Find out the truth about the provision of benefits in the UK. Join us at Cashfloat as we debate the pros and cons of the UK welfare system.

We will begin this chapter by looking at the definition of what a welfare state is. Next, we will consider the advantages and disadvantages of having one. We will analyse welfare expenditure and the allocation of welfare money to determine whether the UK is really a welfare state, and see if it’s possible to make a detailed examination of how many claimants there are for each of the main benefits available in the UK.

Additionally, we will look at how the regional differences affect the number of claimants. Is there still a ‘North-South Divide’ in the UK? Do the rest of the world still envy the UK’s welfare system? We will compare the UK welfare system to other systems used around the world.

What is a Welfare State?

A welfare state is a country that has a well-established network of supportive social institutions. The welfare system takes care of the health and well-being of its citizens. This is done by ensuring good standards of healthcare, education and housing, amongst other things.

Social insurance plays a key role. Mandatory contributions to the welfare state by citizens of the country ensure that everyone gets help in times of need. Most commonly, different UK benefits come in the form of grants, allowances and pensions or through the provision of education, housing and healthcare.

Welfare in Different Countries

The meaning of ‘welfare’ is different in other countries. You can compare the system in the UK to that of the USA to see a different attitude. The UK considers welfare to be essential. The UK welfare system has a long history, with roots going back to the Beveridge Report of 1942 and even before that. However, the USA does not see welfare in the same way. While there have been many welfare initiatives started under different presidents and while there are federally funded programmes of food stamps or other welfare measures available, generally less wealth is redistributed amongst citizens of the USA than those of the UK.

Welfare Throughout History

Welfare also has different meanings in different historical periods. What past generations regarded as reasonable support for those in need in Britain in 1821 or even 1921 is not the same as what is considered to be reasonable in 2021.

The Problems of a Welfare State and the Benefits in the UK

Welfare systems must provide an adequate level of provision for peoples’ needs. One of the primary challenges is ensuring that there is still an incentive to work when the government is able to offer support if you can’t work. Another problem that must be addressed is making sure that state handling of the welfare system works as efficiently as possible. Finally, the government should also provide financial services, such as benefits in the UK, in an equitable fashion. Everyone should receive what they need and people should not receive support that they do not need.

The Advantages & Disadvantages Of The Welfare State

The main advantages of a welfare state are that it ensures a greater level of equality among its citizens and prevents unnecessary hardship.

The provision of a social support network protects people from disease, starvation and overall misery. It allows everyone to live on a more equal level. For example, the welfare system supports those who face a temporary crisis because of the loss of their job and prevents them from going hungry or losing their home. More permanently, the government constantly ensures those with greater needs, such as the disabled. They should have an income if they are not capable of working.

The social support network not only supports people in times of need, but also prevents people from the trap of poverty by providing access to resources which allow for social advancement, such as education.

Some supporters of the welfare state say that it also leads to less crime. This is because claimants do not lack the necessities for life and are, therefore, not desperate enough to steal.

The main disadvantage of a welfare state – and the main reason behind recent welfare reforms – is that it leads to higher tax rates for the country’s citizens and significant governmental expenditure. Critics of the welfare system also say it can encourage high unemployment and low productivity. There is the often-voiced fear that provision of benefits can lead to ‘welfare dependency’ or ‘welfare culture’ where claimants see no reason to get a job.

Another drawback is the concern about welfare fraud (when people receive benefits that they do not have the right to!). Welfare fraud runs rampant if the state is too generous with its financial aid.

Finally, some organisations claim that a welfare system discourages citizens from marrying, as benefits heavily support single parents. For a married couple over the age of 25 in the UK who are unable to work, the standard Universal Credit amount is £596.58 per month and this has to be split between the two people. If the couple are unmarried they can each receive £411.51 per month.

Welfare Spending and Benefits in the UK

Citizens who feel that too much of the tax they pay is spent on benefits often support restrictive welfare reform. The previously quoted total welfare expenditure of around £220 billion sounds impressive, but where does the money go?

