Is your credit card debt running scarily high? Are you wondering, ‘how did I get here? Is there any way I can get out of this?’ Read this article to find out how credit card debt comes about, and how to take control of it.

- After mortgages, credit card debt is the most common form of debt in the UK

- Find out how to avoid getting into debt in the first place

- Find out what happens if you are taken to court for owing money on a credit card

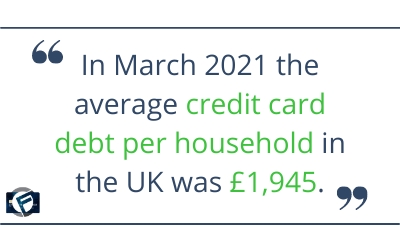

Unfortunately, nowadays credit card debt is a huge problem in the UK and in February 2021, our total credit card debt was £54.7 billion. Cashfloat, a UK payday lender, aims to help the public by pointing out the mistakes people should avoid making with their credit cards, so that they don’t end up in debt. Avoiding bad spending habits can save you hundreds, or even thousands of pounds.

This article provides advice about credit card debt. Firstly, we will discuss what it means exactly to be in debt, how people end up getting into debt and what they can do to avoid it. After that, we will discuss what people who have found themselves in debt can do to get out of it.

As the saying goes, prevention is the best cure. The best thing you can do is to be informed about the danger of credit card debt and avoid getting into debt in the first place. If you have a credit card or are going to get one, then make sure you know how to follow safe spending habits, as we’ll explain below.

Credit Card Debt

Living in a world of credit has become the norm for most people. In the past, it was considered shameful to owe money. However, since credit cards and other types of credit have become more widely used, it has become normal to owe money.

During the coronavirus pandemic, the economic uncertainty led many people to borrow less on credit cards. However, prior to the coronavirus outbreak credit card borrowing was high and many people expect that borrowing levels will return after the economic uncertainty has passed. During times of high borrowing, more and more people find themselves struggling with debt.

While national and international borrowing and debt figures may vary, it is important that individual credit card holders know for themselves what the dangers of debt are, what they can do to avoid getting into debt and what they can do if they find themselves in debt.

While national and international borrowing and debt figures may vary, it is important that individual credit card holders know for themselves what the dangers of debt are, what they can do to avoid getting into debt and what they can do if they find themselves in debt.

If you don’t fully understand how a credit card contract works, then go to Chapter 6 of this guide. Knowing what you will owe for borrowing money with a credit card can help you to avoid getting into debt.

Are you in Debt?

If you do owe money, the first thing to think about is whether the amount that you owe is a problem or not.

Do you consider yourself to be in debt or would you be offended if someone suggested it? The answer will depend upon a few things. Most people do not consider a mortgage to be debt although strictly speaking it is. And, if you have borrowed money from your parents to put down a deposit on a home this too could be defined as debt as well.

In fact, debt is simply defined as money that you have to repay (usually with interest) to either a person, or an organisation like a bank, finance company or a building society.

In the 21st century, it is almost impossible to be debt free. Unless you are very rich, if you want to go to university you will need a student loan for the tuition fees and living costs. Very few people can afford to buy a house or flat for cash, and most people need a loan to buy their first car.

So, spending on credit is now considered to be perfectly reasonable. However, there sometimes comes a point when debt becomes a problem. If you own a credit card and have overstretched on your borrowing, you may discover that paying off the amount you owe has become difficult, if not impossible. It is at times like this when debt becomes a problem.

Too Much Debt Is Never A Good Idea

For an ordinary person, too much debt is a bad idea. It is one thing using a credit card to buy a new washing machine when the old one breaks down but something completely different for someone to use a card to finance most of their day to day living or to splash out on luxuries that they do not need.

Buying something just because you want it should be offset by a consideration of whether you can afford it or not. Investing in a property using a mortgage will usually pay in the long run as property prices tend to rise. However, spending cash you do not have on an exotic holiday will only produce instant gratification and will leave you with a bill.

Credit card spending habits vary from person to person. And, while credit cards can be helpful if people are wise about how they use them, they can cause serious problems if they are used unwisely. Always remember that money you borrow has to be repaid and that doing so usually puts profits into the pockets of lenders.

Questions You Can Ask Yourself to Find Out if You Have a Debt Problem

If you are wondering whether you have a debt problem, asking yourself these questions might help you to understand whether you do or not:

- Are your monthly debt payments such that you are just about surviving?

- Do you know exactly how much you owe?

- Do you lie awake worrying about the next bill that is due?

- Have you left monthly credit card statements unopened?

