Full Guide to Managing Family Finances – Chapter 11

A family can face a variety of circumstances, some sudden or long-term, which can put a strain on their finances. We’ll explore a few of these, and the first steps which can help get a family’s finances and wellbeing back on track.

- Redundancy or dismissal from place of work

- Be aware of your rights

- Register as unemployed

- Start your own business

- Be honest

- Significant debts

- Ill health

- Frequent late bill payments

- Missing payments or only paying the minimum on credit cards

- Not having the money to spend on necessities, for example, food and travel

- Seeking loans or credit cards

- Lenders take legal action against you

- Possibility of eviction from not paying rent or loan repayments

- More money going out then coming in

Redundancy or otherwise losing one’s job can be a big shock. Whatever the circumstances, try to have the right people around you to provide moral support.

Is your union involved? They should be. There are strict processes an employer must follow to adhere to the law when making people redundant.

Redundancies are when the employer needs to reduce its headcount to remain a viable entity – it is not a reflection of the value or performance levels of those selected. Take the time to be aware of your rights, and check any statutory redundancy pay calculation made.

If you’re committed to looking for work, it makes sense to register for the Jobseeker’s Allowance. Your local office may be able to point you to relevant training or work opportunities, too.

If there is something you’re great at – a service or product you can offer and really excel in – now could be the time to start your own business. If you do, and you earn more than £1,000 in the tax year, this changes your tax status, so be sure to let HMRC know. The administration around self-employment is minimal, allowing you to focus on growing your business.

Losing a major source of income affects everyone in the family. Be honest with them about the impact on finances in the short-term. Even young members of the family may have good ideas about how to save or make money.

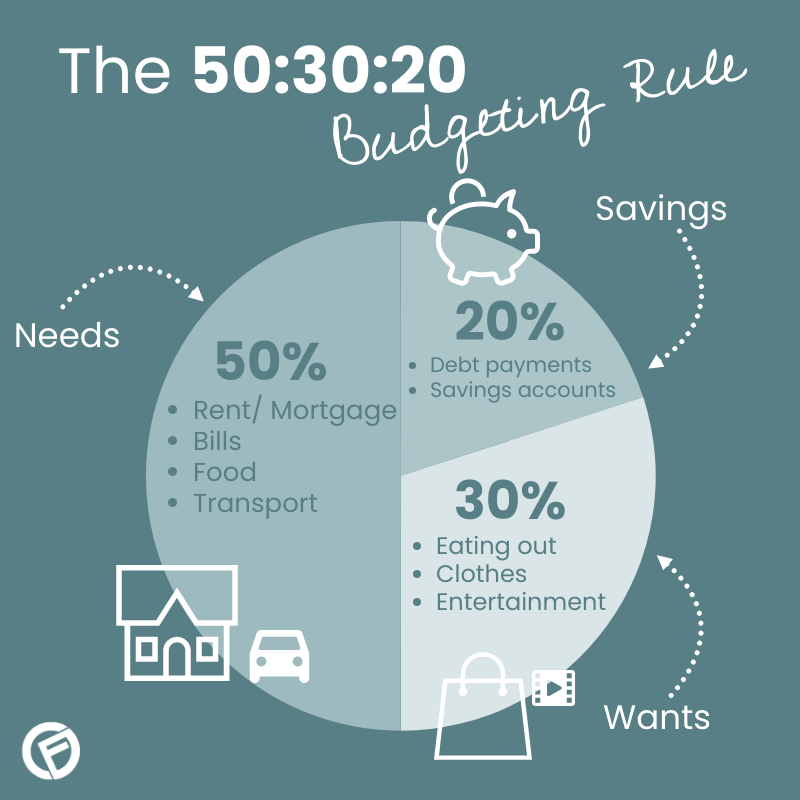

This is another situation where a budget can help to allay everyone’s fears. Stick to spending only what you can afford rather than falling into the trap of alluring short term loans and the financial difficulties can be met head-on. If you have become adept at budgeting when there is a regular income coming in, then you can apply the same principles when you no longer have this income to rely on.

Have you been made redundant? Read our Redundancy Survival Kit.

Reducing the amount of debt that your family has is also a challenge that can make the most optimistic person feel daunted. Debts are an emotional and psychological burden, and the sooner this is faced into and lessened, the better. However, there are lots of organisations that can help with advice about coping with debt and many people who had been deeply in debt have come out the other side wiser and more knowledgeable about how to keep their family money in order.

Ill health is another situation that can prove to be a financial challenge especially if the illness is a chronic long term disease or condition. Get the help of relatives and professionals so that you do not feel overwhelmed by medical costs for prescriptions and caring for the family member who is ill. Try to get some time out from caring, to help to put things into perspective. This will also assist you to remain calm and to get the financial help that is available through the NHS or other organisations.

Signs you might need help with your finances

Most people know if they are facing financial difficulties. The most tangible signs are:

Are you financial difficulties affecting your health and relationships?

What is often less obvious to an onlooker is its impact on the person. Signs can include:

- Feeling anxious about money

- Arguing with those closest to you about money

- Feeling unwell, with headaches or migraines

- A change to one’s normal sleeping patterns and appetite, with resulting tiredness, weight gain or weight loss

- Fear of opening the mail

- Guilt when spending money on non-essentials

What to do if you are experiencing financial difficulties

Fortunately, there are places to turn when you are feeling stressed over money issues. In the UK different debt charities offer financial support and guidance. They help you get your finances under control. Cashfloat is a responsible short term loans lender, and we are trained to spot signs of severe financial struggle, and we have teamed up with StepChange to ensure that our customers get professional help.

There are other ways to help yourself when you face financial difficulties or to avoid them in the future.

- Communicate with the people you owe money to

- Consider contacting a welfare service or your local council in your area

- Put your physical and mental health first

In most instances, they will be understanding, and together you can try and come up with solutions to ease the stress, like loan extensions or smaller instalment payments. If you have a Cashfloat loan online and are struggling to repay, contact us and we will try to come to an arrangement that suits both of us

You might be able to receive help with paying your electricity, referrals to food banks etc.

Get help from your GP if you are struggling with your mental health, feeling overwhelmed emotionally and mentally.

Plan for the short and medium- term

In the short-term, paying overdue bills and clearing debt are priorities. In the longer term, an individual or family can plan for bigger changes to their lifestyle or circumstances, to help avoid financial stress. Nothing is permanent. Good luck.

Chapter 10:

Divorce settlement: What am I entitled to?

Chapter 12:

What do people spend their household budget on?