Do debt management plan providers have to follow any rules? Cashfloat explains here the FCA regulations for debt management plan providers.

- Debt management companies were charging as much as 90% before the FCA instituted these regulations!

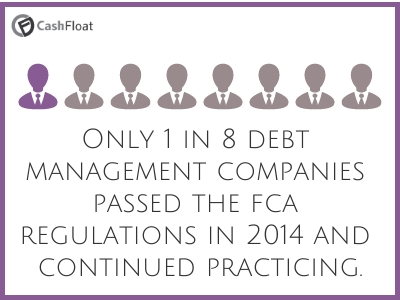

- Only 39 out of 311 commercial debt management firms passed the FCA regulations in 2014.

Are you considering starting a debt management plan? It is important to know what rules your debt management plan provider should follow, so that you know you are receiving a good service.

In this article, Cashfloat explains the governing regulations for debt management plans. Although we are a short term loan lender and a provider of credit, we understand that debt often happens for unfortunate reasons and that people need the right help to deal with it when it happens.

How are Debt Management Plans Regulated?

There were previously a large number of problematic debt management plan (DMP) providers who offered bad advice to their customers and charged huge fees for the service they provided (sometimes as high as 90%!). Customers would, frequently, not only receive bad advice on how to deal with their debts, but were often unaware of the fact that most of what they were paying was actually just going on fees to their DMP provider. Some customers paid into debt management plans for years before realising that they had barely reduced their debts and had just given money to the company which arranged their DMP.

In 2014, the Financial Conduct Authority (FCA) took over the regulation of debt management services and introduced rules in an attempt to protect people who were using debt management plans. The rules which were introduced in 2014 have done some good, with particularly problematic companies being prevented from providing debt management plans. It is essential that DMP providers follow these rules and you should ensure that your DMP provider actually does. We have written this article to help you understand what rules your DMP provider should follow, so that you know whether they are giving you a good service or not.

The rules which the FCA introduced apply to all providers of debt management plans, whether they are a paid-for debt management company or a debt charity. While the rules do prevent fee charging companies from misleading customers and charging such high fees, there is still no reason to pay for a DMP. Cashfloat recommends that no one should ever pay to have a DMP provided by a debt management company. The same or better services are available for free from debt charities, such as StepChange or Christians Against Poverty.

How Does FCA Regulation Protect People?

Among other things, under the FCA regulations debt management plan providers must:

Be Transparent About Their Fees

If you choose to have your debt management plan provided by a debt management company, rather than a charity, you will have to pay fees for the service. They must tell you how much they will charge before you agree to the plan and explain what fees are for. If they can’t tell you the exact amount, then they must tell you how your fee will be calculated. This should enable you to see the full cost of the service that they provide. Any fees that you pay will add to the length of your debt management plan and they should explain how the length of your DMP will be affected by them as well. On top of this, they should explain what the total cost of your DMP will be.

They should also, either at least annually or when a customer requests it, provide a statement explaining any fees they have charged to their customers.

Not Charge More Than 50% in Fees

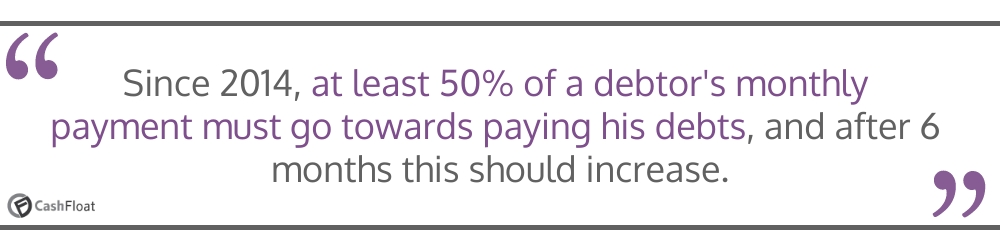

As well as having to explain what fees they charge, a fee-charging debt management company should not charge more than 50% in fees to their customers. While there are no rules about the total amount that they can charge, at least 50% of what you pay should go towards paying off your debts and this should increase after the first six months.

As we already mentioned, we do not recommend having a DMP arranged by a fee charging company. It’s always better to go with a free and professional debt charity than with a debt management company.

