Energy efficient appliances are all the talk nowadays. But how do you know what appliances are really efficient and if it’s worth spending all that money on a super-efficient appliance? Read on for a clear and simple guide to energy ratings and choosing the most efficient appliances for your home.

- Using energy efficient appliances can knock hundreds off your energy bill.

- You can use an energy monitor to track which appliances use lots of energy.

When your home appliance breaks down and it’s going to cost a lot of money to repair, it’s probably better to buy a replacement. But, before jumping into buying any replacement it’s a good idea to do some research and find the model with the best energy ratings.

Living without a washing machine or fridge freezer is not an option anyone wants to consider. To replace an appliance involves paying out a large sum of money and sometimes even a low interest personal loan is required to finance the purchase. By finding the most energy efficient model you will help to offset the initial high-cost outlay.

It is a fact that using home appliances makes up a substantial part of the energy bill. Large items like washing machines, dishwashers, cookers, fridge freezers and cookers eat up alot of energy and amount to around 20% of the energy bill in a home.

Energy Ratings of Home Appliances

White goods and large electrical appliances all come with energy ratings. This will help you to buy the best possible replacement. In 2012, all fridges, freezers and fridge freezers were obliged to have a minimum rating of A+. The new labels assist householders to decide which model is the cheapest to run and this has helped many families to make the right choice. You can run a modern energy efficient fridge freezer for as little as £25 per year. But, the least energy efficient model could cost as much as £89 per year.

Brands and models do vary. Some appliances are rated the same but have a disparity of around 30% more energy use over a five year period. Old appliances which were made and bought before 1999 use up much more energy than newer models. The amount of energy an appliance uses will also depend on how you use the appliance. Families will use machines more often than singles and couples who are both out at work all day. This is something to consider when choosing a new appliance.

Use the web to choose the best energy efficient appliance

There is a wealth of information about energy efficient appliances on the Internet. You can log into the ‘Which’ website where you will find comparisons between brands and models with the same energy ratings. You can also find information about how to buy the best appliances. There is an online calculator which you can use to work out which appliance would be best for your individual use.

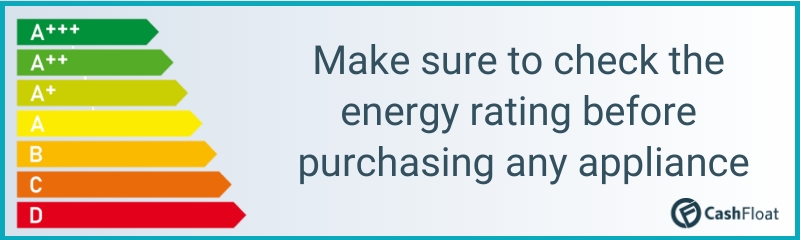

Energy rating labels on appliances

Energy rating labels on new appliances show you the efficiency of the product. This will be graded between D and A+++. The higher the energy rating, the better the energy efficiency of the appliance. Labels also show the kilowatt usage per year.

Save money using energy efficient appliances

Concentrating on saving money on electricity is very worthwhile. It only takes a short time to work out where you can conserve energy with home appliances. You might even save yourself from taking fast decision loans to pay for your unexpected utility bills. The appliances that produce heat such as kettles, and those with moving parts like electric lawn mowers cost the most to run.

It’s not just a question of how many watts an appliance uses but how energy-saving it is. A high wattage appliance like a dishwasher may use a lower amount of energy because it has been designed to be energy efficient. The reason behind the efficiency could be a shorter washing cycle. As it’s working for less time, it uses less energy.

Need some financial help with replacing your broken appliance to an energy efficient appliance. Cashfloat provide affordable and flexible loans up to £1,000.

The benefits of energy monitors

To keep track of energy consumption in the home, you can buy an energy monitor. Basic wireless models cost around £30, or you can ask your energy supplier to provide one for free.

Energy monitors show electricity use in real time. Each time you switch on an appliance or even a light you can see this on the display. This is an excellent way to become aware of which appliances use the most energy.

It will also make you aware of how much energy you are using and how much you waste when you leave devices on standby. An energy monitor is an excellent prompt to switch off those appliances not in constant use.

Saving money on energy efficient lighting

Changing the type of light bulbs in the home can lead to real savings on energy bills. The latest technology produces light bulbs which use 90% less energy than old-fashioned incandescent bulbs which are, in any case, being phased out.

In 2011 new standards were brought in that required all light bulbs to be at a minimum energy efficiency rating. This has caused energy used for lighting to be reduced by at least 33% compared with figures from the 1980’s.

The new LED bulbs cost more than the old fashioned type of light bulb. If you are changing over to LED, you can consider taking a payday loan online to finance all your new light bulbs. But prices are falling as more companies are producing LED. This means that it is cost effective to change over to LED and you can do this one bulb at a time.

A replacement LED bulb costs around £2.90 compared to the budget price of 35p for a ‘normal’ bulb. However, as previously stated, the traditional light bulbs are getting harder to come by and cost a lot more to run.

Leaving appliances on standby

Many people are unaware that leaving modern home appliances on standby costs money. Of course, fridge freezers and alarm systems must always be left running but the energy busting appliances that are not in constant use are televisions, mobile phone chargers, set-top boxes and games consoles.

All of these use small amounts of electricity when left on standby. This can add up to a significant amount over a year. The cost for leaving a 5-watt appliance on standby may be only 1.5 pence per day but if you add up the number of appliances in your home you could be adding up to £100 to the annual electricity bill.

Some units such as wireless routers need to be left on as they often update overnight. But, many of the small appliances can be turned off to reduce energy consumption.

Try to adopt good habits by completely unplugging the television and other devices that have a standby feature. Use an energy monitor to see which uses the most energy and invest in either timer sockets or sockets controlled by a remote device so that you can complete the switch off simply and easily every night.

Then, go to bed knowing that as you sleep you are saving money on energy and helping to protect the planet. And, you might even be saving yourself from taking out a short term loan online.