The credit crunch took a huge toll on the UK economy, and the effects are evident to this day. Cashfloat explores the far-reaching ripple effects of the financial crisis in great detail.

Story highlights

- The recession that took hold was consumption based and not production based

- Between January and December 2008 the FTSE 100 had dropped by 31.3%

The Credit Crunch’s Impact on the UK Economy

The financial crisis’s impact on the UK economy was more significant than some other countries. This had to do with several factors unique to the UK. The UK had no big manufacturing base, and the economy depended on financial services, real estate, and retail sales for growth. This growth lacked substance as it relied heavily on a risky credit borrowing and lending bubble that finally burst in 2008. These three industries were hit hardest by the ripple effects of the financial collapse. Ultimately, this meant that when house prices fell spectacularly and credit sources dried up, the UK economy suffered tremendously. The huge negative impact on the UK economy would prove to have several long term consequences.

Financial reports commissioned after the credit crunch revealed that the UK had depended far too much on service industries. Also, people had not invested enough in UK businesses. However, other sources have viewed the impact on the economy as less severe than first thought. These experts pointed to the fact that the recession was consumption-based and not production-based. So, the economy took a beating from the financial crisis – but how does this translate in real terms?

Bank Losses and Bankruptcies

When the big banks started to grasp what was happening and began to haemorrhage losses, there was an immediate reduction in bank-to-bank lending. Financial institutions that continued to borrow found that the interest rate for interbank lending had doubled overnight. Additionally, the costs for insuring credit shot up. When lending all but stopped, the ripple effects were visible in businesses across the board, especially in the housing industry.

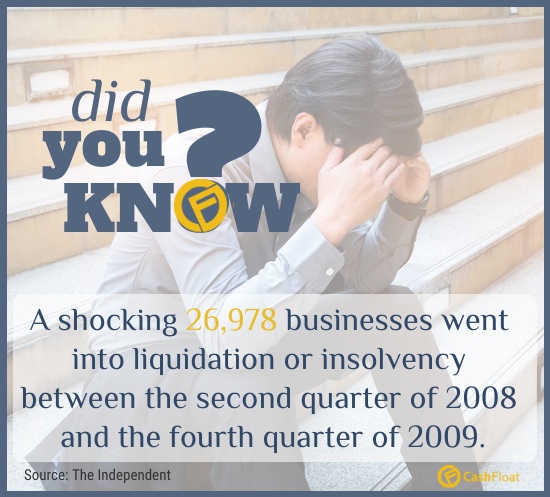

In January 2008, the FTSE 100 fell by 5.5%. This was the biggest loss since the crash of September 11, 2001. It is difficult to pinpoint exactly what triggered the sequence of events. Suddenly, shoppers were struggling to pay mortgages which immediately translated to less retail sales. This first wave of losses affected furniture, household goods and DIY product sales. Soon after, several well-known companies bit the dust. These included Woolworths, which had been trading in the UK since 1909, and MFI, which was one of the UK’s formative suppliers for bedrooms and kitchens. The loss of these two important retailers showed just how hard the crisis impacted the UK economy. Another casualty was Blacks, the outdoor retailers that included Millets under its umbrella group. This company filed for administration in 2012 and was finally bought out by JD Sports.

In April 2008, Persimmon, one of the largest housebuilders in the UK, announced major cutbacks. The deteriorating housing market had seen sales fall by 20% that year, and they were attempting to limit their losses. The company’s share price immediately dropped when it revealed that revenues had already fallen by 24% from January to April. The end of April showed that house sales throughout the UK fell for the first time in over 12 years.

Impact on the Economy: Rise in the Jobless

Following cutbacks in housing and retail sales, widespread redundancies sent the unemployment rate sky-rocketing. This deepened the impact of the financial crisis on the UK economy. The fall in sales had led to a round of redundancies when companies like Woolworths and MFI went bust. So, as more people were out of work, there was a drop in tax revenue. In turn, the government had to slash public spending, so they were unable to boost the economy by investing in public services. The cycle of slump continued with the GDP falling for a fourth consecutive quarter at the end of 2008. Consequently, the country was now officially in recession and many people’s only option was to turn to expensive loans for the unemployed.

In an attempt to stimulate growth, the government cut the rate for VAT in November 2008. However, by that time house prices had fallen by 10.5%. Between January and December, the FTSE 100 had dropped by 31.3%. It was the biggest annual fall since its inception in 1984. The UK budget in April 2009 was a difficult one. There was no scope for boosting the economy – which was still shrinking. Furthermore, the same trend was continuing throughout the globe with companies like General Motors, the largest car manufacturer in the world, filing for chapter 11 bankruptcies.

The over-reliance on credit, such as instant payday loans, was largely responsible for the growth in the economy in the preceding decades. However, this turned into the downfall of the country when hard times struck. Both the financial and business sectors saw serious losses. Lower tax revenues meant it was impossible to expand public spending to help resolve the crisis. The only light on the horizon was that as the value of the Great British Pound fell it allowed exports to become more prolific and more profitable.

To Lend or not to Lend

It is true to say that the only people banks want to lend money to are the ones who don’t need it. In the aftermath of the financial crisis, everyone needed to borrow money. However, due to the low reserves, the banks refused thousands of applications. People no longer had confidence in the financial markets as no one was quite sure who was the most indebted. Many people also began defaulting on their credit cards, as they were simply unable to make the repayments. This also contributed heavily to the impact on the UK economy. Many people viewed the resulting recession as the result of reckless gambling by bankers.

With a daily round of redundancies, more and more people started claiming unemployment benefits. This put more strain on the already overtaxed economy, which led to more job losses and perpetuated the downward spiral. London workers were hit hardest, as many people in the city worked in the financial sector. Occupations related to housing followed closely behind. This included developers, builders, DIY stores, estate agents and home stores that sold furniture,and electrical goods. Employees in the car and truck industry faced large-scale redundancies as well. The financial crisis impacted practically every non-essential industry in the UK economy.

Chapter 5:

The Financial Crisis & the Housing Market

Chapter 7:

Interest Rates & the Finanacial Crisis