Is your business spending in the best way? The rest of this Cashfloat guide has focused on personal credit cards, used by individuals for personal spending. However, credit cards can be useful financial tools for businesses as well. In this chapter we will take a quick look at how business credit cards can benefit both large and small businesses.

- Business credit cards often come with rewards suited to businesses, e.g. free travel insurance.

- Business credit cards come with the same risks as personal credit cards- use wisely.

In this chapter we will take a look at how business credit cards work, and what benefits they can provide a company. We will discuss both the benefits and the risks, so that business owners can make an informed decision when considering applying for a card.

There are many different kinds of business credit cards, so we will look into the factors that businesses should explore when choosing a contract. Credit cards are not always the best option for companies, so we will lay at what alternatives there are out there.

How Business Credit Cards Work

Fundamentally, business credit cards work in the same way as personal credit cards. For an in-depth explanation of how credit cards work to provide people with money and what this costs users, go to Chapter 6 of this guide.

As with personal credit cards, business credit cards allow businesses to borrow money (up to a certain amount) from their card provider. If the business pays this money back before a certain date, then they will not have to pay anything for having borrowed it. However, if they fail to pay the money back before this date, they will have to pay interest on the money that they have borrowed. While the fundamental principle of all credit cards is the same, the specific additional rules and features attached to business credit cards do, usually, make them different from personal credit cards. For example, many business credit cards have credit limits, interest rates or rewards that are different to personal credit cards.

One unique feature that business credit cards often have is that they allow more than one cardholder to use one account. The credit limits and other usage controls on extra cards can be set by the account holder (usually the business owner) and not just by the card provider. Used wisely, business credit cards can be very helpful in helping businesses to operate smoothly, to build up their creditworthiness and to access other rewards and benefits.

Interest rates and Other Costs

In the same way that interest rates for personal credit cards are largely set according to the credit score and income of the account holder, business credit cards are allocated an interest rate which mainly depends on a business’ credit score and income. That means that different businesses will be charged different rates for using a credit card, depending on their circumstances.

If your business has a good score, crucially, you can expect to get a lower APR. You may also be able to take out a credit card with lower additional fees and a lower annual fee (where there is an annual fee).

The difference between personal credit cards and business credit cards is that they, generally, tend to come with higher rates of APR and more additional fees, such as late payment penalties or fees for account inactivity. On top of this, more business credit cards tend to come with an annual membership fee.

Credit Limits

As with interest rates and additional fees, the higher the income of your business and the better your credit rating, the higher a credit limit you are likely to be given. The difference between personal credit cards and business credit cards is that credit limits tend to be higher with business credit cards. While credit limits can be as low as £1000, limits of £10,000 are often offered to new customers.

Rewards

Each business credit card provider will offer different rewards. Rewards schemes are common with business credit cards and are heavily used by cardholders. Many of the rewards which come with business credit cards are similar to personal credit cards, such as cashback for spending, points schemes or air miles. However, some rewards are tailored for business use.

One common reward which comes with business credit cards is free travel insurance. Some types of business involve a lot of travelling and free travel insurance can be a useful feature to have with a credit card. There are many other perks that could come along with business credit cards. See below for common discounted services that card companies use to attract businesses:

| Business credit cards often come along with very useful rewards! Click on the credit cards to discover what different credit card companies offer discounts on: |

||||

|---|---|---|---|---|

| Business credit cards often come along with very useful rewards! Click on the credit cards to discover what different credit card companies offer discounts on: |

||||

|---|---|---|---|---|

Other Features

As we mentioned earlier, business credit cards usually allow more than one person to have a credit card and to spend with it on one account. Personal credit cards only allow the account holder to have a card and they are the only person authorised to spend on credit. Business credit cards allow an account holder (usually the business owner) to give extra cards to their employees, so that they can use them to make purchases. As well as the account holder being allowed to give out cards, they will also usually have control over how much each cardholder can spend with their card and how they are allowed to use it.

One useful feature of personal credit cards is that purchases between the value of £100 and £30,000 are protected under Section 75 of the Consumer Credit Act. With this protection, cardholders can ask their card provider to refund them the full value of a purchase if there is a problem. This is because the card provider is held jointly liable for what they have purchased by the law. As businesses are not classed as consumers, they are not protected by this legislation. Therefore, unfortunately, this protection is not available with business credit cards. That said, some credit cards come with additional guarantees for purchases or insurance against fraud, which is not available with personal credit cards, to make up for this shortcoming.

