Universal Credit is a government benefit to help with your living costs. Read this Cashfloat article to find out what you could receive.

- Payments for Universal Credit are given as standard monthly payments of up to £596.58.

- You are not eligible for Universal Credit if you have more than £16,000 in savings.

In this chapter, we will be looking at how Universal Credit works. Firstly, we will explain what Universal Credit is, who is eligible to receive support under it and what payments they can expect. Finally, we will look at the reason for its introduction and how it has affected claimants to the benefits it is replacing.

Cashfloat is a responsible lender providing fast payday loans. We strive to help our customers make responsible financial choices, with full awareness of their available options. In this article, we discuss the support that is available from Universal Credit so that our customers, who are eligible for this support, can claim it and avoid needing to take direct lender loans online.

What is Universal Credit?

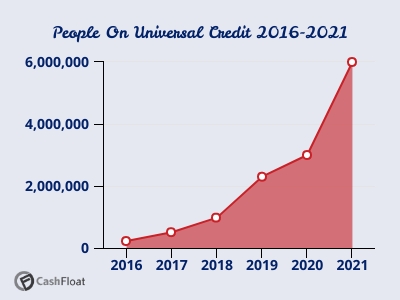

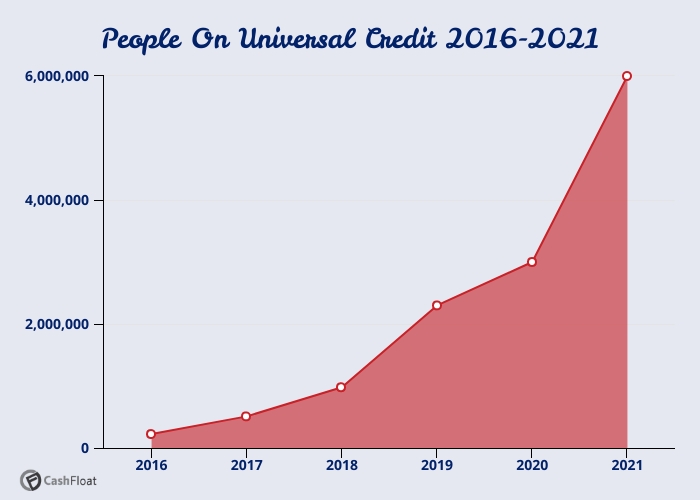

Universal Credit was introduced in 2013 to replace 6 pre-existing benefits, which are now known as legacy benefits. For most people who find that they are struggling financially, Universal Credit is now the main benefit they will claim.

Watch this video for a clear overview:

- Universal Credit is a benefit which is replacing 6 other pre-existing means-tested benefits.

- The government plans to move everyone from these pre-existing benefits onto Universal Credit by 2024.

- To be eligible, you must be over 18 (with some exceptions for 16-17 year olds), be under the state pension age, live in the UK, have less than £16,000 in savings and be on a low income or unemployed.

- You will receive a single monthly payment which varies according to your circumstances and income.

- Additional support is available to help with housing and childcare costs, costs associated with having a disability or illness and for people who care for disabled people.

- You can work while claiming Universal Credit. For most people, their payment will be reduced by 63p for every £1 that they earn. Some people are entitled to a work allowance, which permits them to earn a certain amount before there are any reductions in their payment.

Universal Credit is replacing these 6 means-tested benefits and tax credits:

- Income-based Jobseeker’s Allowance

- Housing Benefit

- Working Tax Credit

- Child Tax Credit

- Income-based Employment & Support Allowance

- Income Support

Universal Credit Eligibility

You may be eligible for Universal Credit whether you are single, have a partner and no children or if you have a family. Although there are requirements that you must meet to be eligible, there is no set income level to be eligible for Universal Credit. What you are entitled to depends on your individual circumstances. If you are on a low income or unemployed and are struggling to make ends meet, you should find out if you are eligible for support from Universal Credit instead of applying for loans for people on benefits.

To be eligible for Universal Credit you must:

- Be on a low income or unemployed

- Be over 18 (with some exception for 16-17 year olds)

- Not have savings of more than £16,000. If you make a joint claim with your partner, your total savings must not be more than £16,000.

- Be under the State Pension Age. Or your partner must be if you make a joint claim.

Unlike the pre-existing benefits that Universal Credit is replacing, there is no limit to the number of hours you can work if you are on Universal Credit. Your payment will gradually decrease as you work and earn more, rather than immediately stopping when you return to work. If you have savings over £6,000 or earn enough to cover your basic living costs, you will receive less money than if you don’t.

If you live with a partner, you will have to make a joint claim and you will receive a single payment for both of you. Even if your partner is not eligible for Universal Credit, you must include their income and savings when you make a claim. Their income and savings could affect what you are eligible to receive.

How Universal Credit Payments Work

Here’s how Universal Credit payments are worked out.

