Do welfare dependants thrive or survive? Cashfloat takes a close look at what life is like in the benefits system.

- Accommodation is difficult to find if you are on benefits.

- A third of social housing tenants in arrears blame the bedroom tax for their situation.

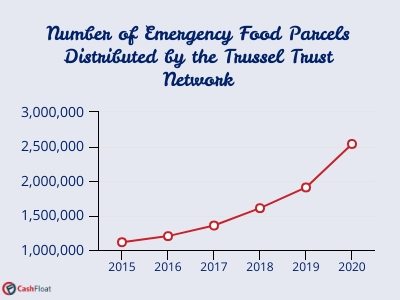

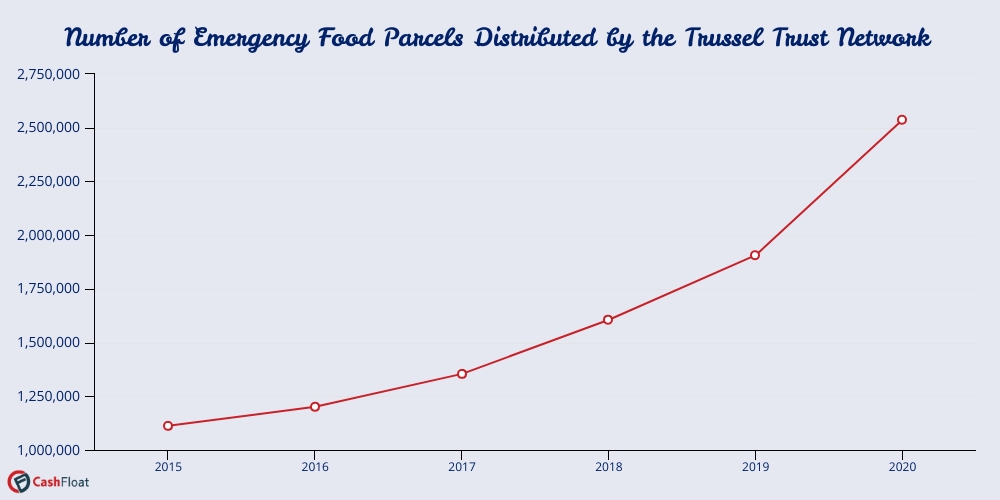

- Between April 2018 and April 2019, even before the coronavirus pandemic, the Trussell Trust saw 1.6 million emergency food parcels distributed to people in the UK.

In this article, Cashfloat will examine the practicalities of living on benefits. We take a detailed look at what housing options people have, looking at the availability of both social housing and rented properties. After that, we will look at how the Removal of the Spare Room Subsidy (Bedroom Tax) has affected social housing tenants. Finally, we will look at food shopping, the increased use of food banks and the costs of energy bills.

The Reality of Life On Benefits

In the first part of this chapter, we looked at the broader effects that the welfare system has for society and the individuals who receive benefits, as well as their children. Now we will look at the day-to-day struggle of surviving on benefits. We will look at the practicalities of life in the welfare system and what it is like to find accommodation, pay the bills, pay for food and take care of other essential things.

Finding Accommodation

There is no doubt that the United Kingdom has a housing crisis. It is difficult enough for professionals to find a place to live. Imagine what it must be like if you live on benefits.

- There is a lack of affordable housing in general and it’s even harder to find somewhere if you’re on benefits. Many people blame the fact that council properties have been sold and not replaced.

- If people can find social housing, the rents are generally lower. However, houses are often in poor condition.

- Renting privately is often difficult for benefits claimants because they do not have the money to pay a deposit and landlords often refuse to rent to them.

- Some private landlords cannot rent to DSS (Department of Social Security) tenants because of the terms of their mortgage or the extra insurance costs involved for them.

- Other landlords are prejudiced against tenants on benefits or do not wish to deal with the council.

The first choice when finding accommodation, is whether to rent from the council or a housing association, or from a private landlord.

Social Housing

The problem with social housing is that since the right-to-buy scheme started in the 1980s, available social housing stock has reduced. Although councils build social housing all the time, there is still not nearly enough to meet the demand. Often, social housing just isn’t available.

