Do you think you’re able to avoid paying car tax, now that it has gone paperless? Cashfloat, a short term direct lender brings you all you didn’t know about car tax, what it is, along with how and why people avoid paying it.

- Why do we have car tax?

- The history of car tax

- Has the change from paper tax disks encouraged avoidance?

- When does one have to pay car tax?

- Can one pay car tax in instalments?

- Is the car tax system different now it is online?

- Does the type of car I drive affect car tax?

- How do the authorities catch car tax dodgers?

- What are the penalties for on-payment of car tax?

- Can non-payment of car tax cause other problems?

- Car tax has been around since 1888

- People think that since car tax has gone online they can dodge paying

- Budgeting ahead can help you pay your car tax on time

Why do we have car tax?

The abolition of the old paper tax disk in October 2014 resulted in a fall of £93 million in revenues for the DVLA (Driver and Vehicle Licensing Authority) in the following tax year.

The car tax system had remained virtually unchanged for decades. One had to display a round paper car tax disk in the vehicle windscreen. It showed the month and year, one has paid the vehicle tax up to. In 2015 the government legislated for the updating of the vehicle tax system to be automatic, with the application system changing to online, with no tax disk displayed on the vehicle. In this article, we look at the whole story, and the effects it has had.

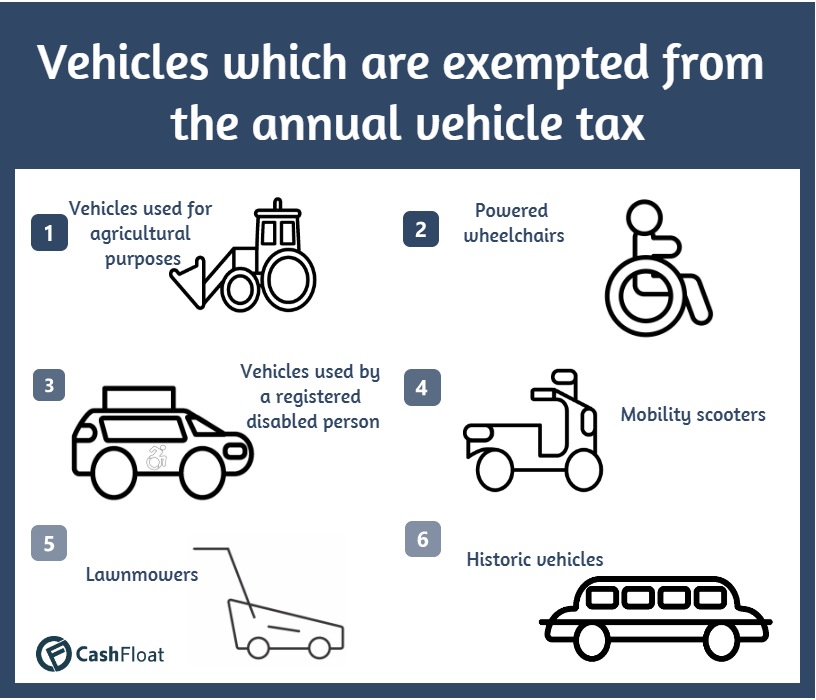

Car tax, formally known as Vehicle Excise Duty (VED) in the UK is an excise duty levied on most types of vehicles used or parked on public roads throughout the UK. The government administer the tax online, and it is compulsory. Even vehicles which currently have a “free” category of car tax, they must still apply for in the usual way before the due date. If not the authority will consider it like you have not paid tax, and subject to disruptive and expensive clamping or removal by the authorities.

History of vehicle tax

Vehicle tax was first introduced in the UK in 1888, with motor vehicle taxation starting in 1920. Initially, from 1920 to 1937 the car tax was specifically raised to fund road building. After 1937 the Road fund, into which vehicle tax was paid, was wound up. As a result car tax simply went into the general taxation pot. Many motorists still seem to think that car tax should pay towards road repairs now. However, even back in the 1920s and 1930s the amount of money raised by Vehicle Excise Duty was insufficient to cover road building and maintenance costs. There had always been a contribution from general taxation, so the reason for having the tax ring-fenced was rather redundant.

Paper tax disks change

Has the change from paper tax disks encouraged avoidance? It would appear that it has. Many people warned at the time that the abolition of the highly visible tax disk would encourage avoidance. However, the government argued that the old paper disk based system of collecting tax on vehicles was both inefficient and susceptible to people displaying forged disks. Many regarded this as yet another manifestation of the government’s austerity programme. Merely aiming to reduce costs. The government claimed, before the introduction of the new paperless system that over 99% of motorists paid their car tax on time.

The claim that the new computerised system would enable enforcement using the network of Automatic Number Plate Readers. They are roadside, or in vehicle cameras, the police and other authorities operate. The police have direct access to DVLA records via the national police computer. They use this to decide if a vehicle has been taxed as a method of enforcement. It replaces visual examination of the old displayed tax disks.

