Confused about the UK State Pension changes? Learn about the new scheme, the basic scheme, and what you will receive, in this article from Cashfloat.

- The full basic State Pension is £137.60 per week, although many can claim more through Additional State Pension.

- Under the new State pension, the full payment is £179.60 per week. Some people can claim more than this.

In this chapter, we will look at the State Pension scheme in the UK. Pensions have become complicated in recent years, mainly because of the introduction of the new State Pension. Many people are confused about what they will receive when they retire, so we will explain how it all works.

In part 1 of this chapter, we will discuss the new State Pension, the basic State Pension, Additional State Pension and Pension Credit. These are the main types of pension support that the government give in the UK. Most people who reach retirement age will receive at least one of these forms of welfare.

State Pension UK

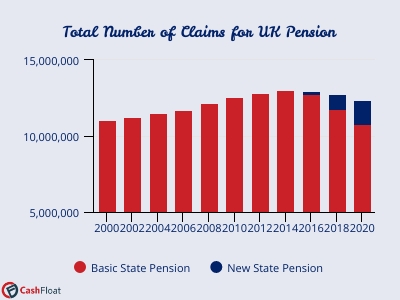

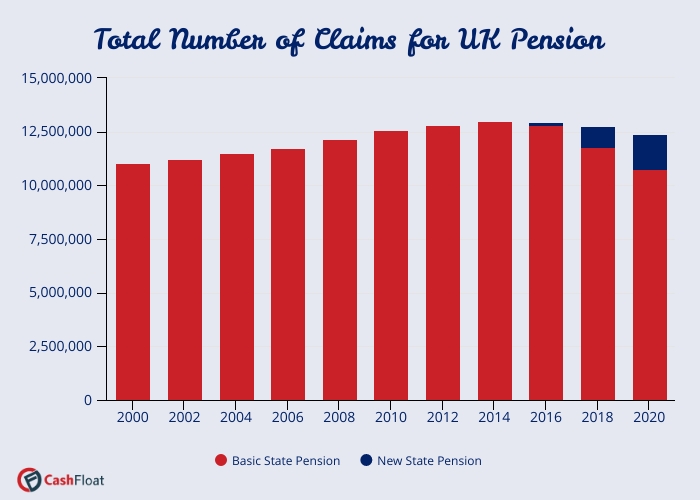

Before 6th April 2016, when people reached retirement age, they would receive what is called the basic State Pension. However, after this date a new pension was introduced, called the new State Pension. Effectively, the state changed the rules about what it would provide as a State Pension on this date.

This has made things complicated, with the amount that people can get being dependent on contributions they made to the state before and after this date. On top of this, claimants for both the basic State Pension and the new State Pension may get additional Pension Credit or Additional State Pension payments.

Many people who have worked in the last ten years may also have been paying into workplace pension schemes made mandatory by the government. This was introduced to get employers to arrange private pensions for their employees so that people are not completely dependent on the state when they retire. In Part 2 of this chapter, we will explain how workplace pensions work and what other support is available for pensioners.

How do State Pensions Work?

The UK State pension is regular payments that people claim from the state during their retirement and last until their death. To be able to claim a pension, you have to contribute to the state during your working life by making National Insurance contributions. To be eligible to receive any state pension, people in the UK must have made a minimum number of contributions. State pensions in the UK are limited to maximum amounts. The more National Insurance contributions you make during your life, the more likely you will receive the maximum amount.

Pension Calculator

If you are wondering how much you will receive from the state when you retire, you can use the government’s forecasting tool. This handy tool from the government will predict how much you will receive.

People who reach retirement age nowadays and anyone who did so since 6th April 2016 will receive the new State Pension. This pension applies to men born on or after 6th April 1951 and women born on or after 6th April 1953. We’ll start by explaining how the new State Pension works so that people born after these dates know what they will receive. We will then explain how the basic State Pension works.

