Lenders use the credit score to help them decide whether or not to grant you a loan or credit. Cashfloat explores the history of credit scoring and how it works. Read on to find out more.

- Many companies all over the world use creit scoring

- Credit scoring in the UK is regulated under the FCA

- Using a credit card sensibly can give you a good credit rating

Authorities established the Fair Isaac Corporation in 1956. This is the company that set the model for credit scores which have such an impact on lending in the 21st century. At first, the concept was to provide businesses with a unified credit scoring system for all clients. This would be instead of delivering a customised score for each one. 50 companies had the opportunity to use it but 49 of them ignored it! Eventually, in the late 1980’s the company came up with a revolutionary credit scoring system known as the FICO score. Ultimately, all companies (not just lenders) can have access to a consolidated view of a credit history.

When Cashfloat receive an application they use credit scoring to find out if the client is suitable to receive an instant payday loan. Generally, if they have a great credit scoring they will be given the loan. Prior to this, system lenders and other businesses took individual scores from each of the separate credit reference agencies. With that they tried to work out a general mean average. Here we will look at a short summary of the credit scoring model used in modern society.

What is credit scoring?

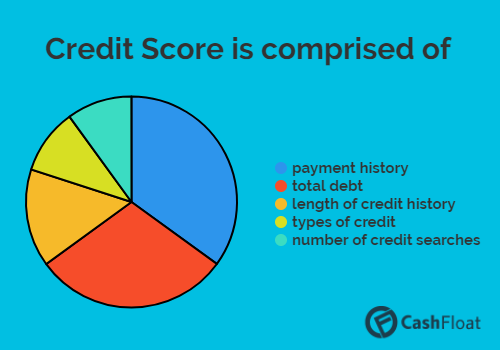

A typical credit score is a three digit number that is made up of five separate sections with some parts having more weight than others. Firstly your payment history comprises 35%. Secondly, total debt is 30%. Thirdly, length of credit history is 15%. Next, types of credit is 10%. Finally, number of credit searches is 10%. The FICO score ranges from 300 to 850. Experian and Equifax, use this. They are the two major credit reference agencies in the UK. TransUnion uses a rating of one to five. Personal information such as age, race, religion and income do not affect the score. Obviously, when you do apply for a loan, whether it is a cheap short term loan or another line of credit, your current income is used by the lender to calculate whether or not you can pay it back. It dose not have any influence on your credit score.

Companies use credit scores all over the world but in slightly different ways. For example, in Australia a credit score will be used to determine not only the risk of non repayment. It is also an important factor in calculating the amount of credit limit allowed for an individual. In Austria, companies use credit scoring as a blacklist but in most European countries credit scores are used in a similar way to the model used in the UK. Sweden is the exception where there are only two levels and those are ‘good’ or ‘bad’.

Credit score UK

In the UK we work out the credit scoring system, purely on the concept of whether you have bad debt or no bad debt. Credit scores in the UK are regulated under the Financial Conduct Authority. Everyone has access to find out how they are rated by the three different credit reference agencies. Lenders who use a credit score to determine whether or not to allow an application to proceed do not need to reveal what they require as a minimum score. So, knowing your score may not be much use. However, having access to your credit history can help you to decide whether or not to apply for a line of credit under your current circumstances.

How Is A Credit Score Calculated?

A credit score is calculated by figures extracted from your credit history. This usually involves a complicated system that is split up into different parts such as payment history, debts, the amount of time the credit file has been in existence, the types of credit and finally the number of times that you have applied for credit. Debts are split up into various kinds including revolving debt on a credit card, instalment debt such as a finance agreement and open debt like that on a charge card. Each of the parts of the credit history is allotted a percentage of the score. Different agencies use different scoring systems but a typical score is calculated as follows. Payment history makes up 35%, debts equal 30%, time on file is 15%, the types of credit is 10% and the new credit searches equals 10%.

The weight given to the payment history and the amount of debt makes these parts the most important factors in a credit score. With regard to payment history, any record of a missed or late payment will lower the score as will any report of a county court judgement, use of a debt collection agency, a repossession or extra fees charged for any of the above. Agencies will also use information about the age of the entries and how severe the transgression. i.e. a repossession is obviously a more serious fault than one late payment and newer reports are rated worse than historical ones.

Applying for Credit

It’s important to understand that no one has an automatic right to credit. Each lender in the UK uses a different set of criteria. The criteria helps them decide whether or not to allow an application to go ahead. All lenders use the data supplied by the credit reference agencies. They also use the information you have supplied on the application form. Your credit history has a wealth of information that will assist a lender to decide whether you are creditworthy or whether you are a serious risk. The most important part of the credit report is your payment history. This shows whether you have ever missed a payment or made late payments. Then the lender will look at how much you already owe. They make sure that you are not overextending yourself with debt.

The length of time that you have had a credit history is also important and this is when some applicants are scored low because they have not borrowed in the past. It is a strange fact that owing nothing is considered to be a high risk whereas if you have had a loan and repaid it, it looks better. The types of credit you have had is also an indicator about your suitability as a good risk. Finally, lenders will consider how many times you have applied for credit. A lot of credit searches lowers your credit score.

Previous loans

Credit reference agencies will hold information that’s been established by previous applications. These details will include your date of birth and current and previous addresses. All details of previous loans, even text loans, will stay on the report for 6 years after the loan has been repaid. However, if you have an unused credit card where the account is still open it will remain on the report as available credit.

In Summary

Lenders look at many factors when considering a loan application and it is not just these businesses that rely on credit scores. Companies that offer mobile phone contracts or monthly payments for car insurance are also granting credit. They use the credit reports and scores to assess the risk that they are taking. In the UK there is no blacklist of bad payers and lenders use purely analytical means to assess the risk of non payment.

Lenders may use the information of a credit report to turn down an application. They do not need to explain why. Alternatively, they may offer to loan less money or to charge a higher rate of interest. This is why your credit score makes such an impact on financial dealing like mortgages, personal loans and credit card applications.