It would appear that the early results of the new automated paperless system for VED was a failure. In 2015/16 DVLA lost over £90m in revenues. To counter non-payment of car tax the government authorises certain bodies within the UK with powers to clamp and impound offending vehicles. These include the police, councils, DVLA, VOSA (Vehicle and Operator Services Agency) and other bodies with statutory or other powers such as airports or railway stations.

When does one have to pay the tax?

Car tax is payable on the anniversary of the first registration. Not at the month end as operated on the old paper tax disk based system. It is vital that you check carefully to ensure you tax your car on time to avoid any penalties for being untaxed. Saying you thought it wasn’t until the end of the month is not an acceptable reason.

Can I pay monthly? Yes. The standard published fees are for payment in cash or by direct debit in full for the entire amount on the due date. The second cheapest easy payment options are by direct debit. You can pay every 6 months or by 12 equal monthly direct debit payments. The most expensive way of paying is in cash each 6 months.

Is the car tax system different now it is online? Yes. The new system is trying to encourage car owners to apply online via the DVLA website. Alternatively, the DVLA vehicle tax service is available by phone 24/7 on 0300 123 4321. One can pay VED at many Post Offices in the UK.

Applying online is the simplest method of applying for and paying new vehicle tax if you have the necessary means of being able to pay online. A credit or debit card, or a bank account from which you can arrange a Direct Debit payment. You will need a reference number for the vehicle you are trying to tax from one of the following documents:

- A recent VED reminder (V11) or ‘last chance’ warning letter from DVLA, or

- The vehicle log book (V5C) for the vehicle which must be in your name, or

- The new keeper’s details slip (V5C/2) from a log book if you’ve just bought the vehicle

The same reference number will be required to apply by telephone to the DVLA. One can only make credit or debit card payments by the telephone service. Direct Debit payments cannot be set up using this option. Using the telephone service to the DVLA also incurs call costs. They can vary considerably depending on your phone supplier.

Anyone wishing to pay with cash must use a Post Office to apply and make payment for VED. Post Offices handling VED applications can also take payment by Direct Debit. If you pay by Direct Debit, you will need your bank details. The Post Office will also require you to produce either the vehicle log book (V5C) (in your name) or a new keeper’s details slip (V5C/2) from a log book if you’ve just bought the vehicle. Some applications may also require you to produce a valid MOT certificate.

If you do not have the necessary documents to make your application, you will need to obtain a replacement vehicle log book (V5C). This will cost you £25. You need to check well in advance of when you will be applying for your VED renewal. Applying for a new log book takes time. The DVLA states it takes 5 days to receive the new document if you apply by phone. It takes up to 6 weeks for postal applications. Phone applications require a debit or credit card to make payment. Postal applications require payment by cheque or postal order. See the DVLA website link “vehicle-log-book” below for further information.

The Post Office branch finder facility is a useful way of checking which branch of the Post Office near you undertake applications for car tax renewal.

Tax rates

For cars registered on or after 1st April 2017, the following rates apply; The amount of tax you will need to pay will probably be different. How you pay has changed too. The initial car tax payment from new (usually arranged by the car dealer and paid with the purchase price) varies dramatically depending upon the amount of CO2 emissions (g/km) the vehicle emits. This varies from £0 for zero-emission cars (electric and hydrogen powered) in steps through to £2000 for vehicles with CO2 emissions which are over 255 g/km.

The government levy slightly lower levels of initial car tax on alternative fuel cars. (This category includes: hybrids, bioethanol and liquid petroleum gas fuelled [LPG] vehicles). New vehicles with a list price of over £40,000 also attract an extra £310 car tax for each of the first five years they are on the road for electric vehicles. £440 for alternative fuel vehicles and £450 for all others.

The tax fees payable which matter to drivers the most are those which apply annually. From the first anniversary of initial registration for cars costing less than £40,000. One needs to pay £140 per year for Petrol or diesel cars. Alternative fuel cars at £130 a year. Electric vehicles are free to tax. (Important note: even though electric vehicles are free to tax, one must make the application in the same way. It must be on time, to avoid being fined or having the vehicle impounded for not having taxed).

Type of car

For petrol or diesel cars registered between 1st March 2001 and 31st March 2017, different VED rates apply. These rates are based purely on the CO2 emissions (g/km) the vehicle emits. For cars emitting up to 100 g/km, there is no charge. The fee payable then rises in increments up to the maximum figure of £535 for the most polluting cars emitting over 255 g/km. Alternative fuel cars pay £5 less for each polluting g/km category.

For cars registered before 1st March 2001 (but not old enough to qualify as “historic vehicles”), they pay car tax based on their engine capacity in cc. For vehicles up to 1549cc, the annual cost is £150. With vehicles over this engine size the fee is £245.