Claiming State Pension

You do not receive your pension automatically; you have to claim it. Two months before you reach State Pension age, the government will write to you, telling you what to do. You are allowed to apply up to 4 months before you reach this age. Applications are made online, with a slightly different process in Northern Ireland.

After you apply, the government will write to you explaining how they will pay you. You will receive your first payment within 5 weeks of reaching the State Pension age, and payments are usually made in arrears every 4 weeks into an account of your choice. If you’re struggling to cover emergency costs until you receive that first payment, and have been declined by mainstream lenders and banks, you can apply with Cashfloat for quick payday loans.

Deferring your Pension

It is possible to defer your UK State Pension if you don’t want to claim it straight away. For instance, if you want to keep on working. Normally, if you defer your pension, you will be able to claim more when you do come to claim it.

Two months before people become eligible to receive the State Pension, the government will write to them informing them that they need to make a claim. If you want to defer your pension, you just don’t claim it. To receive more for deferring your pension, you need to defer it for at least 9 weeks. For every 9 weeks that you defer, your pension will increase by 1%. For every year, this is around 5.8%. The extra amount you receive will be paid in your normal pension payments when you claim it.

The New State Pension

The new UK State Pension is for anyone who reaches retirement age after 6th April 2016 and has different rules for eligibility and payment amounts to the basic State Pension, which is for people who retire before this date.

The rules of eligibility and payment amounts under the new State Pension are relatively simple. However, most people who are currently retiring will have made contributions to their pension both before and after the date that the new State Pension came into force. Many people who retire nowadays will receive a mixture of payment amounts according to when they contributed to the state.

Generally, all payments will be made under the new State Pension, but the amount they will receive for contributions they made before the new State Pension was introduced will be at the rate they would have received for the basic State Pension. For contributions they made to the state after the new State Pension launched, they will receive payments according to the rules of the new State Pension.

Eligibility for the New Scheme

To be eligible to receive the new State Pension, you must:

- Have been born on or after 6th April 1951, if you are a man.

- Have been born on or after 6th April 1953, if you are a woman.

- Be over the UK state pension age.

- Have made National Insurance contributions for at least 10 ‘qualifying’ years (with some exceptions).

Anyone who meets these requirements will be able to receive at least the minimum State Pension. The more ‘qualifying years’ that a person has made National Insurance contributions for, the more they will receive. Qualifying years made before introducing the new State Pension in 2016, count towards your pension in the same way as they do afterwards.

To receive the full new State Pension, you need to have 35 qualifying years. People who receive the new State Pension but are struggling to support themselves may also be able to claim Pension Credit. Go to the end of this section to find out more.

What Counts as a Qualifying Year?

A qualifying year is any tax year (April to April) in which you made enough National Insurance contributions for that year to count towards your state pension.

Most people earn enough to make enough National Insurance contributions when they pay their taxes. This is so even in a year with relatively low income. Some people earn a relatively small amount and do not pay National Insurance. However, if they earn enough, that year can still count as a qualifying year. Also, some people who receive certain benefits, and either don’t work or only work a limited amount, can receive National Insurance credits which they can use to contribute to National Insurance and earn a qualifying year.

For more details on qualifying years, read the information on the gov.uk website.

How Much is The New State Pension?

The full amount for the new State Pension is £179.60 per week.

You can get a pension forecast from the government to indicate how much you will receive when you retire.

How your New State Pension is Calculated

To calculate your new State Pension, you are given a ‘starting amount’. Currently, your starting amount is calculated according to the National Insurance contributions you made before 6th April 2016, when the new State Pension came into effect. Your starting amount will be the higher of either:

- The amount you would have got under the previous basic UK State Pension scheme for contributions you made up to 6th April 2016. This includes if you would have been eligible for Additional State Pension, which is an additional payment some people who receive the basic State pension can get.

- The amount you would be due under the new State Pension for contributions you made up to 6th April 2016, if the scheme had been in place at the time.