Provide Clients With Certain Information

Before you sign a contract agreeing to start a debt management plan, your provider should provide you with certain information. They should explain to you, in writing:

- Exactly what service they are offering and how long the contract will last

- How fees work (as we explained earlier) and also what charges will be levied if you cancel the contract

- What effect your DMP will have on your credit rating

- The time within which they will pass on your payment to your creditors after they receive it from you

- Which of your debts are included in your DMP and which aren’t

- What is likely to happen if you cease paying your priority debts

- The fact that your creditors do not have to agree to your DMP and could back out at any time

- What could happen to you if you ignore contact from your creditors

DMP providers also have to keep their customers closely informed about negotiations with their creditors. You should be informed without delay about the results of negotiations and it is particularly important that they tell you if a creditor has refused to deal with them, refused an offer, refused to freeze interest and charges or returned payments that have been made. On top of this, information about ongoing developments in the relationship between a debtor and their creditors should be passed onto the customer and copies of correspondence should be provided as well.

Not Mislead Their Clients or Make Unsolicited Contact

Any debt management plan provider should not mislead customers by providing inaccurate, unclear or hard to follow information. They should also not make any misleading statements or claim to be working on behalf of the government or any public service provider.

Debt management plan providers also have to follow strict rules about how they contact you. They are not allowed to visit you, send you messages or call you without your permission and they are also not allowed to take your details from a third party without your permission.

Keep in Contact With Customers and Review Their Situation

Throughout your debt management plan your provider should keep in contact with you and regularly monitor and review your circumstances and financial health. This includes monitoring payments you make to them for signs of any change to your financial circumstances. If the DMP provider becomes aware of any relevant changes to a customer’s circumstances, they should review their DMP and amend or terminate it, if necessary. If they are not aware of any changes to their customer’s circumstances, they should at least carry out an annual review. Adapting a debt management plan could include renegotiating payment conditions with creditors to lower levels if a customer has less money available.

Maintain Records and Ensure Accuracy

A debt management plan provider should keep accurate records about all the debt management plans that they provide and they should keep these until the contract is finished. On top of this, they should check that their customer account details are accurate and always try to send accurate information to creditors.

Accept Complaints

If, for any reason, you are unhappy about the service that your debt management plan provider is giving, you can make a complaint. Your DMP provider is obliged to respond to your complaint promptly and fairly. They should respond to a complaint within eight weeks and explain what action they will take to address your concerns. If they fail to reply within eight weeks or if you are unhappy with their response, you can make a complaint to the Financial Ombudsman Service, who will be able to handle a dispute.

How Effective are the Regulations for Debt Management Plans?

The rules which were introduced by the FCA in 2014 have done some good to help people who are in debt to receive better advice and to receive better debt management plan service. Of the 311 pre-existing commercial firms that applied for authorisation to continue after the rules were introduced in 2014, only 39 were allowed it. This removed a large number of unscrupulous companies from the sector.

While people generally receive better advice nowadays and while debt management plans are generally less expensive, where someone uses a fee charging company, there is still some way to go. There are still cases where poor advice is given and where vulnerable customers are not given proper treatment. In an FCA review of 2019, it was found that an 87 year old widow who had been enrolled onto a 97 year debt management plan had been pushed to sign documents, talked over and refused help after she had explained that she struggled with technology, figures and paperwork. While this is an extreme example, it is worth noting that unscrupulous practices do still exist.

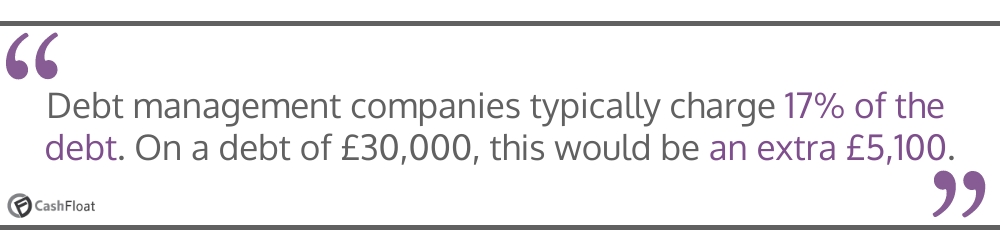

Unscrupulous practices and poor advice are more likely to be found in the commercial sector, where debt management plans are provided by fee charging companies. It is also worth noting that companies are still allowed to charge large fees (up to 50%). This means that people who are on a debt management plan could end up paying a huge amount for a DMP, when they can least afford it.

This is in light of the fact that good, impartial advice and debt management plan provision are available for free from debt charities, such as StepChange, the Debt Advice Foundation, PayPlan or Christians Against Poverty.

In Summary…

It is worth making sure that whoever administers your debt management plan is following the rules. The rules that were introduced by the FCA exist to prevent unscrupulous practices and are there to make sure that you are getting at least a minimum level of service. Everyone should receive at least this minimum level of service. On top of that, we recommend that no one ever use a fee charging company; they should use a debt charity instead.

Chapter 23:

Why You Shouldn’t Use a Debt Management Company

Chapter 25:

Take a Step With StepChange Charity