Poor people pay more for almost everything, from toilet paper to electricity. Find out what the world looks like for poor people, with Cashfloat

- Poor people pay 5.9 percent more per sheet of toilet paper than the rest of society.

- Poor people who don’t have bank accounts pay 8% to cash a cheque

We take it for granted, but having a few extra quid in our wallets saves us endless time, energy, stress and hassle. How would you get to work if you just used the last journey on your bus pass and you didn’t have a tenner for the taxi? How would you give breakfast to the kids when you just used up the last drop of milk? And what will the baby wear when you use the last nappy but have no money to buy more? Worst of all, it costs so much more to always be scraping your last pennies together. You need to be rich to be poor.

The Poor Pay More

To get a feel for how much more poor people pay, I spoke to some UK citizens who live below the poverty line. Meet Kate and Jenny.

Kate Tawson

Kate is from Rochester. She is married, but her husband is currently unemployed leaving her to provide for her young family of three alone. As we discuss her financial situation, her 4-year-old daughter Fay, comes bursting through the front door of the two bedroom apartment. She is agitated, babbling about a new i-pad that the neighbour’s kids received for their birthday.

“That’s alright,” says Kate, “but the last time I bought any toy for Fay or Mike, was last Christmas. If you have ever had to watch your kid’s eyes glitter with jealousy as they watch their friends playing on their new i-pads, while you know that the last time you bought them something was a year ago, you’ll know what I mean.” In fact, Kate buys the Christmas presents at a second-hand shop at the beginning of January. She knows that if she doesn’t buy something then when everyone is selling off their unwanted gifts, the stockings and the tree will be bare when the next December 24th rolls around.

But Kate has more to tell. Before her first child, Mike was born eight years ago, they were still a starry-eyed couple. Arriving back from their honeymoon in Rhodes, they found a beautiful semi-detached house, got their down payment together and signed up to a twenty-year mortgage.

Then the factory where Larry worked went bust, and he lost his job. The few savings that they still had left after their honeymoon went into a cot, buggy and other baby accessories for their brand new firstborn. They no longer had the means to pay off the mortgage. Three painful months later, the bank reclaimed their only chance of ever having a place to call their own. They moved into the small flat where they now live, and where they will live until fate shines good fortune on them once again. But for now, each month they take a chunk out of their salary and effectively throw it to the wind as they pay month after endless month of rent instead of a mortgage.

And what about Larry? Two years after he lost his job, things still looked bleak. After taking odd jobs here and there he signed up for a computer programming degree in the local university to finally get his degree. His final exams are coming up in May but he still faces a huge obstacle. Who will employ a 35 year old computer technician when there are thousands of twenty-something-year-olds flooding the employment market?

Jenny Kimp

I met Jenny in Launderama on Whitehall Road in the northern town of Gateshead. Jenny, a single mum, has brought her four kids along with her to the launderette this Monday afternoon. Kelly, all of 9 years old, is the oldest, but she takes responsibility like a twenty-year-old. Being poor weathers you like the sun on the skin of a labourer. She drags two loads of laundry while mum pushes the buggy with the other two loads hanging precariously off the handle bar. They don’t have a car, it broke down last month and the income from Jenny’s zero hour contract as an assistant in a second-hand clothes shop wouldn’t stretch far enough to fix it. They sold the car to a spare parts dealer for 30% of the price that they paid when they bought it three years ago.

Jenny had wanted to use the money to buy a washing machine because she couldn’t bear the thought of having to carry all the washing three blocks to the launderette. But she had overdue electricity bills, and was worried that they would switch her to a prepaid meter. Well, that means higher energy tariffs and more money wasted on nothing. So she paid off the bills and spent the rest on a two-month bus pass. And now, each Tuesday afternoon she pays the high price of being poor.

Yet, there is another aspect to the poverty penalty that is much harder to speak about. Jenny suffers from this issue every time her mum comes to visit. Jenny’s mum, Karen, is a successful high school teacher. She earns a decent living, hopefully enough, to support herself and her husband throughout her upcoming retirement. The stress begins before Karen enters the front door. Why is the doorbell broken? Do you not have a doormat? And seriously, could you REALLY not afford to fix the car?

Karen doesn’t mean to be overpowering. She just wants the best for her child. “I worked hard for a living. At the beginning, it was hard when the kids were young, and all. But we never, ever lived like that. And it is so bad for the kids.” Karen feels frustrated and upset. She feels like her daughter can do so much better. “She needs to get out of that ridiculous clothes shop and find herself a better job. And she needs to fix up the house and the car, buy the kids some new clothes. Nothing fancy, just decent.”

For Jenny this makes everything so much more challenging. “If you have never been so poor you just can’t understand what it is like. It’s like you are on some endless merry-go-round and no one understands how desperate you are to get off before you throw up or something.”

That’s the poverty trap in all its dreadful glory. It’s like a cavernous jaw that wraps itself tightly around these needy families. Why do the poor pay more and what does it mean for those struggling to survive?

How expensive is it to be poor?