Many people will find that deductions are made to their starting amount. This happens when they were previously in a workplace, personal or stakeholder pension. People who contributed to one of these pensions may, at the time, have made lower National Insurance contributions. This is known as being ‘contracted out’ of the Additional State Pension and will affect many people.

The amount that your starting amount is may be less or more than the full new State Pension. Normally it is only higher for people who would have been eligible to receive Additional State Pension.

What You Will Get

Following the calculation of your starting point you will be allocated a pension amount.

For each qualifying year you have between 6th April 2016 and your retirement age, you will have 1/35th of the full new State Pension added to your pension up to a maximum of the full new State Pension. In 2021, this amount is £5.13.

This only happens to people who can also get the Additional State Pension. Luckily for these people, they will be able to receive this higher amount as their pension. The additional amount that they receive is known as the ‘protected payment’.

In this case you will receive the full new State Pension when you retire.

Additional Information About The New State Pension

The amount that people receive in their pension increases each year. The rate of increase is set as the highest of either the percentage growth of earnings in the UK, the percentage growth in prices in the UK or 2.5%.

This is known as the ‘triple lock’ and this system began to ensure that the value of pensions doesn’t decrease when the rate of inflation rises. This system has worked well for pensioners in recent years as the inflation rate has been lower than 2.5%. Following the ‘triple lock’ system, the increase of 2.5% has been the highest value and, therefore, the amount that pensions have increased by. This has effectively increased the value of people’s state pensions.

If your partner dies it is possible to inherit an extra payment from them on top of your new State Pension. It is possible to inherit Additional State Pension or protected payments. Whether you are able to do this depends on whether your partner reached the UK state pension age or died before 6th April 2016, or if they reached state pension age or died on or after 6th April 2016. You can contact your local pension centre for advice about this.

Under the basic State Pension, many people can increase their pension by using National Insurance contributions made by their partner. Under the new State Pension, most people’s pensions can only be calculated using their own contributions. However, some women who paid married women’s or widow’s reduced rate National Insurance may be able to claim extra pension using their partner’s contributions.

The rules for people who lived overseas and made limited National Insurance contributions, as a result, are complicated. However, it is often possible for people to claim a pension even if they have lived abroad for a lengthy period. In many cases, the amount that they will be able to claim will drop. Usually, it is easier for people to claim a UK pension using time spent working in a country in the European Economic Area, Switzerland, Gibraltar or another country with a social security agreement with the UK. Many of these people may also be able to claim a pension from another country if they worked there and made contributions to the country’s social security system.

For people who wish to move abroad after retiring and claim a UK pension from overseas, this is possible. Normally, you will have to nominate which bank account you have payments made into for an entire year. This means that you cannot receive part in a UK bank account for part of the year if you plan to split your time between your overseas accommodation and your accommodation in the UK.

Don’t forget: People who receive the new State Pension, but are struggling to support themselves may also be able to claim Pension Credit. Go to the end of this chapter to find out more.

The Basic State Pension

Anyone who reached retirement age before 6th April 2016 will receive the basic State Pension. In this section we’ll explain how it works.

- You are entitled to a full Basic National State Pension, if you made National Insurance contributions for 30 years.

- The full basic State Pension is £137.60 per week.

- Many people who claim a basic State Pension may also be able to claim Additional State Pension, which is an extra payment on top of the basic State Pension.

- People who have a small pension and are struggling to get by may be able to claim Pension Credit to top up the amount they receive.

The basic State Pension is available to men born on or before 6th April 1951 and women born on or before 6th April 1953. Most people who can get this pension will already be receiving it. This is unless they have chosen to defer it to receive it later in life. Every four weeks, recipients should receive the basic State Pension in arrears into a bank or building society account of their choice. The day of payment differs according to the last two digits of their National Insurance number.

Eligibility for the Basic Scheme

Anyone who reached retirement age before the cut off date of 6th April 2016 is entitled to receive the basic State Pension. Those who reached retirement age after this date will have to claim the new State Pension instead.