Will a Business Credit Card be Useful for My Business?

Personal credit cards, which people use in their daily lives, allow people to have access to credit and also offer a host of other benefits. The same thing applies to business credit cards.

Having access to credit can be very useful for a business, in terms of cash flow management. As well as helping with cash flow, they can be used to cover large purchases and the extra benefits that they come with can be very useful. The simplicity of accessing credit with a credit card is a major bonus for business use. Whereas, being able to access credit on a personal credit card is usually just convenient for cardholders, for businesses being able to access credit in this way can actually save money or help a business to make more.

The extra benefits that company credit cards come with, such as air miles, travel insurance or cash-back can be very attractive and are sometimes quite useful. Where rewards match the needs of the business they can be particularly useful.

However, as with all credit cards, while business credit cards do offer a range of benefits to businesses, it is important to remember that credit cards are a risk and deciding whether or not to take out a credit card is a decision which needs careful consideration.

Here is an explanation of the advantages and disadvantages which credit cards offer businesses:

The Advantages of Having a Business Credit Card

Cash flow issues are common in many businesses. Money is often needed to pay for things before it becomes available when customers pay their bills. Having access to credit overcomes this problem. Instead of having to wait to receive money from customers before making payments, you can just pay for whatever you need with a business credit card. Where money is needed quickly to get hold of materials or something else needed to secure new work, having access to credit could also boost profitability.

For some businesses, credit cards could be used to fund large purchases which would otherwise be difficult to afford. Business credit cards often come with high credit limits, which can be used to fund expensive supplies which could help a business to succeed. Where credit cards come with lengthy interest free periods, it may be possible to pay off the debt before any interest is accrued.

The convenience and simplicity of spending with a credit card may actually save a business money, by reducing bookkeeping and administration costs. Where a business owner’s, secretary’s or even an accountant’s time may be taken up planning and administering a business’ expenses, this can be avoided by using a credit card.

This is particularly relevant when employees need to pay for things during work. Instead of having to administer an expenses system, a business owner can just give their employees a credit card. All payments can be made on the credit card and time spent organising and making repayments to employees can be avoided.

Often people forget that many businesses, particularly new ones, don’t have a detailed credit history or even have one at all. This can make it difficult to secure loans or other forms of credit, which are often very useful to a business. Business credit cards can be used to establish a business credit history. Careful use of a credit card, following good spending habits, can help to build a good credit rating, which can help a business to succeed.

For businesses which operate overseas, credit cards can be very useful. Visa and Mastercard credit cards are accepted all over the world, allowing employees or business owners to travel for business and to be able to pay for whatever they need. Business credit cards offered by American Express are also widely accepted around the world.

As with personal credit cards, when it comes to rewards that come with using a card, it is important to check that the benefits which rewards provide really do outweigh the cost of having them. Business credit cards which offer many rewards usually come at a price and it is a good idea to be careful that you don’t end up paying over the odds for rewards that you don’t use effectively. That said, rewards can be useful and where the rewards offered closely match the needs of a business they can be particularly useful.

The Disadvantages of Having a Business Credit Card

While there are many advantages to credit card ownership for a business, there are also many disadvantages. Here are the five biggest disadvantages:

As with all credit cards, used wisely they are an asset. However, used unwisely they can cause serious problems. There is always the risk of over expenditure on credit. The result could be an accumulation of debt for a business. If a business is unable to pay off what it has borrowed quickly enough, hefty interest rates and fees could be applied. While it may not seem much at first, bills can add up and borrowing can end up costing a lot. Some debts even spiral out of control. It is important to remember that while business may be going well when a credit card is taken out and debts are put onto it, the business may face difficulty and debts which initially seemed easy to pay off may become more difficult.

On top of the risk of debt, is the fact that business credit cards tend to come with relatively high rates of APR and with costly fees. Borrowing with a business credit card is often more expensive than with a personal credit card. Before you take out a business credit card, it is important to check that borrowing with it is actually the cheapest option. It may be that an alternative form of borrowing, such as with an overdraft, may actually be cheaper.

