On 23 March 2023, Amigo announced that it had been unable to secure the capital it needed to continue in business. It was using the next year to wind down the business.

Insiders said that Amigo loans preyed on friendships and persuaded vulnerable people to take out guarantor loans.

Cashfloat, a responsible and ethical lender offering unsecured loan alternatives to Amigo loans, bring you the facts and concerns of borrowers and ex-employees.

- What was Amigo Loans?

- What wss Amigo accused of?

- Conclusion

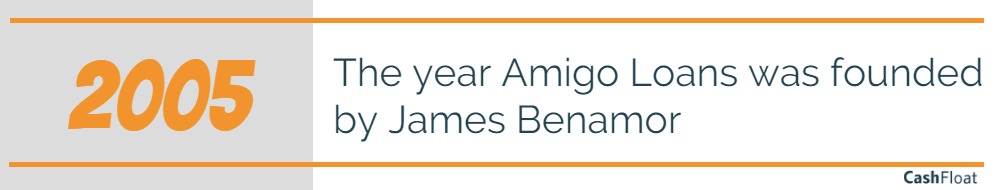

What was Amigo Loans?

Amigo was a guarantor loan company that allowed customers to borrow up to £10,000 with bad credit scores. In case a borrower could not pay off a loan, the guarantor was required to step in and pay. The risk of lending was much lower than that of no guarantor loans. Like most types of loan lenders, they were FCA authorised to ensure fair and responsible borrowing.

What was Amigo accused of?

Persuading People to Lie on Their Application

Former staff from Amigo Loans have accused the company of convincing people to lie on their applications to pass the affordability checks. Applicants were able to manipulate their expenditure and financial details on the application form to quieten an on-screen warning light that told them they couldn’t afford the loan. Underwriters making phone calls to potential applicant allowed those failing affordability checks to have additional chances to change their answers and getting approved.

Unrealistic Cost Cuts to ‘Afford’ the Loan

For Amigo, the more applicants, the more money they made. Accusers said Amigo Loans created a ‘bending of the rule’ culture. Staff faced targets for converting applications into loans and the office displayed a live leaderboard. It was no doubt that this pressure to succeed caused employers’ ethics to slip.

Former staff had also accused Amigo of encouraging borrowers to cut down on smoking, shopping and other ‘non-essentials’ like mobile phone costs, etc. in order to be eligible for a loan. This was against FCA regulations due to unrealistic expectations. It was not clear whether Amigo allowed this or not – yet it seemed common practice in the company. These allegations appeared to break the FCA regulations of only lending to people who would be able to make and afford the repayments.

Unfair Use of Guarantors

The problem went deeper, however, as it involved the use of a guarantor. By allowing their borrowers to lie on the application forms, thereby making them unaffordable, the guarantors had to bail out money that they shouldn’t be in the first place. No one should be forced to pay money because a company are too greedy to care about who they are lending too.

Furthermore, the FCA has upheld reports that Amigo did not perform sufficient affordability checks on the guarantors either. In their defence, Amigo’s Chief Executive, Glen Crawford claimed that only 15% of people that applied for a loan actually received the money, and of those, 90% repaid without needing their guarantor to step in. It was unclear, however, upon which parameters Amigo used to reject the other 85%.

The fear was, that people were unaware of the full liability they faced as guarantors. Citizens Advice warned, that friends and family were unknowingly trapping themselves in enormous debt and putting their assets at risk,

Unreasonable Treatment in the Case of a Defaulted Loan

It didn’t end there. A former staff member accused Amigo Loans of teaching him to say, ‘paying off this loan is the next important payment after paying rent.’ This attitude seemed to shift from Mr Benamor’s pledge to the BBC in 2013. He told Radio 4 that, the loan companies policy was always to collect what someone could comfortably afford. They should never prioritise payments over their living expenses.

Amigo contacted the guarantor – only 2 weeks after the borrower defaulted on a payment. Other companies do so after a longer period. When it comes to taking the case to court, most loan companies only start court proceedings after a year. Amigo claimed they would only go to court in the case of debt, as a last resort – if all else fails. However, the Times dispute this. It was not unknown for Amigo to enter court after just three months, after a barrage of emails, calls, text loan messages and letters to the defaulting customers. They took both the customer and the guarantors to court – totalling around 500 new cases a month.

Damaging headlines relate that Amigo had pursued family members for payment after suicide or injury of the customer. Amigo policy confirmed that it placed a two-week pause on contact in the event of a family death.

Conclusion to Our Amigo Loan Review

Amigo was a guarantor loan company that WAS ALLEGED TO have bent the FCA rules to bring around higher profits causing unfair and irresponsible lending. Now that Amigo is gone from the lending scene, loan customers can rest knowing that the short-term loan market is now a safer place for everyone. Amigo’s departure has brought about a wave of positive changes in the industry, leading to stricter regulations and increased scrutiny on lending practices. The absence of Amigo, which was notorious for its controversial lending policies and high interest rates, has paved the way for more responsible and ethical lending institutions to fill the void

Guarantor loans vs No Guarantor Loans

|

|

GUARANTOR LOANS | LOANS WITHOUT GUARANTOR |

|---|---|---|

|

RISK |

High |

Low |

|

LEVEL OF REGULATION |

Loosely regulated |

Highly regulated by the FCA, so safer |

|

DECISION TIME |

Slower, as process is longer |

Instant decision |

|

BAD CREDIT |

You can apply for guarantor loans with bad credit |

You can apply for no-guarantor loans, even with bad credit |

|

APR |

Low APR |

High APR |

If you’re looking for a quick small loan (up to £2,500) with low risk levels, you can apply here at Cashfloat. We do our best to keep the process as hassle-free as possible, so you can normally get approved within just a few hours without any paperwork or phonecalls. Click below to apply and get an instant decision.