Those entitled to the full amount of £137.60 per week, should have worked and paid National Insurance contributions for at least 30 qualifying years. Alternatively, people who were claiming benefits that entitled them to receive National Insurance Credits can use these to count towards a pension instead.

How Much is the Basic State Pension?

The full basic UK State Pension is £137.60 per week. For people who don’t receive the full basic State Pension, there are ways to increase the amount that they can receive. People may be able to increase their pension using Additional State Pension or Pension Credit.

How to Increase your Basic State Pension

There are some ways to ‘top up’ the amount you receive if you do not have enough National Insurance contributions to qualify for a full basic State Pension.

- It is possible to defer your retirement date and continue working until you have made enough contributions to earn a higher pension. Deferring will also automatically slightly increase the amount that you receive, even if you do not make further National Insurance contributions.

- You can make voluntary National Insurance contributions. This often happens when people have insufficient contributions because they were self-employed with low profits, employed on a low salary, unemployed but not receiving benefits or were living abroad.

- You can get a ‘top up’ from your spouse’s or civil partner’s National Insurance contributions.

- You might qualify for Additional State Pension, or if you are on a low income, you could apply for Pension Credit.

Look at the gov.uk website for a complete explanation of ways to increase a basic State Pension.

FAQs about State Pensions

Can all people continue working after they reach retirement age?

Anyone may work past retirement age. However, some jobs have an age limit set by law, such as the fire service. Additionally, if an employer gives a good reason, they could force you to retire. An example would be if your job is physically demanding (i.e. in construction).

How are increases in the State Pension calculated?

State Pension increases are decided according to the ‘triple lock’ guarantee. Increases are made every year according to the higher of the following 3 things: the percentage increase in average earnings in the UK, the percentage increase in prices measured by the CPI (Consumer Prices Index) or 2.5%.

Additional State Pension

- People who receive a basic State Pension, may be entitled to receive Additional State Pension.

- To be entitled to receive Additional State Pension, you must have made contributions to additional government pension schemes, which ran between 1978 and 2017.

- Those schemes were the State Second Pension, the State Earnings-Related Pension scheme and the State Pension top up scheme.

People who qualify will normally receive their payments automatically when they receive their basic State Pension payments.

In order to be entitled to receive Additional State Pension, you must have made contributions to additional government pension schemes, which ran between 1978 and 2017. Many people will have contributed without realising. Here’s an explanation:

The State Earnings-Related Pension Scheme (1978-2002)Normally, unless you chose to opt out of making contributions to the State Earnings-Related Pension Scheme or you were automatically opted out, and you were employed and making National Insurance contributions, then you paid into this scheme. Most people will find out how much they contributed when they come to claim their basic State Pension. Some people don’t realise that they can inherit their partner’s contributions to this scheme if they die.

The State Second Pension (2002-2016)Most people who were in employment between 2002 and 2016 would have made contributions towards a State Second Pension. The State Second Pension worked similarly to the State Earnings-Related Pension Scheme, except that people who received certain benefits, acted as carers or were registered foster carers also automatically made contributions to the scheme.

UK State Pension Top Up (2015-2017)To have made State Pension top up payments, you would have opted into the scheme and made voluntary contributions. Most people who contributed to this scheme will be aware that they have done so.

FAQs about Additional State Pension

How do I know if I was ‘contracted out’ of the Additional State Pension?

You would only have been ‘contracted out’ if your employer ran a workplace pension scheme. To find out, you can check an old pay slip or contact your other pension provider. If you are not sure who provided you with a ‘contracted out’ pension, you can use the Pension Tracing Service.

What happens to Additional State Pension in the case of a divorce?

In the case of a divorce, the court will decide the allocation of this pension as part of a financial settlement. You will have to fill in form BR20 during the settlement.

What happens to the Additional State Pension in the case of a spouse’s death?

