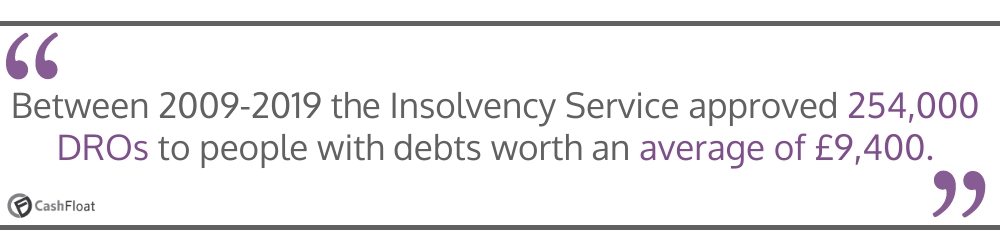

Debt relief orders have written off over £2.3 billon in debt since 2009! This Cashfloat article compares debt relief orders and debt management plans.

- Debt charities provide free, professional debt advice

- Debt relief orders cover some priority debts such as rent and electricity

Cashfloat is a leading lender of short-term-loans in the UK. As well as providing short term loans, we also publish financial advice on our blog.

As part of our guide to debt management plans, our team have put together this article comparing debt management plans and debt relief orders. Read it through for a clear understanding of what the difference is.

Seek Professional and Impartial Debt Advice

For people struggling with debt, it is important to find the right solution to the problem. There are many ways to solve debt problems, and debt management plans (DMPs) and debt relief orders (DROs) are just two possible debt solutions. Before deciding whether a DMP or a DRO is right for you (or if a completely different solution is more appropriate) make sure that you seek professional and impartial advice. There are many things to consider when trying to resolve a debt problem and finding the right solution can be complicated. Having good support is a vital part of the process.

Luckily, for people who are struggling with debt, there are a number of free and professional charitable organisations which are able to offer good debt advice. As well as offering debt advice, many of these organisations are also able to offer extra services and support to help people clear themselves of debt. Good organisations to go to are StepChange, PayPlan and Christians Against Poverty.

Avoid Debt Management Companies

While there are a number of helpful and professional charities which provide good support to people who are struggling with debt, there are also a number of debt management companies which should be avoided. Debt management companies offer many of the same services that debt charities do, but charge a fee for providing this service. They often hide their fees and have been known to advertise their services as free, when they are not. As well as charging fees to people who needn’t pay them, some of these companies also give bad debt advice to people. The bad advice and unnecessary fees that these companies provide can be very harmful and come at a time when people are most in need of real help.

| Think you’re the only one struggling with debt? Click the logos below to reveal how many people reached out for debt advice in 2019: | ||

|---|---|---|

|

|

|

| Think you’re the only one struggling with debt? Click the logos below to reveal how many people reached out for debt advice in 2019: |

||

|---|---|---|

|

||

|

||

|

||

How Debt Management Plans and Debt Relief Orders Work

If you are looking at a way to resolve a debt problem, you may have heard of debt management plans and debt relief orders. Both of these are commonly used debt solutions, in the UK. Knowing which one is the most appropriate choice isn’t always straightforward. Here we’ll explain how each of these debt solutions work.

Note: You may also have heard of individual voluntary arrangements (IVAs). For an explanation of how IVAs compare to debt management plans, go to this article here.

How Does a Debt Management Plan Work?

A debt management plan is a non-legally binding agreement which a debtor (someone who owes money) makes with their creditors (the people they owe). Where a debtor has some spare money, but not enough to pay back what they owe at the rate they should, they will try to negotiate lower monthly payments with their creditors. If they can negotiate lower monthly payments, they will then repay what they owe at a rate that is slower than what they agreed to when they originally borrowed money.

As part of a DMP, the debtor will also usually ask creditors to freeze interest and fees on the debt while the plan is in place. This is to stop the debt rising and becoming difficult or impossible to repay. Debt charities usually run DMPs, and they make all the necessary negotiations on behalf of the debtor.

How Does a Debt Relief Order Work?

A debt relief order is a formal (legally binding) debt solution and a form of insolvency, often used as an alternative to bankruptcy. Debt relief orders allow people, who qualify to receive one, to write off debts that they cannot repay in any reasonable amount of time.

If an application for a DRO is accepted, the debtor will not be obliged to make any payments towards debts covered by it for 12 months. Creditors will also be unable to collect the debt during this period, although they are still allowed to add interest and charges. If the debtor’s situation has not changed after these twelve months, then the debts covered by it will be written off.

While there are drawbacks to being on a DMP, they can restore order where debt makes life difficult and allows people to clear their debts at an affordable rate. For a more complete explanation of how debt management plans work, go to Chapter 3 of this guide.

On the other hand, while a DRO may seem appealing, there are serious consequences to receiving one. On top of this, they are only available to people who have very little spare money and are truly unable to repay their debts in any reasonable amount of time. For a more complete explanation of how debt relief orders work, go to this article here.

What are the Key Differences?