- Are you constantly looking to borrow more to pay off debt?

- Do you panic when Christmas or a special birthday comes around?

If the answer to these questions is yes, then you should get help sooner rather than later. No one likes to think about debt. However, for many people, it is a fact of life. If you have a credit card it is important to understand the danger of debt, how to avoid getting into debt and what you can do to get out of it.

Is a Rise in Credit Card Debt Good for the Economy?

If you are an economist, then a boom in credit card spending is a sign of consumer confidence. This usually happens when unemployment is low and earnings are beating the annual inflation rate figure. However, just like in the early 2000s, it is predicted that boom can only turn to bust and, while the economy is expected to bounce back after coronavirus, there is a certain amount of concern creeping in about what will happen when economic growth slows down in the future. People with credit card debt may find that their problems multiply if the economy suffers a downturn.

The Different Kinds of Debt

Debt comes as secured debt or unsecured debt and many people have a mixture of both types. If you have a mortgage, you can compare the terms of your mortgage to those of a credit card. You will see that the rates of interest for secured debt (your mortgage) are much lower than those for unsecured debt (your credit card). Debts which are secured by something that you own are much cheaper to pay off.

When it comes to facing up to debt one of the most important considerations is how to prioritise debts. If you are struggling, always make sure that secured debts are first in line to be paid. That way, you can ensure that whatever you used to secure a loan (such as your home) is safe even if you end up with a black mark against your credit rating.

Secured And Unsecured Debt

Understanding the difference between secured and unsecured debt will help if you have a number of debt commitments and are finding it difficult to meet them all.

What Is Secured Debt?

Secured debts are debts where an asset of yours is used as collateral in case you are unable to make payments for what you owe. A mortgage is a secured debt because it is secured by your home. This means that the lender has a claim on your home if you do not keep up the monthly repayments. The mortgage provider would be entitled to repossess your property and is then at liberty to sell the house to cover the cost of the loan.

The same thing would apply if you took out a car loan (which is secured by the car) and failed to keep up with repayments. The finance company can take away the car, and they usually specify these terms in the credit agreement. With a secured loan, your creditors are immediately able to take whatever you have used to secure the loan if you fail to meet the agreement that you have made.

What Is Unsecured Debt?

Unsecured debt is money that you borrow without any collateral. This usually includes credit cards, student loans, store cards, most personal loans UK, and bank overdrafts. Your assets and possessions are not directly in jeopardy with an unsecured debt. Having this kind of debt is less of a threat. However, you should read on because things are not quite that simple.

The lender has no immediate right to claim your assets or possessions. But, falling behind with repayments could mean that you end up in court. If your creditors are able to prove in court that you owe them money, then they may then be able to take your assets or possessions to pay what you owe. As well as putting your property at risk, this can damage your creditworthiness for future borrowing. However, the important thing to remember is that, with an unsecured loan, you are less immediately likely to lose something that you own. Creditors of unsecured loans benefit more from cooperating with their debtors than those of secured loans and will often try to avoid the cost of a court case and asset repossession.

The leeway that you have with unsecured debts means that you should always prioritise any secured debts that you have.

The Causes of Credit Card Debt

It is important to know what the common causes of credit card debt are. As we said earlier, prevention is better than cure. If you can avoid getting into debt in the first place, then that is the best thing.

When you first get a credit card you might be tempted to spend up to the credit limit and forget to consider that you will have to pay back the funds. Paying by card does not always feel like handing over money. When the statement comes in at the end of the month, it can come as a shock to see what you owe.

The credit limit is not what you need to stick to. You need to stick to only borrowing amounts that you will be able to pay back. While the credit limit may seem like a good target, the only good target is what you will be able to pay back.

Interest rates on credit cards are made apparent to card users. There should be no reason not to be aware of when interest will be introduced or when rates will change. However, having had the benefit of a zero-rated card for a long period of time, some people forget that the free period is going to come to an end. Other people do not plan well enough ahead of time to make payments before interest begins to be applied.

It is important that you are well aware of when you will start to pay interest on what you owe and that you plan well enough ahead of time so that you do not end up with interest payments that you cannot meet. Always read the terms and conditions of your credit card agreement and make sure that you begin making payments early enough to avoid trouble.

Losing a job is traumatic enough without having to cope with paying off a credit card. For many redundant people, there will be a period when they have to go through bureaucratic hoops to get benefits, and sometimes they use credit cards to fill the financial gap.

If this is your situation, try not to rely on your card to get you through the first stages of redundancy and try to think long term about the consequences of building up debt. Check out our guide on dealing with job loss for more information and useful advice. Cashfloat also have a complete guide to the UK welfare system for people who are in need of its assistance.