Another problem with social housing is that where housing is available, it is often poorly maintained. With the funding cuts for local councils, which took place between 2016-20, things are likely to have worsened in recent years. Often the councils, quite simply, do not have the money to carry out repairs that are desperately needed.

When renting privately, properties are often difficult to get hold of for people on benefits. Rents in the private sector tend to be higher, and people on benefits often do not have the money to pay the initial deposit to secure a contract. To make matters worse, private landlords tend to avoid people who receive benefits.

Private Landlords and Welfare Claimants

One of the reasons why many private landlords only rent to salaried tenants is that they are often in the ‘buy-to-let’ category. The terms of their mortgage do not allow them to rent to people living on benefits. If caught, they could risk increased interest payments or even foreclosure by their mortgage provider. Even if they are allowed to take DSS tenants according to their mortgage rules, they might be expected to have extra liability insurance.

Many private landlords do not wish to deal with the council as they have complex rules for landlords to follow. Landlords often complain because councils pay the housing benefit in arrears and continue to use 4-week cycles instead of the calendar month. Payments are also sometimes irregular and the allowance rate can change without any warning. Also, in cases of housing benefit fraud, the landlord is expected to repay the money which has been paid to them and then get it back from the tenant (if they can).

As well as some landlords not wanting to face the trouble of dealing with the council, some are prejudiced against benefits claimants. Some landlords suspect that benefits claimants will likely vandalise their property or cause problems with the neighbours when this is unlikely to be the case.

FAQs about Living On Benefits

Is there less childhood poverty than there was 20 years ago?

Between 1998 and 2003, there was a major drive to lift children out of poverty. This effort was relatively successful, with around 600,000 children being lifted out of poverty.

The situation for children living in poverty in the UK has changed since then. Poverty always used to be linked with joblessness. However, nowadays, employment does not always provide a route out of poverty. 75% of children who live in poverty in the UK, come from a household where at least 1 person works.

The other finding made by the ONS said that between 2010-2013, 7.8% of the UK population entered poverty for the first time. In the same period, 48.6% left poverty. In other words, poverty is affecting a greater percentage of the population, but it is a constantly changing situation.

How does poverty affect a child’s academic attainments?

In 2015, only 33% of children receiving free school meals obtained five or more good GCSEs, compared with 61% of other children.

What happens to benefits claimants who have a mortgage?

If you have a mortgage, you may be entitled to help with payments if you receive certain benefits. Help is normally only available to pay off the interest, not the capital. Nowadays, most people will receive this help under Universal Credit. Be aware that most people won’t receive help with a mortgage until 9 months after they begin claiming Universal Credit. On top of this, the money they do receive will normally have to be paid back.

The Bedroom Tax

Not since the introduction of the Poll Tax in the 1980s has legislation caused such protest and upheaval. The RSRS (commonly called the Bedroom Tax) was introduced in the Welfare Reform Act of 2012. The idea was to reduce government expenditure on Housing Benefit and encourage people to move home if they had spare bedrooms. It was hoped that this would free up room for other people who were struggling to find accommodation.

The ‘Bedroom Tax’ has had a massive impact on tenants in social housing who depend on Housing Benefit to pay for all or part of their accommodation. The government believed that the RSRS would encourage a more appropriate reallocation of housing (as tenants moved into smaller properties), reduce overcrowding in some areas and cut council waiting lists. Alternatively, it would force people into getting a job to keep their home, making another saving for the government.

However, the reality has not been what they expected. Even for the tenants who wish to move, it has not been as easy as the government thought. This is mainly because there is a lack of property for renters living on benefits to move into. This is caused by the previous failure to build enough 1- and 2-bedroomed housing. People are often only likely to find a smaller property by renting privately, but for many people, this isn’t an option. In many cases, it has just made life difficult for vulnerable people.

Who has been Affected by the Bedroom Tax

The Bedroom Tax has affected the disabled the most. Often disabled people need to be close to hospitals or other facilities and being forced to relocate can make their lives very difficult. On top of that, many disabled people actually need an extra room if their condition requires overnight care. Furthermore, it is often difficult for disabled people to find a property that suits their disability if they have to move.

