Are you looking for short-term finance? Creditspring is a new credit scheme on the market. Cashfloat looks at how it compares to payday loans.

Set up in 2016, the online loan firm Creditspring offers a new style of loan, which the founders say is a viable payday loan alternative for cash loans. In this article, we compare and contrast these two financial products and how they work. We also examine the personal philosophy of the founders of Creditspring and what gave them the idea for this new financial product. We conclude by answering the question: Is the Creditspring interest-free loan really cheaper than instant payday loans, or is there a hidden catch?

How does a Creditspring Loan Compare to a High Cost Loan?

Like payday lenders, Creditspring is authorised and regulated by the FCA. Its eligibility criteria are very similar to short-term lenders. Members of the scheme must:

- Be 18 or over

- Be a permanent UK resident

- Have no recent history of CCJs, IVAs, bankruptcies or arrears

- Be in full-time employment, earning at least £20,000 a year

- Pass affordability checks (including providing proof of income) and undergo credit file checks by a credit reference agency

Customers can make applications for Creditspring membership and loans online. Members need to set up a direct debit to repay the loan.

Need an emergency loan? Cashfloat can provide hassle-free loans with same-day funding!

- Bad credit considered

- No hidden costs or fees

- Flexible repayments

- FCA authorised direct lender

- Get cashback on your loan

Why Was Creditspring Set up?

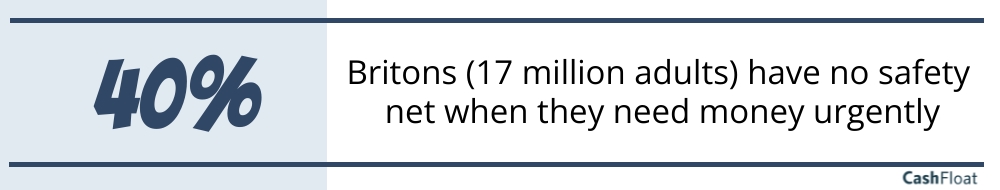

The co-founders of Creditspring, Neil Kadagathur and Aravind Chandrasekaran, set up the company because of the UK’s “broken” credit market. They say that 40% of Britons (or 17 million adults) have no safety net when they urgently need money. They criticised existing credit products for being complex and costly, adding that some could be dangerous, trapping borrowers in spiralling debts.

Their aim was to set up a simpler and better value loan scheme than other consumer credit products like overdrafts, credit cards or payday loans. Above all, they emphasise that Creditspring is an ethical lender.

Have they achieved their objectives? Let’s examine how their system works to get a better idea.

How far have they achieved their objectives? Let’s examine how their system works to get a better idea.

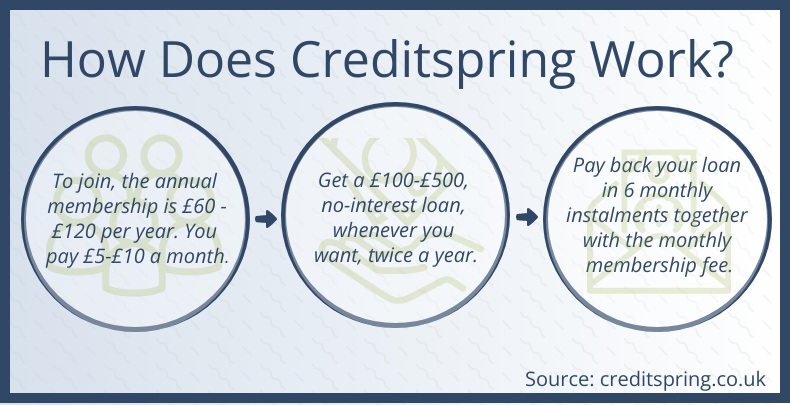

How Does the Creditspring Loan Scheme Work?

To be eligible for a Creditspring loan, applicants must become members of the organisation. Membership costs £60-120 a year (payable in monthly instalments of £5-10), depending on the tier. In return for these fees, members can take out two loans a year totalling a maximum of £300-1000. They will repay these loans in six monthly instalments, completely interest-free. The company imposes no charges for late or missed payments, although they will report defaulters to a credit reference agency. Creditspring guarantees that its borrowers will never pay more than the loan amount and the cost of its membership for access to these short-term loans.

To simplify the loan procedure, borrowers can only take a specified loan amount. Its founders recommend that those who need less money should repay the excess immediately, and they will adjust the instalments accordingly. The table below sets out the membership tiers.

| Tier | Membership Fee | Loans | Repayments | APR (%) | Total Repayable |

|---|---|---|---|---|---|

| Step | £5 per month (£60 per year) | 1. £100 2. £200 | First month: £16.70 Next five months: £16.66 | 87.5 | £360 |

| Core | £8 per month (£96 per year) | 1. £250 2. £250 | First month: £41.70 Next five months: £41.66 | 77.3 | £596 |

| Plus | £10 per month (£120 per year) | 1. £500 2. £500 | First month: £83.35 Next five months: £83.33 | 43.1 | £1,120 |

Creditspring members cannot take out a second cash advance until they have repaid their first loan. Customers can cancel their membership at any time, but the firm requests a month’s notice. If they have a loan outstanding when they cancel, they must contact Creditspring to arrange an early settlement. They must also notify any change in their circumstances affecting their ability to repay the loan (such as a job loss). In these situations, Creditspring automatically cancels their membership.

Is the Creditspring Loan Cheaper than High Cost Loans?

Although Creditspring loans don’t incur interest, by law they must include an APR so consumers are aware of the total cost of their borrowing. For Creditspring loans, this works out at a fixed APR of 43.1%-87.4% when taking membership fees into account. This compares favourably to all payday loans on the market.

The problem with the company isn’t the costs of their loans because there are no hidden fees. One problem is the lack of flexibility compared to instant payday loans. If consumers can only take a set loan amount, there is a danger that they might be tempted to spend it all just because it’s available. This isn’t an issue with payday loans as customers can borrow exactly what they need.

The other problem with the Creditspring loan scheme is that members must pay their fees, irrespective of whether they take out two loans in the 12-month period. Even if they take out only one loan, they receive no reduction in fees, nor are they automatically entitled to take out three loans in the next 12-month period. In other words, consumers pay for access to emergency cash which they may never need. Perhaps it would be better to put an equivalent sum aside and slowly build up a rainy day fund?

ConclusionIt’s true that Creditspring offers loans that are much cheaper than payday loans. However, before anyone becomes a Creditspring member, they should weigh up how often they really need two loans a year, especially as they can’t choose the loan amount. If the answer is ‘rarely’, it might be better to save the membership fees and build monthly savings for unanticipated expenses.