pension schemes. As of 2019, you must pay a minimum of 5% of your qualifying earnings. Your employer must pay a minimum of 3% and the government must add 1% through tax relief. However, within each scheme, the way the contributions work can vary slightly in different companies.

Nest Pension Scheme

The NEST (National Employment Savings Trust) pension scheme is a workplace pension scheme set up by the government to give employers a low-cost option that meets the government requirements for pension provision. This scheme is a very popular one, having grown to over 9 million members since its introduction in 2011. Between March 2019 and March 2020, there was an increase from 7.9 million to 9.1 million members. To find out more about how this scheme works, click here.

Opting Out of a Workplace Pension

It is possible to opt-out of a workplace pension if you would like to. Normally, in order to do this, you just need to speak to your employer and they will arrange it. While you may have to make fairly large contributions to workplace pensions, and it may be tempting to opt-out, it is always wise to think long term and to take advantage of the fact that your employer and the government will also contribute to your pension.

Managing Your Pension

You will receive an annual statement from your pension provider, informing you of how much money you have accumulated in your ‘pot’. After you begin a workplace pension, you should check to see whether it says ‘net pay’ or ‘pay at source’ when you receive your new payslip. ‘Net pay’ means your employer takes your pension contribution from your wages before tax, which means you are eligible for full tax relief whichever rate you pay. However, if it says ‘pay at source’, your employer takes the pension payments after tax and NI. The pension provider will add tax relief at the basic rate, which you may be able to claim back.

FAQs about Workplace Pensions

How do I know that my workplace pension is safe?

There are safeguards in place to protect your pension. For example, if your pension provider goes bust and is a member of the FCA, you will receive compensation. Also, the Fraud Compensation Fund protects you in cases of fraud, theft or mismanagement.

How do I know how my pension is doing?

Every year you will receive a statement about your pension ‘pot’ and how much you will get when you retire.

What happens to my pension if I change jobs?

If you change jobs, you can carry on with your previous pension scheme. However, you should check that benefits are the same if you are no longer an employee of your old company. Some benefits may only be for employees of your old company. Alternatively, you could begin on a new scheme. Sometimes it’s possible to combine your new and old pension schemes. Alternatively, if you have worked less than two years for your previous employer, you may be allowed to take a refund, which you could invest into your new pension.

What happens to auto-enrolment if I am self-employed?

If you are self-employed, you do not have to enrol yourself in a workplace pension. If you want to begin saving into a pension, you could pay into a personal or stakeholder pension scheme. Alternatively, you could join NEST (National Employment Saving Trust).

Other Financial Aid Available For Pensioners

Apart from your state pension, did you know that if you are a pensioner on low income, you may be entitled to other benefits?

In Chapter 6 and Chapter 7 of this guide, you can see if you qualify to receive Carer’s Allowance or Attendance Allowance. You are especially likely to be able to receive this if you and/or your partner have problems with a disability or ill-health.

As a pensioner, you may be able to claim Housing Benefit from your local council. On the whole, Housing benefit payments remain the same for pensioners despite the introduction of Universal Credit. The one stipulation for receiving Housing Benefit as a pensioner is that usually your partner must also have reached State Pension age. You should also check to see if you are eligible for Council Tax Support; you can still make a claim even if you are a homeowner. Have a look at Chapter 9 and Chapter 10 for more information.

If you recently came out of the hospital and need therapy to readjust to a health problem or disability, the Social Services Department of your local council might help you. They could provide you with reablement free of charge for six weeks . Also, if your home needs minor adjustments, such as grab rails for the bath, if the cost is under £1000, the Government may pay for their purchase and installation. Furthermore, if you feel you need to make major adjustments to your home, you can apply for a Disabled Facilities Grant.

Most pensioners are entitled to receive support to pay for their home, through Winter Fuel Payment, Cold Weather Payment or the Warm Home Discount Scheme. Have a look at Chapter 8 for more information about this.

Financial Help With Emergencies

Whether you need money quickly to replace a household appliance or to cover removal costs, did you know you are entitled to a budgeting loan if you receive Pension Credit? This loan is interest-free and is repaid gradually out of your monthly pension payments. To apply, you should download the form or go to your local JobCentre Plus.

If you have just made an application for a benefit, including the State Pension or Pension Credit, and you are struggling to get by while you wait for the payment to come through, you may be entitled to a payment advance. You will normally pay this back gradually through your future benefit payments. To apply for this, you need to call the relevant department for the benefit that you are claiming.

If these options are not available to you, and you need money urgently until your payments come through, Cashfloat does not provide pensioners with payday loans now, however, pensioners should avoid these loans anyway as they can get expensive.

Again, your local council might be able to help if you have an emergency situation,such as a fire, and are left without material possessions that you need. Schemes like this vary considerably throughout the country and help that comes from your council may not be financial. For example, if you have suffered a fire, you may be given replacement furniture rather than money to replace it with.

FAQs about Additional Benefits for Pensioners

How much is the Winter Fuel Payment?

The Winter Fuel Payment is between £100-£300 and is tax-free. The amount you receive depends on your age and circumstances.

How are ‘means tests’ calculated?

Means tests take into account your income, any benefits that you receive and any savings or investments that you have. Normally, if you have over £16,000 in savings you will not be eligible for means tested benefits.

Summary: The UK Pension Scheme

The CashFloat team hopes that the new UK Pension Scheme is a little easier for you to understand after reading these two articles. In short, the State Pension has changed over to a new scheme, which all claimants since 2016 have been receiving. If you are not entitled to the full State Pension under either scheme, you may be eligible for Pension Credit or Additional State Pension. Workplace Pensions are another payment you could receive when you retire. In recent years it became compulsory for employers to enroll their workers into a scheme. Besides for these, there are other ways that the government provides for pensioners on low income. A few of them are Council Tax Reduction, Housing Benefit and Disability Benefit. For all information on UK welfare, read through the guide, so you know your entitlements and how to go about claiming them.