When you give an employee a credit card, you have to trust them to make the right choices when they buy things. Although you can set the spending limits, delegation always involves risk. It could be that an employee deliberately misspends or buys the wrong items by mistake. Each transaction will have to be honoured regardless of whether you approve of the payment.

Where items between the value of £100 and £30,000 are protected by Section 75 of the Consumer Credit Act on a personal credit card, this does not apply to a business credit card. That means that there is no extra protection for purchases that you make with a business credit card. That said, other guarantees or insurance which is often offered with personal credit cards can offer more protection for purchases than you can get by making them through other methods, such as with a debit card.

While credit cards are useful, the best way to make purchases is always with money that you already have. Having access to credit can discourage a business from developing more responsible spending habits. It is a good idea to keep money aside to cover emergency expenses and to keep a good cash flow. It is important not to become over reliant on a credit card and to make sure that you save money where possible, instead of using one.

How to Choose a Business Credit Card

Different credit cards offer different features, and the one that you should choose depends on your business’ needs and level of eligibility. Remember that while the ideal credit card might be available for your business, if you don’t have a credit rating, you may have to settle for a different card. If the cards which are available to you are pricey because of your lack of a credit rating, then be careful to closely examine the price before you take one out. As with all credit cards, the most important thing to consider is how much it will cost you to borrow money.

The Cost of Borrowing

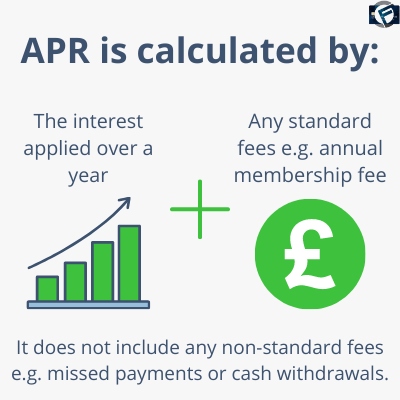

APR rates provide the best way to compare the cost of borrowing. These rates show how much it will cost to borrow money over a period of one year. For example, if you borrow £500 at 20% APR for one year, it will cost you £100. Of course, if you borrow £500 and pay it back quicker than that it will cost you less. It is important to note that the APR rate that the provider gives you does not have to match the advertised rate and you may receive something different. On top of this, it is important to read the terms and conditions of a credit card carefully and to check if there are extra fees, such as fees for account inactivity or annual membership fees.

When looking at the cost of borrowing, don’t just look for the cheapest card or simply compare the cards on offer, but also be realistic with yourself about whether your business can afford to have one.

Interest Free Periods are another consideration to make when looking at the cost of borrowing money. Credit cards with a long interest free period offer a good way to borrow money. However, they may come with additional costs and it is also important, if you take one out, to be disciplined and to schedule repayments so that you pay the money off before high rates of interest are applied.

Credit Limits

A card with a high credit limit is useful because it allows you to spend more. If you need to fund a large purchase and you are sure that you will be able to pay the money back in time, then having a high credit limit can be a bonus. As with all borrowing, though, it is important that you don’t overstretch yourself and borrow more than you can afford to pay back.

Rewards

Rewards are often something that attract people to a particular credit card. If you would like to take out a credit card with rewards, then make sure that the value of the rewards outweighs what you will pay to receive them. A wise choice is to choose a credit card with rewards that closely match the needs of your business and will help it to succeed. For example, a card which provides free stationery may be useful for a business which uses a large amount of it.

Do you Need to Build your Credit Rating?

If your business either has a poor credit rating or does not have much of a credit history, then it is useful to build a good credit rating. In this case, then it is a good idea to get a credit card that will make this easy. To build a good credit rating, you need to follow responsible borrowing habits. Choosing a card which does not stretch your budget is the best approach. You should try to choose a card, which has a credit limit that you can stay well within and which you will be able to make prompt repayments to easily.

Payment Protections

Cards, which come with guarantees for purchases and insurance against harmful activity, such as fraud can be useful to businesses which are at risk of fraud or are likely to make purchases which may be problematic. While Section 75 protection is not available with a business credit card, many of them come with other features. Read the terms and conditions carefully to make sure you know exactly what you will be covered for.