Some people may also find that they are suddenly faced with redundancy when they already have debt on credit cards. Their lack of income can make it difficult to meet payments and can lead to a spiral of debt. If this is the case, it is important to organise debts and to plan repayments as soon as you are aware that you will be made redundant.

Other situations, such as pregnancy, can lead to people ending up in similar circumstances. It is important when you take out a credit card to remember that you may be faced with changes to your circumstances and that your borrowing habits do not cause you to suffer if something unexpected happens.

In the UK most people are only one or two payslips away from financial problems. If you don’t have an emergency fund and an unexpected emergency arises, whether it is something as basic as needing car repairs or a new freezer, a credit card can be invaluable. However, be mindful of the fact that this is money that must still be paid back. Otherwise, you may find yourself desperate for credit card debt help. Cashfloat suggest that people try to keep an emergency fund available on top a credit card and do not use a credit card as their only source of emergency income.

When you first get a credit card and, if you are foolish enough, you rack up a significant amount of debt, it is easy to get into the habit of only paying off the minimum amount. This is how the provider makes money. This kind of behaviour leads to credit card debt.

The minimum repayment amount will usually be a percentage of what you have borrowed or a minimum figure (such as £5) plus the interest that you owe for that month. This means that the balance will go down each month. However, as the balance reduces so does the minimum payment figure which makes the debt last longer. The finance company will always win if you do not make higher payments than the minimum required.

See this example: £3,000 borrowed at 17.9% will have a first month’s repayment of around £71.50. The next month this reduces to £70.75 and so on. Fast forward to twenty years later, and the minimum payment is just £6. If no more were ever added to the balance, it would take over 27 years to pay off this relatively small sum. And the interest charged would amount to £4,000.

One simple way of overcoming this problem is simply to fix the repayment amount to the first monthly figure. In this way, you can get rid of the debt far earlier and save a lot of money in interest charges.

Solutions To Debt

As you can see, there are many reasons, besides irresponsible spending, that people end up in credit card debt. Tackling credit card debt is a must for all those in debt. Do not ignore the problem. With some effort you will be able to overcome it. If you are unfortunate enough to have ended up in debt, let’s look at what you can do to tackle the problem.

Consulting a debt professional or an organisation which help people deal with debts can help you to get back on your feet quicker. Stepchange are the UK’s leading debt charity and provide advice and support to people who are facing debt problems. You can go to them for help at any time. The National Debtline also offer advice and help to those in debt, over the phone. They are available on 0808 808 4000 and their lines are open from 9am to 8pm Monday to Friday and from 9.30am to 1pm on Saturday.

There is a long list of options for dealing with debt. These range from simple debt management plans, individual voluntary arrangement plans and debt relief orders to the more extreme process of bankruptcy. Bankruptcy is only necessary in extreme cases of debt.

For many people, there is no need to make complicated arrangements, and putting in place a budget and cutting back on spending is enough to enable them to clear their debts.

Being in debt can leave you feeling frightened and isolated, but it doesn’t have to be that way. Making a decision to take control of your finances can help you to feel better. The first thing to do is to work out exactly how much you owe and what payments you will need to make in order to clear your debt, as well as the interest that you will have to pay on it. Although this sounds simple, it is not always easy to face up to it.

Having totalled up your credit card debt, if the figure is so large that you are unsure of how to deal with it, then it is a good idea to get some outside help. As we said earlier, StepChange and the National Debtline are good places to start if you need outside help. If you don’t think that you need outside help, then you may be able to cut back on your spending, make a budget and meet a repayment schedule that you can set for yourself.

The first thing to do is to make a plan. If you are able to tackle your debt problems on your own, make sure that you draw up a detailed budget and plan, which takes all of your financial commitments into account and that you stick to it. Remember to prioritise your commitments when you are making your own repayment plan.

All financial advisors will recommend prioritising debt repayments. Keeping a roof over your head is the priority. So make sure rent or mortgage payments are top of the list of priorities when making payments. After this make any secured loans that you have your next priority.

As unsecured loans, credit card bills are often classed as non-priority payments. However, the important thing is that you still leave enough in your budget to cover your credit card debts. When budgeting yourself to pay everything that you owe, make sure that you know exactly what you need to cover all of your priority payments, outside of your credit card repayments. When you know what you have left, you need to make sure that you leave enough of this to meet your credit card repayments as well.

You will then need to stick to a budget so that you can make your credit card payments. Self-discipline is key when you are trying to stick to a budget.