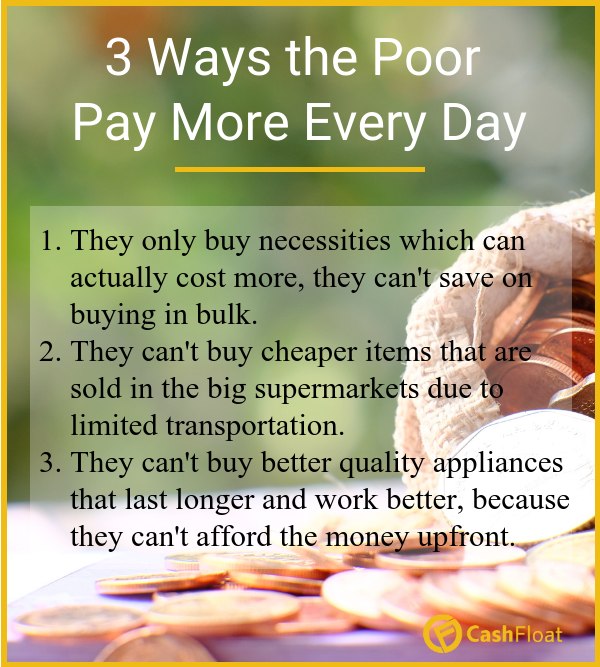

A study conducted by the University of Michigan showed that poor people spend 5.9 percent more per sheet of toilet paper than the rest of society. The study specifically focused on toilet paper because that is something that everyone has to buy and something that you don’t use more of just because you have it on hand (polar opposite to chocolate). Because poor people don’t have savings and only have a small amount to spend each week, they cannot afford to buy in bulk, which is almost always cheaper. They also can’t afford to stock up when there are cheap offers. Not in money, and not in space. Many poor people live in small housing where every square inch counts. They simply don’t have the space to store 200 rolls of toilet paper. But it goes beyond toilet paper.

Do the poor pay more for food?

Research by the IFS (Institute of Fiscal Studies) shows that those households earning less than £10K a year, pay more for food than those earning £10-£20K. Poor people often don’t have access to the supermarkets where most items are cheaper. Without a car, they can’t drive to the store, which means dragging home the groceries on the bus. Alternatively, it means shopping in local shops. But an orange in Tesco Express costs 40% more than if you would buy it at the supermarket. The worst part is that the biggest price differences between local and supermarket prices are in healthy food such as meat, fish and fresh fruit & veg.

Luckily, this particular aspect of the poverty penalty comes with a solution. The growth of online shopping affords many of us extra convenience. But for the poor, online shopping is more than practical.

Jenny explains to me that shopping online saves her endless time, hassle and money. She doesn’t have a car anymore. If she went to the superstore, it would mean hiring a babysitter because her only spare hours are after the kids’ bedtime. It would also mean a bus ride on the way there and a taxi on the way back, unless she fancies dragging the entire contents of her shopping trolley to and from the bus stop.

“And I also really like it that all the offers pop up when you shop online, because, trust me, I would never see them if I went to the shop. It’s gotta be right there in my face for me to see it.”

Do the poor pay more taxes than the rich?

In 2015, the richest 20% in the UK paid only 34.8% of the overall income in tax. But those earning the least paid 37.8% to the taxman. So, it is true that the poor pay more taxes. While the Chancellor, Phillip Hammond has promised to raise the tax threshold above £11,000, this does little to help the poorest households in the UK who earn below £10,000. Who can these poor people turn to for help, if not the UK government?

The Poor Pay More for Eveything

Beyond grocery shopping and taxes, the poor pay more for housing, transportation, credit and electricity. Let’s look at some really simple activities that we all do at one point, whether it is once in a blue moon, or every day. How much do these activities cost for the those who are just about managing?

Buying a microwave- quality versus quantity:

When I bought my microwave, I could have bought a Tesco solo microwave for £35. But, I was totally fed up of those cheap microwaves we used in uni that broke down every year. So, I went for Russell Hobbs Solo Microwave for £79.00. I used that microwave for six years now, and it has never once caused me any grief. If I had bought a basic Tesco microwave every year for six years, it would have cost me two and a half times the price of my trusty red microwave. On top of that, I would have had to cope with all that half-heated food. That is yet another price of being poor. In the short run, you can’t afford to shell out the extra £44, so you spend less on lower quality and pay the difference over the long term.

Getting the laundry done- bulk discount

Jenny does four loads of laundry each week. Each load costs £7. That is £28 a week. If only Jenny wouldn’t have to do washing for two months, she could save up £224, enough to buy a decent washing machine. That would let her stop dragging the washing to the laundrette, entertaining the kids while it washes and dragging home the wet laundry.

