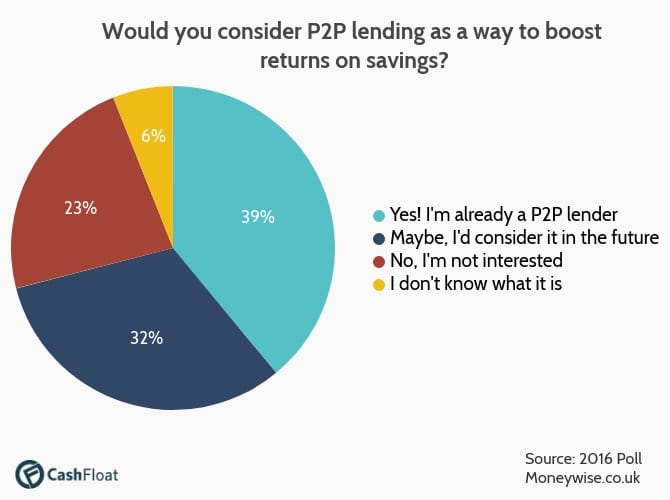

When you need to borrow money, there are always several options. It’s crucial you understand the choices available and pick the one that’s best for your situation. In the last decade, peer-to-peer lending has become a popular way of borrowing money for both borrowers and lenders.

Lenders profit from higher interest rates by lending their money rather than saving it. Borrowers may get a better deal from peer lending than from the high street lenders or payday loans online. However, as with any loan or investment, peer-to-peer loans are not without risk. Cashfloat explores how peer-to-peer lending works, including all the pros and cons, so you can make an informed decision when choosing a lender.

What is Peer-to-Peer Lending?

Peer-to-peer (P2P) lending allows individuals to lend or borrow money from each other without the intervention of a bank. P2P websites provide a platform to match lenders and borrowers, depending on their needs. These platforms also include the tools you need to create lending agreements, get a good deal on a loan, or make a higher return on investments.

People often become P2P lenders as an investment alternative to opening a regular savings account. However, the rate these lenders charge is still low compared to other loans, which is great for borrowers and encourages them to try P2P lending rather than other options.

The Risks of Peer-to-Peer Lending

Before diving into peer-to-peer lending as a safe investment option, you should know the risks involved. Understand that your savings won’t have the same protections a bank or building society can offer – the Financial Services Compensation Scheme (FSCS) does not cover P2P lending.

Losses due to borrower defaults often fall entirely on the investor. Putting your savings into P2P lending is a gamble, just like any other investment. Losing money is a very real risk you must be prepared for.

Taking out a P2P loan is no riskier than borrowing from a bank, and you can easily compare loan options based on the available interest rates.

You may be required to pay fees depending on your credit score, how much you want to borrow, and the loan terms. Before applying for a loan, it’s vital to consider these factors as they ultimately dictate the amount you have to repay.

What Safety Nets Exist for P2P Lenders and Borrowers?

It’s always advisable to have protection when you invest or borrow money. Although the FSCS doesn’t cover P2P lending to the extent that it covers traditional loans, some protections are still in place. For example, the FSCS protects P2P investors who lose money due to bad advice from a financial adviser. Badly advised investors who lose money may be able to claim up to £50,000.

Some investors might also be protected through the P2P company itself. While many peer lending companies pass losses on to investors, not all do. You can select a website with a provision fund to help cover bad debts. Fees paid by borrowers and lenders often contribute to creating and maintaining these funds, serving as a safety net for investors and borrowers and giving both parties a greater sense of security.

Many sites conduct credit checks to verify potential borrowers can pay back their loans. Precautions like these benefit both sides, denying loans to borrowers who could easily end up landing investors with bad debts.

P2P Lending: Rewards for Investors

Several potential rewards make P2P lending appealing. For investors, the potential for higher ROI is attractive. Peer-to-peer lending offers better returns than traditional savings, amounting to around 3.5%. Those willing to take greater risks can double their profits.

In April 2016, the UK government introduced the Innovative Finance ISA (IFISA) account that upped the ante for the UK’s peer-to-peer lending market. The IFISA is an investment account that allows P2P lenders to accrue tax-free interest on their money, adding significantly to their gains. This innovation is great for investors already operating on P2P platforms and potential investors contemplating joining them.

P2P Lending Perks

Potentially Higher Returns

Accrue Tax Free Interest

Gradual Introduction to Investing

Many investors are unhappy with the ROI they receive from conventional accounts but wary of trying more complicated investments. Hence, peer lending gradually introduces new, more timid investors, helping them build confidence and expertise in their money-making abilities.

P2P Lending: Benefits for Borrowers

For borrowers, the main reward of P2P lending is finding better rates. Interest on your peer loan can be significantly lower than on a traditional short-term loan. In fact, the process is similar to borrowing from a bank.

These P2P loans can be cheaper to repay because early payments are often possible without fees. Additionally, there is usually no minimum borrowing threshold, so you can borrow exactly what you need. If borrowers take the time to understand costs and other relevant factors, peer-to-peer loans can be an excellent solution.

When Should You Consider P2P Lending?

Peer-to-peer lending can be an excellent option for lenders and borrowers. If you’re looking to invest, P2P lending is a good way to grow your savings. If you decide to take the plunge, remember that there is a significant element of risk.

You can reap better returns; you could equally lose money. But if you’re willing to take that chance, peer-to-peer lending could be for you.

P2P lending is especially useful for borrowers looking for loans with better interest rates. You may find it easier to secure a great loan if you have a good credit rating. They can also provide a viable alternative if banks have rejected your loan application.

Peer-to-peer lending can be a great way to borrow and make money. But before you decide if it’s right for you, look at it from every angle.