Some people have not wanted to move because it would mean leaving their support network and their home neighbourhood behind. Consequently, many people have unsuccessfully tried to cope with the drop in their income, falling into rent arrears and relying on payday loans. Being owed money has had a knock-on effect on how much money councils have collected and has also increased their administration costs. This is due to the growing transfer lists and the increased amount of time spent chasing arrears from those who cannot pay.

Despite the lack of positives arising from the bedroom tax, we should point out to people who find themselves suffering as a result that the government has, at least, provided some extra money for Discretionary Housing Payments for those who are struggling.

Paying for Food and Utility Bills

- Food shopping is difficult when you are on a budget and many more families use food banks now than they used to before.

- Apart from one-off payments and the Cold Weather Payment, many people on benefits have to pay their own energy costs.

There are many websites which advise people on a low income about food shopping. The things they recommend often include looking for supermarket special offers and shopping from the reduced shelves. Unfortunately, in reality, this means that you might have to shop every day or go to different stores to find enough bargains. This makes food shopping time-consuming and hard, particularly when most people on benefits do not own a car.

To add to the stress, time spent shopping must be fitted in with the time spent looking for a job and meeting the demands of a ‘Claimant Commitment’. Perhaps this is the real reason for sanctions being made against benefit claimants.

For good advice about surviving on benefits, we suggest that people who are on a low income and/or on benefits look at the following websites: Surviving on Benefits and ‘Confessions of a single mum’.

Food Banks In The UK

When benefits run out early, or new claimants have to wait for their first payment, some have no choice but to go to food banks to feed themselves and their families.

The Trussell Trust supports over 1,200 food banks in the UK. It is the most well-known charity doing this in the UK, although many more operate across the country. Food bank use is highest in areas of deprivation, such as poor parts of London or the North West. While many people know that there has been an increase in food bank usage during the coronavirus pandemic, many people do not know that usage has generally increased in recent years. Between 2018-2019, before the coronavirus pandemic, the Trussell Trust distributed 1.6 million emergency food parcels to people in the UK. They found that one of the main reasons for food bank usage was that benefits are too low to live on, have gaps in payment or are unavailable to people who need them. People in the welfare system have really been struggling, some turning to online loans to tide them over.

Read Cashfloats report on who needed payday loans during the pandemic.

Energy Bills When Living on Benefits

Many people in the UK mistakenly assume that those living on benefits have all their energy bills paid for them. This, however, is far from true. The government is not a piggy bank. Apart from the Cold Weather Payment and the Warm House Discount Scheme (a one-off payment of £140), people living on benefits must pay their own energy bills. Even if that means facing a stark choice between paying for heating or putting food on the table?

FAQs about the Bedroom Tax

How much funding have local authorities received from the central government for the Bedroom Tax?

When the scheme launched, local authorities received £14.8 million in funding from the Department for Work and Pensions to support the cost of implementing this welfare reform. Since then, they have received at least an additional £500 million to cover the costs of Discretionary Housing Payment. A further £870 million was promised up to 2020.

How many tenants in social housing have found a job because of the Bedroom Tax?

According to the English Housing Survey, around 5% of people found a job as a result of the bedroom tax. Around 6% of people moved house as a result of it.

Has overcrowding been reduced because of the Bedroom Tax?

No. The English Housing Survey found overcrowding in social housing has remained constant since 2012-13.

How much has the Bedroom Tax cost people in social housing?

According to the DWP’s Impact Assessment, the average cost to tenants has been £13-£22 per week.

Summary: Living on Benefits

In this chapter, Cashfloat looked at the reality of living on benefits. It’s not as easy and simple as many people think it is. The housing situation is dire, even for professionals, and there is a limited number of landlords offering to rent out their properties to people on benefits. On top of this, there is a lack of social housing and a lot is in bad condition. Furthermore, the Bedroom Tax has hit people, who can find social housing, hard. It affects the disabled the most and many people are unable to move due to a lack of available properties. Finally, contrary to popular belief, with the exception of the disabled, those living on benefits usually have to pay their own energy bills and balance the cost of this with buying the food that they need.