The Basic Monthly Allowance

Your monthly payment amount for Universal Credit depends on your income and circumstances. Every applicant is allocated a maximum monthly payment, according to their age and whether or not they live with a partner. The individual circumstances of each applicant are then taken into account and, if necessary, the amount that they will actually receive is reduced. What a person eventually receives is called their basic ‘standard allowance’. Many people receive less than the maximum allowance and the amount varies from person to person. After a person’s standard allowance is determined, they will receive this amount as a basic allowance each month.

Standard Maximum Monthly Allowances | |

|---|---|

| Personal Circumstances | Maximum Monthly Amount |

| An individual under 25 | £344 |

| An individual over 25 | £411.51 |

| A couple both under 25 | £490.60 (for both people) |

| A couple with at least 1 over the age of 25 | £596.58 (for both people) |

Extra Allowances

People who have children, people who are disabled or have a health condition, people who care for a severely disabled person and people who need help pay for their housing are entitled to extra amounts, on top of their standard allowance. The extra amounts that people receive vary according to their additional requirements and their circumstances.

Everyone who has either 1 or 2 children will receive an extra amount for each child. If they have a third child or more, then they may be able to receive support for more than 2 of their children depending on their circumstances. These payments are made as standard for Universal Credit claimants who have children. In addition to these standard extra payments, different support is available for people who have children and for people who need help with childcare costs. Have a look at Chapter 5 of this guide for an in depth explanation of the support that is available for childcare and parents who have disabled children.

Normally, you can only claim for more than 2 children if any of the following applies to you:

- Your children were born before 6th April 2017.

- You were already claiming for 3 or more children before 6th April 2017.

| Circumstances of Claim | Extra Monthly Amount |

|---|---|

| For a first child | £282.50 (if the child was born before 6th April 2017) £237.08 (if the child was born on or after 6th April 2017) |

| For a second child and any other eligible children | £237.08 per child |

| For a disabled or severely disabled child | £128.89 or £402.41 |

| For help with childcare costs | Up to 85% of the cost of childcare |

People who have a disability or a health condition, which affects both their ability to work and their ability to do work related activity, such as look for work, are entitled to additional payments on top of the standard monthly allowance. Have a look at Chapter 7 Part I of this guide for a detailed explanation of this. The extra monthly amount for this is usually £343.63.

People who provide at least 35 hours per week of care to a severely disabled person are entitled to an extra payment. In order to qualify, the person that they care for must be receiving at least one qualifying disability benefit. The extra monthly amount for this is normally £163.73. Have a look at Chapter 7 Part II of this guide for a detailed explanation of this.

People who are struggling to pay their rent or for their mortgage are entitled to extra help. The amount that people can receive varies according to their circumstances and whereabouts they live. It is worth noting, that while Universal Credit will support people with mortgages, there is a 9 month qualifying period during which people need to receive Universal Credit and have no earnings before they are eligible for mortgage support. Have look at Chapter 10 of this guide for a detailed explanation.

How you are Paid

The government will pay this benefit into a bank, building society or credit union account. Any additional payments (e.g. for housing or childcare)) are paid with this monthly allowance in the same payment.

If you receive an extra payment to cover housing costs, you might have to pay this to your landlord or mortgage provider by yourself. Under Housing Benefit, the payments often went directly to claimants’ landlords. Since you receive a monthly payment, you need to make sure that you budget it accordingly to last until the end of the month. You don’t want to have apply for an online payday loan at the end of the month because you ran out of money.

Universal Credit Work Allowance

Under the legacy benefits, which Universal Credit is replacing, when people returned to work, their benefits would be immediately cut, or they would be cut suddenly after people started working a certain amount. Universal Credit has been designed to make it easier for people to return to work. There are no limits to the amount that a person can work while they are on Universal Credit. As a person earns more, their payments will gradually decrease until they earn enough to be no longer eligible.

For most people for every £1 that they earn, their Universal Credit payment is reduced by 63p. This continues until they reach a threshold, at which point their Universal Credit payments will stop altogether. The aim is that at this point, people are earning enough to support themselves and do not need Universal Credit.

Claimants responsible for a child or have a disability or illness that affects their ability to work are entitled to a work allowance. This is an amount of money they are allowed to earn before the payments they receive for Universal Credit begin to drop. The work allowance is lower if they receive support for housing costs, as shown in the table below:

Work Allowance | |

|---|---|

| Claimant’s Circumstances | Allowance Amount |

| Eligible for the work allowance and receive help with housing costs | £293 / month |

| Eligible for the work allowance and do not receive help with housing costs | £515 / month |

Universal Credit Application

- You can claim Universal Credit online here. Within 6 weeks, you will receive a statement outlining the details of what you will receive and when you will receive your first payment.

- After your application is accepted, you will have to arrange an interview at your local JobCentre Plus. If you do not attend, you will not receive any payments. During your interview, you will have to sign a ‘Claimant Commitment’, which will detail what you plan to do to find employment.

- You will have to stick to your commitment while you are claiming Universal Credit.

- If you have difficulties making ends meet while you are waiting to receive your first payment, you can apply for an advance payment.

- You must report any changes in your circumstances while receiving Universal Credit, or you may receive sanctions or fines.

What Happens After You Apply?