Does the type of car I drive affect car tax? Tax for cars registered before 1st March 2001 depends on the engine size. After this date, the level of VED depends on carbon dioxide emissions and the fuel type.

Car tax dogers

How do the authorities catch car tax dodgers? The police and other authorities have direct access to the DVLA database which lists all cars taxed in the UK, giving them real-time access to records. This means that any officer, whether on foot or in a vehicle, can check a vehicle they suspect the owner has not paid tax for, instantly. They can then take steps to have the vehicle immobilised and removed from the road. In addition to having an untaxed vehicle on the road, a vehicle with a SORN (Statutory Off Road Notification) can get taken away if the owner leaves it on a public road. A vehicle with neither SORN nor road tax paid may get taken off private property too.

Penalties for tax evasion

What are the penalties for non-payment of car tax? Firstly, if your vehicle gets a clamp or is impounded for non-payment of car tax, you must pay the outstanding car tax – online – before trying to recover your vehicle. If you cannot pay online, a period of five days must pass after paying at a post Office before you try to recover your vehicle – a much more expensive option which can lead to taking an unsecured quick loan to pay off. If you pay to have your vehicle released within 24 hours of the authority clamping it, it will cost you the car tax due plus a fee of £100.

Delaying the recovery of your car can become very expensive for you. After the first 24 hours the release fee increases to £200 plus a storage fee of £21 per day.

If you do not have VED paid before you collect your vehicle, you’ll also need to pay a deposit to ensure subsequent payment of the tax within 14 days. This is £160 for a car or motorcycle and up to £700 for other vehicles. Failure to pay the outstanding car tax within 14 days forfeits this payment.

In addition to the fees, storage charges and deposit required, you will also be responsible for the cost of any calls made to sort out matters to recover your car.

Will it cause other problems?

Yes. The DVLA work closely with insurance companies in a system called “continuous insurance enforcement’”. This cooperation between the DVLA and the Motor Insurance Bureau (MIB) to identify drivers who do not have insurance can result in further financial penalties. After being reminded to get insurance or tax, anyone failing to act can get a £100 fixed penalty notice by the DVLA. They can also have a clamp put on or taken to court with a maximum fine of £1,000. Obviously being clamped will also involve the recovery costs detailed above in this article.

It is obvious from the estimates made following the abolition of paper car tax disks that the number of people not paying car tax has increased from its previous level estimated at 10%. Whether this increase in non-payment is by accident or design is open to debate. Some people may think the lack of needing to display a tax disk will make it more difficult to get caught. They couldn’t be more wrong. The UK is thought to have more CCTV cameras than any other nation on earth. In recent years many CCTV cameras, especially those used for traffic management and as “speed cameras” has had an upgrade using digital technology and now offer number plate recognition capabilities. These cameras, and mobile cameras fitted in marked and unmarked police vehicles, along with mobile community partnership cameras, are live linked to the national databases operated by the DVLA and insurance companies.

You will get caught

This means that any vehicle spotted which the owner has not paid tax for, gets a flag by the computer instantly. Even drivers who think they can use back streets to make journeys to avoid camera recognition cannot evade detection forever. The police use technology to support their intelligence to track even the most devious of motorists. The financial risks of being caught without car tax paid for your vehicle, as detailed above, are substantial. Fines and recovery charges can have a significant impact on your personal or household finances. Fines may also force you to get a payday loan.

If you did avoid paying the car tax through financial hardship, how much worse will it be if you are caught and not only have to pay the tax but additional penalties too? In addition to the financial penalties of non-payment, have you considered the effect not having your car could have on your life? Do you need your car to travel to work, or to enable you to cope with juggling childcare and working hours? The cost of getting caught without up to date VED could begin amounting to a major dent in your finances.

Budget ahead

As with any facet of personal and household finances owning a car needs careful planning and budgeting. Running a car is a significant expense which brings financial costs well beyond buying fuel to keep it going. If you have considered the alternatives of using public transport or walking and cycling as impractical, you need to budget carefully to ensure you can afford to run your car and meet the big bills this entails. Plan ahead for the year, taking into account the known costs of car tax, insurance, servicing and repairs, and MOT testing in addition to paying for fuel. Calculate and estimate of the annual cost and try to put aside and save towards the big bills – as paying in full can sometimes reduce the cost. Alternatively, research the ways of spreading payments of tax and insurance by making regular payments by Direct Debit.

In summary

Whichever decisions you make, budgeting makes sense. If you are caught out needing to make big payments when you haven’t saved towards them, you may end up in the unenviable position of having to take out an instant decision online loan on a short notice. Do you really want to take on expensive 24/7 loan debt when good planning and budgeting could avoid the expense? Plan your finances to avoid expensive debt and get into the good habit of saving towards your future.