Full Guide to Managing Family Finances – Conclusion

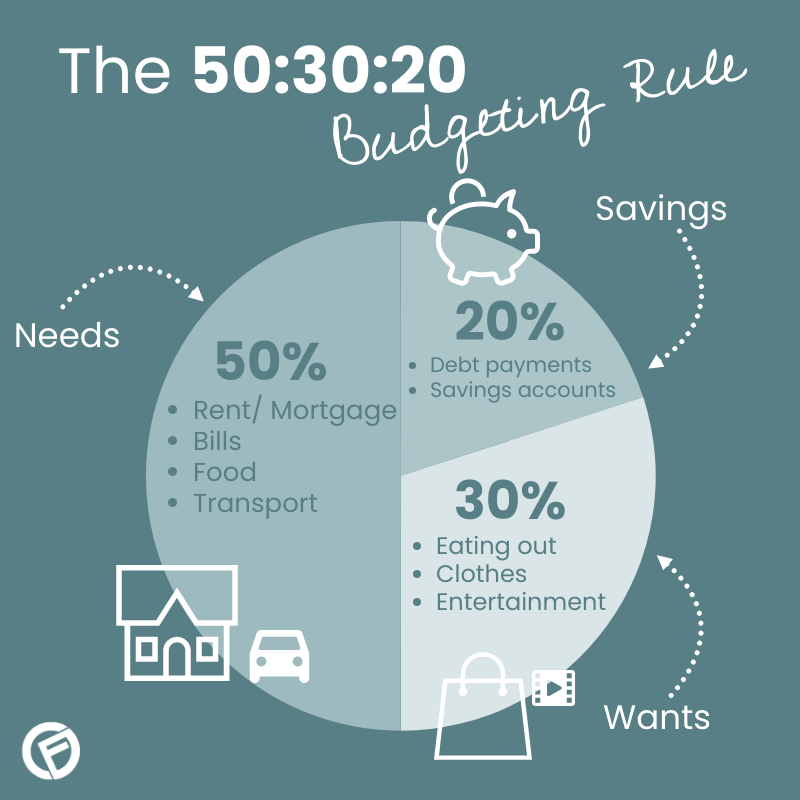

Planning your family’s financial future may appear to be a complex and challenging project. As we come to a close of our family finances guide, we want to sumarise some basic budgeting and savings ideas.

Basic principles like living within your means, saving for both short and long term goals, paying down debts and thinking ahead will all help you to secure your family’s future financial security.

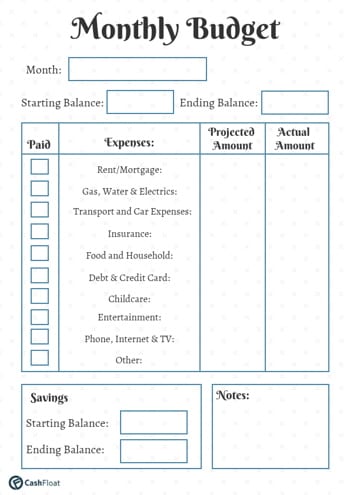

Manage Your Family Finances with a Budget

One of the most effective tools that is useful for managing family finances is maintaining a record and analysis of your current spend, either on a spreadsheet or written down in an organised fashion, with income and expenditure in the relevant categories.They will clearly show you exactly where your money comes from and where it’s going to. If you use an online budget planner when recording your finances it will show a breakdown of where the money has been spent. This will give you an indication of where you can best cut down on non-essential spending.

Once you have achieved a close look at where you are spending your money and the total in comparison to your income, it will soon become clear if you are spending more money than you have coming in. This should be addressed as soon as possible.

Cut down on debt by repaying credit cards and loans

Deal with the credit cards first, because they usually charge the highest rates of interest. Although you are only asked for the minimum payment each month, it could take years to clear even small debts. So pay off store cards and credit cards first. Then apply your payments to personal loans including payday loans as long as there is no early repayment penalty clause. If there is, you can put aside the extra money in a regular savings account. This will at least offset some of the interest being charged.

If you do have a lot of debt and have been getting letters about late or missed payments then please don’t ignore them. Most companies will come to an arrangement if you are struggling to make the amounts required. Always keep in mind that the priorities for payment are rent, mortgage and utility bills. If these are also causing problems then you probably need some serious advice from a debt counsellor or an organisation like the Citizens Advice Bureau.

Getting help to deal with debts can feel like a difficult step to take. However, most families owe money on a mortgage or car loan and when times are hard they will have faced the same kind of problem. So, don’t bury your head in the sand about debts. Face it head on. Totalling up the full amount you owe can often be a painful experience but once the amount is out in the open you can begin to deal with it.

Savings, insurance and pensions

Savings, insurance and pensions are three of the most important aspects of managing family finances.

- Saving for a ‘rainy day’

- Saving for special one-off events and treats

- Insurance for the Family

- Planning for your retirement

Before saving for a new gadget or phone, instead save up an emergency fund that can be used for when something unexpected occurs. This could be something like a large car repair bill or a central heating boiler breakdown. Most families in the UK could only last for two or three months if they lost their main source of income, so it is always a good plan to have six months worth of salary saved up if possible.

When you’ve established your emergency pot of savings you can think about saving for a new car or a holiday. Focus on the item you want to buy.

Whilst many people find it difficult to get motivated to save for a specific goal, this is a habit well worth cultivating. Instead of relying on credit cards to foot the bill and pay back large sums of interest, use your new savings account and enjoy interest-free money.

A regular savings account that is funded by a direct debit or standing order from your current account is a good option. This side-steps the administration of making transfers, and the money is not ‘lying around’ in the current account, ready to be spent . If you get a pay rise, don’t allow the extra amount to seep away on everyday spending. Put it to one side as savings and enjoy the benefits of the extra money at a later date.

Insurance is a must for all families. This means not just buildings and contents policies but also cover for the mortgage repayments. In addition you should consider ill health cover that would pay for household bills should you be off work for a long period of time. Shop around for car and travel insurance and you could save some large sums of money. Do your research so your forward planning is best for your family and circumstances.

One of the most ignored dimensions is retirement planning. The ONS reported that in March 2018, only 57% of people below retirement age were contributing to a private pension.

We all think there is plenty of time to go before we retire, but the time passes so quickly that starting a pension as soon as possible is an essential. As the age for receiving a state pension increases it has become even more essential to make some plans for a pension so that you do not have to work until you are 70. Pension contributions receive tax relief so pay the maximum contributions you can. It is also important to ensure that you have enough National Insurance contributions to qualify for a state pension. If there is a gap in your record you can top it up with voluntary contributions before you retire.

Remember to regularly review pensions and savings plans so that you remain ahead of the game. And consider how you will manage on a reduced income when retirement is looming. If you want to stay in your current home you may need a larger income than you will get from a pension. So look ahead and work out your possible retirement income well in advance. These are just a few of the simple steps that you can take to ensure that you and your family are living the standard of life you would choose for yourselves both now and in the future.