If, after adding up all of your priority payments and credit card payments, you find you are unable to meet your full financial commitments, contact an outside organisation for help. A debt counsellor will be able to advise you how to contact creditors to arrange meetable payments or to follow other courses of action.

If you are unable to tackle the problem by yourself then you will need to seek outside help. Stepchange have a lot of information on what action people can take if they find that they are unable to deal with their problems by themselves.

The possibilities range from contacting your creditors to see if a repayment schedule or Individual Voluntary Arrangement can be made, to bankruptcy. It is important to remember that bankruptcy is only necessary in extreme cases. There are a number of debt arrangement schemes, debt management plans or options, such as settlement offers which can be looked at first. Make sure that you are well informed on all of your options and choose a plan that is right for you.

Telling you friends and family about your debt issues can also be a relief. Don’t be afraid to seek support from people close to you. Your creditors may also be able to offer you a repayment plan that you will be able to meet and so you can discuss your issue with them as well. If you have come to terms with the fact that you just owe too much money, then it is time to get help and to get your financial life back on track.

After you have made a plan about how to deal with your debt, making an immediate start to tackling it will help to ease your worries. If you have the self-discipline to form a plan and carry it out, you will be well on the way to getting back on top. Make a start straight away and your debt problems will begin to become manageable.

Additionally, telling your family or friends about the problem will also come as a huge relief. Family and friend backup can help you to make the changes you need to tackle your debt problems.

Borrowing money to pay off debts is usually a no-no and can leave you worse off than when you started. That being said, there are certain situations where this may be good. Refinancing, as it is known, can sometimes be an answer to debt problems. However, make sure you know what you are doing because done incorrectly it can make the situation worse. There are two main ways of doing this:

- Debt Consolidation Loans

- 0% APR Credit Cards

Yes, sometimes you can lower interest charges by taking out a personal loan to pay off debts. But, plan ahead and think about how long it is going to take you to pay off the loan. Read more about debt consolidation loans to be fully aware of what you are doing. It is important that you do not rush into a debt consolidation loan and that you only do it having had sound outside financial advice. While the terms of debt consolidation loans may seem favourable, for many people they do not work and when this happens people can end up in a worse situation than when they started.

The other option is to transfer the balances of credit cards onto one 0% interest rate card. This can work if you are a diligent payer and are sure that you can clear the debt before the high rate comes in at the end of the interest free period. You also need to be aware of balance transfer fees and make sure that you don’t choose a card which ends up costing you a large amount of money to transfer the balance onto. It is best to seek financial advice before transferring debts onto new credit cards. While this may seem like a favourable solution, it does not always work and can make a person’s situation worse.

It is very important, if you decide to use consolidation loans or 0% interest credit cards that you know exactly what agreement you are making. Many consolidation loans, for example, will ask that you use your house as collateral to secure the loan. We suggest that you seek professional independent advice before taking this course of action.

All things considered, if you can manage to clear your debts without resorting to more borrowing, you will be better off once your debts are cleared.

Creditors and their Rights

As already explained, creditors (people who are owed money) have certain immediate powers over secured debts, but for credit card debt their powers are more complicated. It is useful to know just what could happen if you cannot meet your financial obligations.

County Court Judgements

A payday direct lender, for example, can ultimately make a claim through the County Court to get their money back from you if you do not make repayments. Before you are taken to court there will be a period of time, in which your creditors will request money from you and you will be able to negotiate a repayment offer with them. If you are unable to make a repayment offer, they do not accept an offer that you make or if you do not stick to an agreed offer, then your creditor will usually take you to court. If you disagree that you owe money, you can also reject your creditors claim for money. In which case, your creditor can take you to court to claim it.

The court will make a judgement on whether you owe your creditor money or not. If it is found that you do owe your creditors money, the court will normally order you to make repayments. It is important that you stick to these repayments. If you fail to do so, your creditor may take further action, such as applying to the court to send bailiffs to your home or to take money directly from your wages. On top of this, your creditors can request to the court that your debt is secured against an asset of yours, such as your home, and this could put your assets in jeopardy.

Summary: Advice on Credit Card Debt

In this article, short term lender Cashfloat, explored credit card debt. If you are in debt, you should do all you can to help yourself get out of it. Sharing your debt problems with family and friends can help you to start tackling the problem. Once you have made a commitment to deal with it, make sure that you make the best plan for your individual circumstances and that you stick to it.

Remember that you can go to StepChange or the National Debtline if you are unsure about what to do.

In the next chapter, we will be looking at credit ratings. We will look at how your credit history is used to determine your credit rating and how your credit rating determines your ability to borrow money.