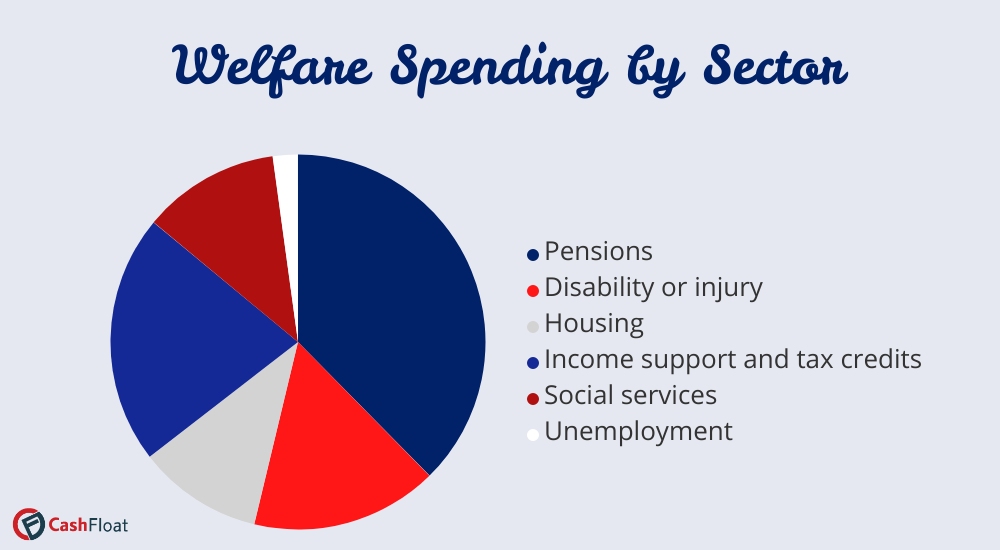

According to a BBC report in 2019, the £220 billion pound that was spent in 2019 was used as we explain in the image below.

Of the total of £220 billion, around £120 billion is spent on pensions and benefits for pensioners, while £100 billion is spent on benefits for working age people.

They estimate that there are around 1.8 million households of working age in the UK who get at least 80% of their income from benefits. On top of this there are a large number of households who receive smaller amounts, with around half of all households receiving some kind of benefit. The majority of benefits given to working age people go on tax credits, housing benefits and disability benefits.

The government spends almost £100 billion per year on pensions. Another £20 billion is given to people above the pension age in benefits, with around £6 billion being given to pensioners in the form of housing benefits.

Increased quality of life and medical advances have raised the average life expectancy in developed countries. Now that there are more people of retirement age, more has to be spent on them. According to the Office for National Statistics, the life expectancy of a man in the UK who is at the retirement age of 67 is another 12 years. For women it is another 16 years. With the prospect of an ageing population, welfare spending seems set on increasing. However, the prospect of an ageing population has encouraged recent changes in the pension system and an increase in the state pension age.

While the amount spent on people of retirement age may have increased in recent years, the amount of government money spent on working-age citizens has generally remained static since the 1980s at around 3.5% of the GDP (reaching a high of 4.6% in the 1990s).

Is the UK a Country of Benefit Claimants?

It is very difficult to get an accurate breakdown of how many people are on benefits.

Working practices and welfare reform have changed the picture of employment in the UK. There has been a rise of zero-hours contracts and ‘permitted work’ practices in some benefit schemes. This means that the number of people claiming financial aid from the government is in a constant state of flux and changes on a daily basis. Consequently, claimants receive variable benefits and it is difficult to get an accurate picture of to what extent people rely on benefits.

Furthermore, statistics that show the total number of claimants for each benefit do not give an accurate indication of the true numbers of people receiving benefits. This is because people are often entitled to more than one benefit. For example, one person might receive Income Support, Housing Benefit and Child Benefit, rather than just one benefit.

This is changing as Universal Credit is introduced. Under Universal Credit, payments which were previously made as seperate payments are consolidated into one monthly payment. Here’s what we learnt so far:

How many disabled people are there in the UK?

According to the government, there are around 11 million people with a limiting long term illness, impairment or disability in the UK.