Account Controls

If you are planning on giving subsidiary cards to your employees, it is a good idea to find a card which allows you the right amount of control over their expenditure. This can help you to avoid costly bills being run up by employees who are not properly limited. On top of this, cards which provide bookkeeping services, such as itemised billing can be useful in keeping track of expenditure and in accountancy.

Will you Use your Card Abroad?

businesses which operate internationally and need to use their cards abroad, it is best to find a card that does not have high fees for doing so. Some business credit cards are designed for this purpose and are, usually, what a business should choose if they plan to use their card abroad.

Using a Personal Credit Card for Business

A common question is whether or not it is possible to use a personal credit card to make purchases for a business. While, for some people, this is common practice, it is not generally advisable. Mixing your personal accounts with your business accounts can make things complicated and, also, you will miss out on some of the benefits of using a business credit card.

One of the major benefits of using a credit card, which is registered to your business, is that you can build a credit rating for your business. If you use your personal credit card, your borrowing habits will only impact your personal credit score. This can come with the additional risk of damage being done to your personal credit score if your business runs into financial difficulty.

While there are ways for a business to account for expenditure made on a personal credit card, mixing your personal finances with those of your business can make things complicated. It may be hard to account for your expenses and could, potentially cause concern for HMRC who may look into your personal accounts as well those of your business. In some circumstances, you could personally become liable for aspects of your business expenditure. On top of this, your credit card provider may take issue if you use your personal credit card for business expenditure and may not allow you to do so.

Another benefit of using a business credit card that you will be missing out on is access to a higher credit limit. Credit limits with business credit cards are usually higher and where large purchases are needed it may not be possible to fund them with a personal credit card.

What if you Just Need to Fund a One Off Purchase?

If you just need to fund a one off purchase and are considering using your personal credit card to avoid the commitment of taking out a business credit card, then it may be worth looking at other borrowing options. It may be more convenient to use a business overdraft or to take out a loan. Read on to find more alternatives to business credit cards.

Alternatives to Business Credit Cards

Here are some alternatives to taking out a business credit card:

If you like the idea of tracking your business spending but aren’t keen on accruing debt, then a great alternative is prepaid cards.

While prepaid cards do not allow a business to borrow money on credit, they do offer the convenience of being able to make payments by card. Where a business needs to enable its employees to make payments on card, but doesn’t need them to be able to borrow money, this is common practice.

With prepaid cards, you have to load funds onto them before you are able to spend with them. If you have the funds available to load cards with money, the ability to access card payment systems can be useful and the bookkeeping simplicity that comes with card payment systems can save time and money.

For a complete explanation of how prepaid cards work, go to Chapter 14 of this guide.

A good alternative to a credit card, for one off borrowing, is a business loan. Instead of making a long term commitment to a credit card contract you can borrow money on a loan. Loans are often particularly useful where a large amount of money needs to be borrowed. It is also possible to take out small loans, which can be used to make purchases similar to those offered by a business credit card with a relatively low credit limit. As with all forms of borrowing, loans are a risk and it is important to be careful that you can pay the money back before you decide to borrow it.

Many business bank accounts come with an overdraft. As with personal borrowing, an alternative to using a credit card to borrow money is to use an overdraft. The rates offered by business overdrafts vary from bank to bank and banks will change what they offer for different businesses. The interest rates and fees which come with business overdrafts can be complicated. It is important to read the terms and conditions of your overdraft facility carefully, so that you know exactly how much it will cost you to borrow money with it before you decide to do so. In some cases, borrowing from an overdraft will be better than borrowing with a credit card.

Summary: Business Credit Cards

Hopefully, this chapter has given you a clear understanding of how business credit cards work and has helped you to understand whether your business could benefit from having one. Having access to credit can help a business to succeed and the other benefits that come with business credit cards can be very useful, as well. That said, as with all borrowing it is good to take a measured approach and to be sure that you can afford to fund a business credit card before you take one out. It may also be cheaper to borrow money through a different method and it is a good idea to weigh up all of your options before you make a choice.

In the next chapter we will be looking at subprime credit cards and exploring whether they are, potentially, more damaging than borrowing from payday loan companies.

Chapter 15:

Debit Card vs Credit Card

Chapter 17:

Are Subprime Credit Cards Worse Than High-Cost Loans?