If you are trying to decide whether a debt relief order or a debt management plan is appropriate for you, it will be helpful to understand what the key differences are. While this will help to inform your decision about how to tackle your debt problem, it is important to remember that finding the right solution can be complicated and will depend heavily on your individual circumstances. As such, it is always best to discuss your situation with a free, professional and impartial debt advisor from a charity, such as StepChange, PayPlan or Christians Against Poverty.

Qualifying for a Debt Relief Order

The first thing to note is that in order to be able to receive a debt relief order, you will need to qualify. In order to qualify, you will have to:

- Have total debts of less than £30,000 (£20,000 in Northern Ireland)

- Have less than £75 spare each month to contribute towards your debts

- Not be a homeowner

- Have assets worth less than £2,000

- Not have a car worth £2,000 or more (this is allowed on top of your asset allowance)

- Lived in or run a business in England, Wales or Northern Ireland in the last three years. In Scotland a similar solution, known as minimal asset process bankruptcy is available instead.

The eligibility criteria for receiving a DRO make them only suitable for people who are truly unable to repay their debts in any reasonable amount of time. The £75 maximum monthly amount of spare money is what is still available after household bills and basic living expenses are covered. With this amount of spare money it would take many years to repay even low levels of debt. As such, for someone to be able to apply for a DRO, they should have no viable way to repay what they owe in any reasonable amount of time.

They Last for Different Amounts of Time

The amount of time it will take to become debt free under a debt management plan varies from person to person, depending on how much they owe and how much spare money they have. For a debt relief order, once it is accepted and is not revoked for any reason, it will take twelve months for a person’s debts to be cleared.

How Long Will it Take to Clear Your Debts?

If you think that it would be likely to take you an unreasonable amount of time to pay off debts with a DMP, then it may be worth considering alternative solutions. A DRO could be a possible alternative. Remember to speak to a debt advisor, however, before you jump to any conclusions. It is worth noting that, while a DRO or a different alternative debt solution may resolve debt more quickly, the consequences which come with them are quite serious and there can be effects which last for several years.

Which Debts are Covered?

Generally speaking, debt management plans are used to cover non-priority debts. Before starting a DMP, you will budget yourself so that you can pay your priority debts and living expenses before you make contributions to debts which are covered by your DMP. As such, you will need to make your normal payments towards your priority debts and will only be able to make reduced payments towards the non-priority debts, which are covered by your DMP.

DROs, on the other hand, are able to cover a more extensive range of debts. One key area in this is arrears on household bills, such as rent, gas, electricity, telephone and council tax. These debts can be covered by a DRO, meaning that you might not even have to pay them back at all. While DROs do cover a more extensive range of debts, there are certain debts which are excluded. These are:

- Criminal fines

- Student loans

- Child Maintenance Service arrears

- TV license arrears

- Social Fund loans

- Damages for personal injury that you have to pay

They Affect Your Credit Rating Differently

Both of these debt solutions will, unfortunately, harm your credit rating. While a DMP is not specifically recorded in your credit file, the reduced payments you will be making towards your debts will be. Also, your creditors may default your debt or add a ‘payment arrangement’ note to it, which will indicate to future lenders that you are on a debt management plan. When you receive a DRO, your details will be added to the Individual Insolvency Register (DRO register in Northern Ireland) until three months after your DRO has finished. On top of this, your DRO will also be recorded in your credit file for six years from the approval date.

The effect of being listed on the insolvency or DRO register and having a DRO recorded in your credit file can be quite serious. This could limit your financial options to a relatively serious degree. Having a debt management plan will also limit a person’s financial options, although the extent to which it will do so will be more variable according to individual circumstances.

The extent to which different debt solutions will affect a person’s credit rating and financial options will vary considerably. It is best to discuss your situation with an impartial debt advisor, to get a clearer picture for yourself.

Consequences of Receiving a Debt Relief Order

As well as affecting your credit score, which will limit your financial options there are other legal restrictions which come with receiving a debt relief order. The main restrictions are:

- You are not allowed to take out more than £500 of credit without telling the lender that you have a DRO

- It’s forbidden to continue to do business under a different name, without telling everyone you do business with that your previous business was subject to a DRO

- You are not allowed to set up a limited company or act as a company director without permission from a court

In comparison, as an informal solution, there are no legal restrictions which come with being on a debt management plan.

A Debt Relief Order Could Affect Your Employment

While it is uncommon, one thing to consider before applying for a debt relief order is whether or not it could affect your employment. If you work in certain professions, you may find that you will be unable to continue working after receiving a DRO. Most often this is in financial and legal professions. If you are unsure whether this could apply to you, it is good to either speak to your employer, check your contract or speak to a professional membership body.

In Summary…

Debt management plans and debt relief orders are both solutions to problematic debts. Generally speaking, DROs are a more drastic solution and are only applicable where a person is truly unable to repay what they owe in a reasonable amount of time. If you are unsure about whether you should pursue a DMP or a DRO (or a completely different solution), then it is best to speak to a free, professional and impartial debt advisor.