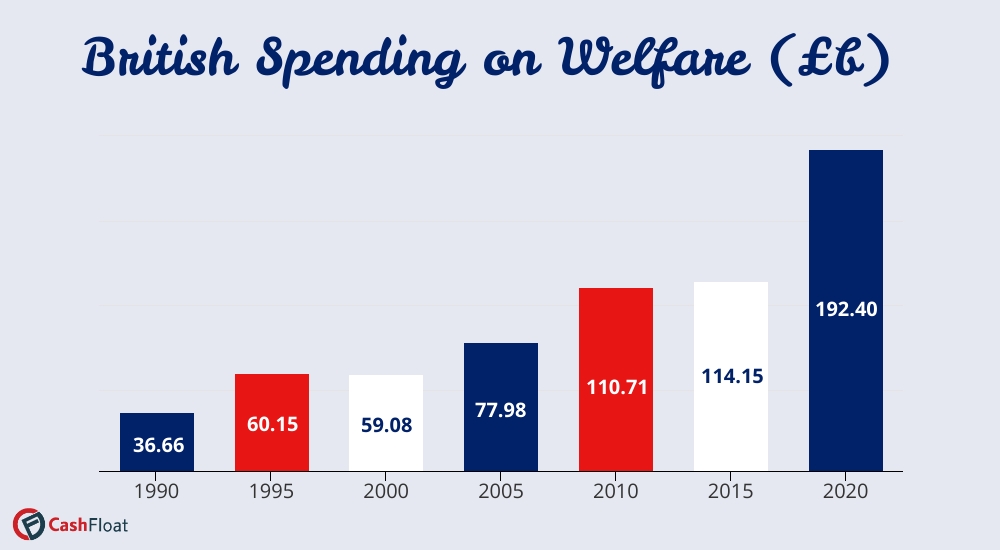

How much has spending on benefits increased in the UK in the last 30 years?The increase in benefit expenditure in the last 30 years depends on how you calculate the amount. According to the Office for Budgetary Responsibility, the amount spent on benefits (including pensions) has increased fourfold in the last 30 years.Currently, government spending on benefits takes up about 11% of the country’s GDP.

How many retired people will there be in 30 years?According to the ONS, by 2050 one in four people in the UK will be aged 65 or older and on the verge of retirement. The over 65 age group will also become the fastest expanding age group in the country. This means that there will be less people working to support those retired than in the past.

Why don’t the unemployed just get a job, so they don’t need benefits?The problem of unemployment is a difficult one to solve. While there are some people who are reluctant to work, the vast majority of Jobseeker’s Allowance claimants are just unable to find work. Additionally, government expenditure on Jobseeker’s Allowance accounts for less than 1% of the government’s total expenditure on benefits.

Also, not all people who claim benefits are unemployed. Low wages, irregular hours and insufficient hours mean that there is a section of the population whose household income is below the poverty threshold even though they are in work. According to the Joseph Rowntree Foundation, in 2019 there were around 4 million people who were in work, but still living in poverty in the UK. Unfortunately poverty is a tough cycle to break out of, especially since poor people pay more for certain things.

Which group are more likely to suffer from ‘in-work poverty’?According to ONS, 1-adult households are least likely to leave poverty even when they get a job. (57% leave poverty compared to 73% of 2-adult homes). They may have reduced credit options as well and be driven further into debt with the use of payday loans, for example.

Benefit Distribution in the UK

The UK government holds up to date data on how many claimants there are for different benefits provided by the UK welfare system.

Here is a breakdown of the number of claimants there are for some of the most well known benefits, up to January 2021:

| Type of Benefit | Number of Claimants |

|---|---|

| State Pension | 12.4 million |

| Universal Credit | 5.96 million |

| Housing Benefit | 2.96 million |

| Disability Living Allowance | 1.37 million |

| Carer’s Allowance | 939,988 |

| Jobseeker’s Allowance | 337,175 |

| Income Support | 281,383 |

| Incapacity and Severe Disability Allowance | 281,383 |

Regional Differences In Employment & Benefit Claimants

It’s probably no surprise to learn that despite recent improvements, there’s still a ‘north-south Divide’ in England. In the 1980s, when the country changed from a manufacturing-based economy to one based on the service industries, many manufacturing jobs were lost. The loss of jobs heavily affected Northern England, Wales, Scotland and Northern Ireland. While some regions have been able to improve the unemployment rate, in some cases, these jobs have still not been replaced leading to lower incomes in these areas and higher demand for benefits and online loans.

The Office for National Statistics holds data on unemployment rates in the UK. Their latest findings on labour, employment trends and unemployment in the period May-July 2020, show that the unemployment rate for the whole of the UK was 4.1%. This figure hid some regional differences and while London may have a high rate of unemployment, the South East (3.5%) and South West (3.8%) as a whole, have lower unemployment than the North East (5.2%), Yorkshire and the Humber (4%), the East Midlands (4.4%), the West Midlands (4.4%) and Scotland (4.6%).

For the purposes of their research, the ONS counted the proportion of the economically active population who are unemployed. The economically active proportion of the population is normally counted as people of working age who are able to work.

Looking at the rate of unemployment does give a useful indication of how many people are claiming Jobseeker’s Allowance. But, it does not give a reliable account of the total amount of benefits being claimed. This is because it does not include the many claimants who are receiving UK benefits, other than Jobseeker’s Allowance. It is likely that on top of the number of people being forced to claim Jobseeker’s Allowance in areas with higher unemployment, many people may also be forced to claim other benefits. If you’re unemployed and on benefits, you should only borrow online in an absolute emergency and as a last resort.