When your children grow up and head out into the real world, will they be sufficiently prepared for the financial decisions they’ll have to make. Could these decisions have repercussions on their entire lives? Are schools educating them enough? And if not, what can you to teach kids about money, now, to help them?

How to Teach Kids About Money

In this article, Cashfloat take a look at how to teach kids about money. We specifically look at financial education at school and at home. We will give parents tips and explanations about teaching children and the benefits to doing so.

Financial Education in Schools

Financial education is part of the UK schools national curriculum. This means that teachers should teach all children aged 11 to 14 about:

- Using money

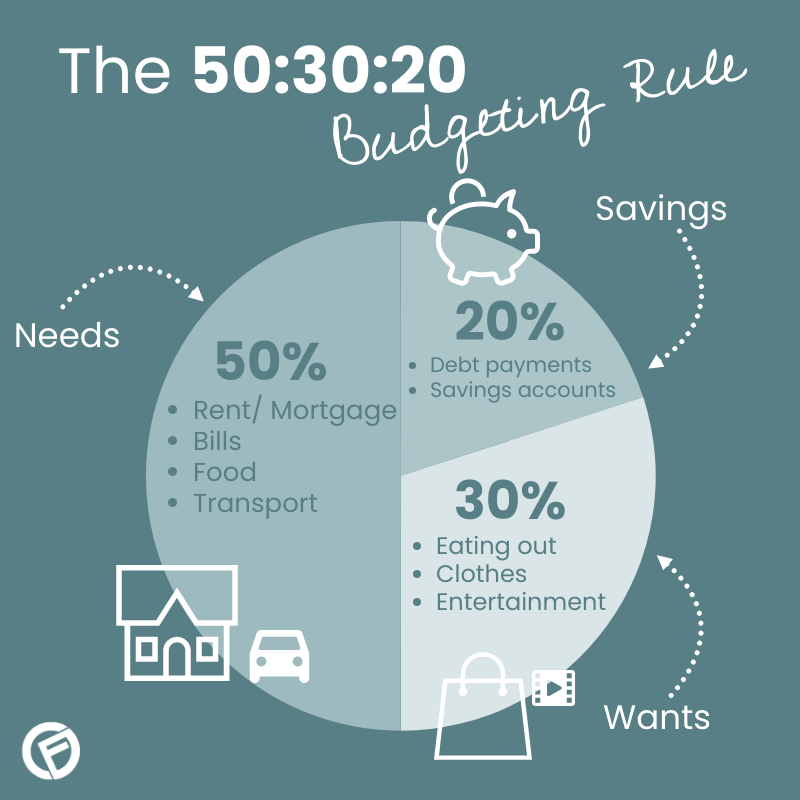

- Budgeting

- Different kinds of actions which could constitute financial risks

Older pupils from ages 14 to 16 receive more in-depth lessons about:

- The differences between credit and debit

- Income and outgoings

- Savings

- Pensions

- Different kinds of financial products including payday loans

- How the state functions and uses public money that they raise from taxes

The importance of this addition to the curriculum can be understood when it appears that many people are unaware of certain things like, base rates, national government debt, government deficits and inflation. Moreover, many people do not give a thought to saving for a pension until they reach an age when it is impossible for them to accrue enough to receive a decent income after they retire.

It has taken a long time for the importance of financial education to come to the fore. However, there are still no lessons on offer to younger children at a primary school level. So, how can we help our children get to grips with the concept of financial affordability?

How to Teach Your Child about Money at Home

If you’re wondering how to teach your child about money right from the comfort of your home, we’ve got you covered. It’s never too early to start instilling good financial habits in your little ones. Here are a few friendly and easy-to-implement tips to get you started:

Start with the basics

Use piggy banks

Teach them about earning

Budget with the kids

Let them make mistakes

Be a good money role model

Begin by introducing the concept of money and its value. Show your child different coins and bills, and explain their worth. Make it fun by playing games like “shop” where they can pretend to buy and sell items using play money.

Encourage your child to save by giving them a cute piggy bank. Help them understand the importance of saving money by explaining that it can be used for special things they want in the future. You can even create saving goals together, like buying a toy or going on a fun outing.

Introduce the idea of earning money through simple chores or tasks appropriate for their age. This helps them learn the value of hard work and how money is earned. It could be as simple as making their bed, setting the table, or helping with small household chores.

Involve your child in family budget discussions in an age-appropriate manner. Explain the concept of budgeting and involve them in decisions about spending on family activities or purchases. This will help them understand the importance of making thoughtful choices with money.

Allow your child to make small financial decisions on their own, like spending their saved money on a toy or treat. If they make a less-than-ideal choice, use it as a learning opportunity to discuss the consequences of their decision and how they can make better choices in the future.

Kids learn by observing, so be a positive example when it comes to money matters. Show them responsible spending habits, saving practices, and how to differentiate between needs and wants. Encourage open conversations about money and answer any questions they may have.

Remember, teaching your child about money is a gradual process, and it’s important to tailor the lessons to their age and understanding. By implementing these friendly tips, you’ll be setting your child on the path to financial literacy and a brighter financial future. Good luck and have fun on this money journey with your little (or big) one!