How about the washing powder? I looked at the price of no-frills washing powder- Tesco nonbio. The table below shows the difference in price between the three different size packages available online.

| Product | Weight | Amount of Washes | Price | Price per wash |

|---|---|---|---|---|

| Tesco non-bio washing powder | 650g | 10 | £1.50 | 15p |

| Tesco non-bio washing powder | 1.625kg | 25 | £3.50 | 12p |

| Tesco non-bio washing powder | 2.5kg | 40 | £4 | 10p |

So, for the larger package you pay 5p less per wash than the smallest package. Is that such a big deal? Either pay the extra £3.50 to get the larger package, or pay the extra 5p per wash? But, when you pay an extra 5p on every item because you don’t have the spare cash, or a car to facilitate buying in bulk, it adds up. Take Jenny, she does 4 loads of washing in the laundrette every week. Paying an extra 5p per wash adds up to £10.40 per year. Just on washing powder.

Cashing a Cheque – to bank or not to bank

Many poor people don’t have bank accounts. In fact, according to money saving expert.com, over 1 million individuals in the UK don’t have a bank account. Without a bank account, you lose your rights to countless services.

For a start, many employers won’t pay someone who doesn’t have a bank account. The alternative options to bank accounts, such as prepaid cards cost more in purchase and transaction fees. Chris, a construction worker from Blackburn, has just cashed a cheque in Cash Converters. It was £100, his wages for the week, but it cost him £8 just to cash it. When I asked Chris why he doesn’t have a bank account, he looked pensive.

“Well, I tried all the big banks, Lloyds, Natwest, HSBC, y’know. They all declined me, so I went on to building societies and all that lot. But I just couldn’t figure out all their jargon. Y’know, I just don’t have the time and the patience to chase after these bank people. I pay the £8 a week and get on with life.”

Not having a bank account costs more than £8 a week. Without a bank account, it is difficult to get broadband, rent a car and get cheap credit. Take cheap credit as a good example. If you have a bank account you can get an overdraft, a credit card and possibly a bank loan. According to Which consumer magazine, the annual cost of a £500 overdraft for two weeks out of every month is £17 when you use the recommended provider, First Direct. First Direct charge 15.9% interest. But if you don’t have a bank account, and you run out of money, your only option is a payday loan direct lender or a pawnbroker. Yet another stark example of the steep charge of being poor.

Some people think:

“IF YOU ARE BORN POOR IT IS NOT YOUR FAULT. IF YOU DIE POOR IT IS”But did they ever stop to think that maybe it is not so easy to get out of poverty?

As Eli Khamarov said:

“POVERTY IS LIKE A PENALTY FOR A CRIME THAT YOU DIDN’T COMMIT”And the poverty penalty is a penalty on a penalty

Click here for our poor pay more infographic.

Buying a house – affordable accommodation

Getting on the housing ladder is a challenge for many. But if you can’t afford to buy, that leaves you renting for the rest of your life. It is true that most people buy their homes using a mortgage which also involves monthly payments. But somehow it feels better to pay a finite mortgage which will end after a specified time. Paying rent is a bit like bailing water out of a boat with a hole in. You bail and bail but you never actually get the boat dry.

Does it cost more to rent your entire life than to buy a house? Let’s look at one of the most affordable places to live to live in the UK; Salford, Greater Manchester.

Zoopla estimates that the average price of a terraced house in Greater Manchester is £138,946. The average rental price in Manchester rose to £555 in mid-June, according to the Manchester Evening news. So, paying £555 in rent every month for a year, adds up to £6,660. That means that it would take just over 20 years until you have paid enough to buy a terrace. Obviously, it is not that simple. Buying a house with a mortgage also incurs interest, taxes and insurance. But considering that most people live in their houses for well over 30 years, we can still understand how renting ends up significantly more expensive than buying, even with a mortgage.

But it goes further than that. Renting in poor neighbourhoods is more expensive than renting in neighbourhoods where many own their homes. In the 2011 census, Salford was found to have the lowest home ownership statistics. Only 33.65% owned their homes. According to home.co.uk there are 149 one bedroom properties for rent in Salford, with the average rental price £724. In Leeds, where the average home ownership is 48.7%, there are 759 on bedroom properties for rent, with the average rental price £606. Pure economics of supply and demand justify this rationally. The more demand there is for rentals, the more landlords can charge (up to reasonable limit) because they know that they have a higher likelihood of renting it out. Hence, in Salford where less people own, there are less properties available for rent, driving up the price of rental properties.

Car Insurance: The Premium Premiums

When it comes to car insurance, residents of poor neighbourhoods find themselves in a vicious cycle. A study of the 10 most expensive areas for car insurance premiums in Toronto showed that 7 out of the 10 areas are neighbourhood improvement areas. But what is significant is that these neighbourhoods were generally further from public transport. The lack of public transportation leads to more drivers and therefore more accidents, driving up the price of car insurance premiums for those postal areas. But the residents of these regions are considerably less well-off than their cohorts in the city centres, and that is why they have moved out of the centre to the more affordable suburbs. But there you have less public transport, leading to more drivers, and more accidents and hence, higher car insurance premiums. You get the idea? One resident told the Toronto Star that he sold his car and got around on a little moped instead. But can you imagine carrying your grocery shopping home on a moped?