Private loan sharks are on the rise in Wales. Learn more about how they carry out their activities and how you can protect yourself from falling into their traps. Discover more with Cashfloat.

In this article, you’ll learn:

- Firstly, why people borrow from private loan sharks

- Next, how the tactics of loan sharks keep their victims paying

- The work of the WIMLU

- How the WIMLU uncovers illegal lenders

- Whether loan sharking only affects Wales

- How to stay far away from illegal lenders

- Finally, a conclusion

Private Loan Sharks in Wales

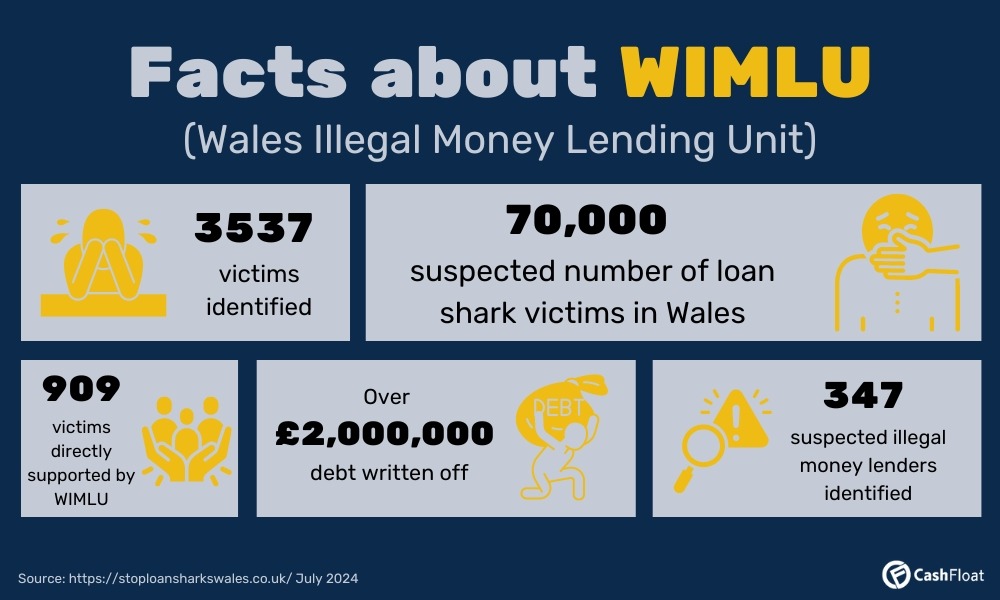

Since the WIMLU team was established in 2008, they have identified over 3500 victims of loan sharks and have written off over £2M in debt!

In this article, Cashfloat looks at what tactics illegal money lenders use to make sure their victims keep paying up. If you need financial assistance, make sure to avoid no credit check lenders. We look at the work of the WIMLU and how these criminals were discovered. What are the typical punishments given to illegal lenders and why doesn’t the FCA do more to combat the problem? Let’s start by answering the most commonly-asked question; if they know they’re illegal, why do their victims turn to private loan sharks in the first place?

Why Borrow from a Loan Shark?

Victims of loan sharks often find themselves in dire financial circumstances when they can’t access loans from mainstream lenders as they’re seen as ‘high risk’.

Often private loan sharks will target specific vulnerable groups and present themselves as a friend offering a ‘helping hand’. The further they get into the clutches of an illegal lender, the more difficult they find it to get themselves out. Arbitrary increases in their interest rate and additional (unspecified) charges make it impossible to reduce the amount they owe. WIMLU has found victims who had carried on paying for over 10 years. After such a long period, it becomes a way of life. So, why don’t they seek help?

Watch this video to see how loan sharks work and find out how to report a loan shark:

How do the Tactics of Loan Sharks Keep their Victims Paying?

Ryan Evans, a client liaison officer at WIMLU, explains that there are two reasons why victims of illegal lenders will keep silent. One of the reasons is a feeling of embarrassment that family, friends and neighbours will find out. They don’t want to be judged for their poor judgement or their inability to support themselves and their families.

Another equally powerful reason for not coming forward is their genuine fear of reprisals. Intimidation tactics can be in the form of threats, harassment, nasty text messages, actual violence and even sexual abuse. The WIMLU said that one mother in Cardiff was intimidated when the loan shark threatened to burn down her home with her children inside. In another case, an illegal lender in Swansea said they would beat up the victim in front of their children. These examples are far from unusual. Bearing this in mind, how does the WIMLU investigate such crimes when the victims are too afraid to ask for help? Before answering this question, let’s look briefly at how the unit operates.

The Work of the WIMLU

Set up in 2007-8, the WIMLU is part of a network of such units across the whole of the UK. They’re funded by the National Trading Standards Board and their employees come from various backgrounds including ex-police officers, debt advisors and trading standards.

Apart from making sure that victims are safe, they also help them get back on their feet financially. This includes support with re-payment plans for priority debts and assistance with benefit entitlements, health problems and housing issues.

How does the WIMLU Uncover Illegal Lenders?

With the constant fear of reprisals and public humiliation, how does the unit investigate the crimes of illegal lenders? Some of their leads come in the form of anonymous tips to their website or phone helpline. Sometimes victims themselves are courageous enough to come forward.

What the illegal lending team has repeatedly found is that if one victim is brave enough to seek help, this often opens the floodgates and others quickly follow when they realise they aren’t alone.

What kind of punishments can private loan sharks expect to get? To answer this question, let’s look at one criminal prosecution of a loan shark.

How are Loan Sharks Punished?

In May 2024, Tabitha Richardson, an 83 year old loan shark from Newport pleaded guilty to illegal money lending, money laundering and other money related crimes. She was ordered to pay back over £173,000 with over £35,000 returned to her victims in compensation. If the money isn’t paid back within 3 months, she potentially faces 21 months in prison.

Victims didn’t see Tabitha as the typical loan shark due to her being female and age 83! This proves that loan sharks may be anyone looking to lend money without the necessary authorisations.

Does Loan Sharking Only Affect Wales?

You might be thinking that these are isolated incidents and that illegal lending doesn’t affect your area. However, a study by the FCA estimated that there are 300,000 victims of private loan sharks across the whole of the UK. For obvious reasons, it’s difficult to identify and quantify illegal lending. And there’s little the FCA can do. They’re only responsible for the regulation of legitimate lenders. More worryingly, the WIMLU says that the problem is growing and that illegal lenders are becoming more organised. So, how can you avoid falling into the clutches of loan sharks?

Stay Far Away from Illegal Lenders

First of all, don’t think of a loan shark as your friend. You’re just a ‘cash cow’ for them but you won’t see this side of them until you miss a payment. And it’s almost certain that you will miss a payment. The way that the loan is given, without anything written down or interest rates and charges explained. This means that your loan can very very quickly spiral out of control.

Also, don’t think that you can just take out one online loan to see you through a rough patch. It’s very difficult to escape them so easily especially when they target you and offer you more money playing on your feelings of guilt about providing for your family. If you find yourself in financial difficulties, you should contact debt advisory services. They’ll be able to help you with alternatives to borrowing money illegally, with advice from budgeting to entitlements to state benefits.

Conclusion

Unfortunately, loan sharking is a growing problem in the UK. However, there is support available for those who are excluded from applying with mainstream short term loan lenders. For those who have already fallen victim to loan sharks, the thing to remember is that you are a victim and not the criminal. The loan doesn’t have to be paid back because the lender is operating illegally. Seek help, you aren’t alone. You’ll soon be joined by others following your example.

If you enjoyed this article, you’ll enjoy learning how to when you should seek help with debt.