You may inherit up to 100% of a spouse’s Additional State Pension if they die, but not if you remarry or form a civil partnership before you reach State Pension age.

Additional State Pension is drawn from contributions to 3 different schemes; the State Second Pension Scheme, the State Earnings-Related Pension Scheme and the State Pension top-up scheme. For your partner’s contributions to the State Second Pension scheme, you can inherit up to 50% of their pension. For contributions they made to the State Earnings-Related Second Pension Scheme and the State Pension top-up scheme, you can inherit up to 100% of their pension, depending on the date they died and their date of birth. Most people will not be able to claim 100% of their partner’s pension.

Pension Credit

People who receive either the new State Pension or the basic State Pension, may be able to receive Pension Credit. Pension credit is available to people receiving a pension and are either on a low income, disabled, act as a carer or are responsible for a child.

Eligibility for Pension Credit

Pension Credit is available in England, Wales and Scotland, with a similar scheme operating in Northern Ireland. To be eligible for Pension Credit, you must be over the UK State Pension age if you are single. If you have a partner, either you will both have to have reached State Pension age, or one of you must be getting Housing Benefit for people over State Pension age.

Normally, Pension Credit is given to single people whose income is below £177.10 or to couples whose combined income is below £270.30. Income includes private pensions, state pensions, employment and benefits. The state does not count some benefits as income when calculating a person’s entitlement to Pension Credit.

People who are disabled, act as carers, are responsible for a child and people who have housing costs can sometimes claim extra money above the thresholds mentioned. On top of this, people who reached retirement age before 6th April 2016 and have made savings for their retirement, may be able to claim Savings Credit.

If you are eligible for Pension credit, you will often automatically become eligible for other benefits. It is worth carrying out some research to see what you could receive.

How Much will you Receive?

Here’s an explanation of what people can receive through Pension Credit:

Pension Credit Amounts | |

|---|---|

| Basic Pension credit for people who are not eligible for extra amounts | Singles – tops up weekly income to £177.10 |

| Couples – tops up weekly income to £270.30 | |

| People who have a severe disability | Up to £67.30 per week |

| People who care for another adult | Up to £37.70 per week |

| People who are responsible for a child or young person | If the child was born after 6th April 2017 – Up to £54.60 |

| The child was born before 6th April 2017 – Up to £65.10 | |

| If the child is disabled – either £29.66 or £92.54 depending on the severity of their disability | |

| People who have housing costs | The amount depends on the costs that a person has to cover |

| People who have savings or a second pension and are entitled to Savings Credit | Singles – Up to £14.04 |

| Couples – Up to £15.71 | |

Claiming Pension Credit

The quickest way to claim for Pension Credit is by phone on 0800 99 1234. Alternatively, you could call the helpline for a claims form. To make your claim, you will need your National Insurance number, bank account details and information about your income, savings and investments. The earliest you can apply is 4 months before you reach State Pension age. If you are applying after you have reached the State Pension age, the most that you can backdate a claim by is 3 months. It is possible to appeal against a dismissed claim, if it was unsuccessful.

FAQs about Pension Credit

Is Pension Credit the same for everyone? Will I receive Pension Credit automatically if I am eligible?

For most people, Pension Credit is a standard payment, which tops up their weekly income to either £177.10 (for singles) or £270.30 (for couples). However, people who have a disability, are carers, are responsible for children or young people, need help to pay for housing, or have savings, may be able to receive extra amounts.

No, you have to claim it. According to a study by the Pensions Policy Institute in 2013-2014, only 68%-72% of people eligible had claimed it. It’s a shame to lose out, so find out if you are eligible.

The second part of this chapter discusses workplace pensions and other benefits for pensioners, such as financial aid in emergencies. Read on to find out more.

We hope that this first section has helped you out. We try to do everything we can to make sure that our customers make the most of their money. It’s important to have your finances sorted for later on in life. After all, most lenders don’t approve pensioners or people who are loans for people who are unemployed, so if you get short of cash, things can get difficult.