Within six weeks of applying for Universal Credit, you will receive your first payment. You will also receive a statement, which will give you details of your entitlement amount and dates when you should expect to receive payments. If you were receiving other benefits before Universal Credit, they might stop. Any claims you have for legacy benefits will stop and claims you have for other benefits may be affected. Some legacy benefits have a grace period of 2 weeks when you continue receiving them while you move over to Universal Credit.

If you need any help with your Universal Credit application, you can call the Universal Credit helpline on 0800 328 5644.

Warning:

There has been an increase in Universal Credit scams and the public is being warned.

- Scammers posing as JobCentre Plus agents may approach you if you are a potential Universal Credit claimant.

- Offering to arrange your benefits, they will ask you for a few personal details and a photo ID.

- Shortly after applying, an amount of around £1000 will be paid into your personal bank account. They will then say that the money was paid in error and ask you to return it and then they will disappear.

- In reality, they have signed you up to Universal Credit. The money that is in your account is an advance payment to get by while your Universal Credit is getting processed. You will end up having to pay this money back to the Department for Work and Pensions. Since the scammers took it all, you will be short.

If you think this type of scam may have targeted you – report it immediately.

Reporting Changes In Your Circumstances

You should report any changes in your circumstances to your local JobCentre Plus. These changes could include finding or leaving a job, changing your address or your rent either increasing or decreasing. If there is a reason that you were unable to stick to your claimant commitment (i.e. if you were too sick to meet your work coach or to attend a job interview), then you should inform your Jobcentre Plus as well.

If you get married or move in with a partner, you will have to report this and make a joint claim. Both of your incomes will affect your claim and you will both then need to make and sign a new ‘Claimant Commitment’.

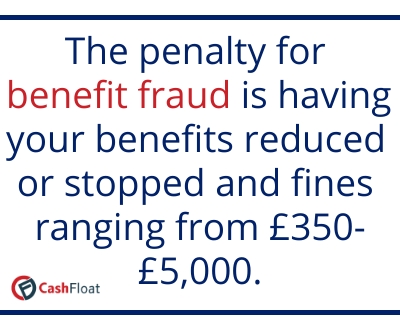

You may have to repay the money if you do not report a change in circumstances quickly enough, if you give the wrong information or you receive too much by mistake. In cases where you are found to have broken the rules, you might have your benefits reduced or even stopped. Having your benefit stopped is called being ‘sanctioned’. You may also receive a penalty if your work coach feels that you are not keeping to your ‘Claimant Commitment’.

If you are sanctioned and you are finding it hard to get by, you can apply for a hardship payment. Every application is judged individually and you are not guaranteed to receive anything. You may also have to supply proof that you have done everything in your power to find the money elsewhere and that you will only spend the money on essentials.

Information for People Who Receive Legacy Benefits

Universal Credit is being introduced to replace the 6 pre-existing legacy benefits. Most people are now unable to make new applications for the older benefits and the government plans to move everyone over to Universal Credit by 2024. At the moment, people are only being moved under what is known as ‘natural migration’. Under natural migration, people will only move if they have a change in circumstances that makes them eligible for extra benefits under Universal Credit and make a new application for it or if they choose to do so. As a result, many people still receive legacy benefits. Eventually, however, the government will introduce ‘managed migration’. Under managed migration, people will have to end their claim to legacy benefits and make a new Universal Credit application instead.

You can find out if you will be better or worse off under Universal Credit than under legacy benefits by using a benefits calculator.

FAQs about Universal Credit

Do Universal Credit housing payments only cover people who pay rent?

No. Universal Credit can also cover people who pay mortgages. On top of this, payments can be made to people who have used a property to secure an online loan of up to £200,000. However, there is a 9 month waiting period before people will be eligible for this support.

Can I get Universal Credit with Income Support?

No. Universal Credit replaces certain 6 other benefits and one of them is Income Support. Once you claim Universal Credit, your claim for Income Support will end. The other benefits it replaces are income-based Jobseeker’s Allowance, Income-related Employment & Support Allowance, Child Tax Credit, Working Tax Credit and Housing Benefit.

Can I apply for Universal Credits if I am self-employed?

Yes. However, you must record your income and expenses on a ‘Statement of Earnings’ form during an assessment period. The form will tell you when your period of evaluation begins and ends. Within 14 days of the end of your assessment period, you should call the Universal Credits helpline (0800 328 5644) to report it to them.

Have there been any changes to Universal Credits since it started?

Yes. The rules do sometimes change for Universal Credit Claimants. During the height of the coronavirus pandemic, most allowances increased. In April 2021, allowances are set to increase from their previous amounts according to inflation. Before this, there have not been changes to allowances since the ‘benefits freeze’ of 2016.

Summary: Universal Credit

In this article, we discussed what Universal Credits is, who is eligible for it and how to apply. There have been some concerns that the Universal Credits system is not efficient and doesn’t suit the needs of the people. Many people worry that those most disadvantaged will not adjust to the new system and will instead turn to payday loans to survive. There have also been problems with the administration and roll-out of Universal Credit. In the next chapter, we will look at these problems and what you can do if you are having problems with your Universal Credit.