In June 2023, over 200 companies were named by the government for failing to pay some of their staff the minimum wage.

Over 200 businesses in the UK were failing to pay employees the minimum wage. As a responsible lender, we help UK consumers get to payday safely – extending a helping hand when needed. Sadly, dishonest companies left many vulnerable citizens grappling for their next salary. This forced many of them to rely on short term online loans month after month. Payday loans and wage day advance loans are only supposed to be a short-term solution for emergencies. However, when people rely on them consistently, it can lead to a cycle of debt.

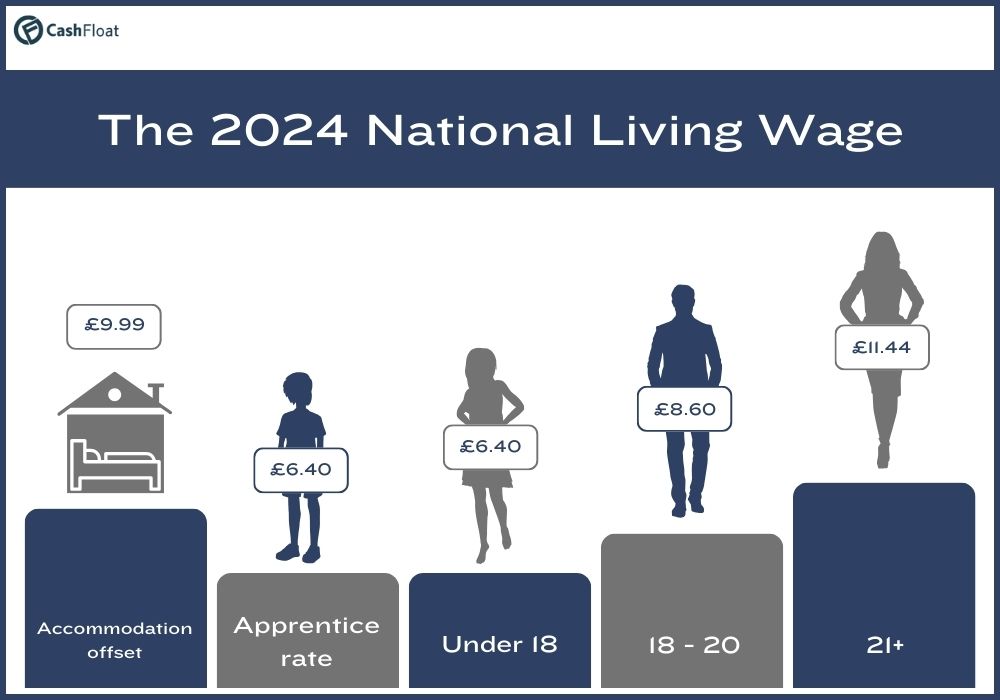

What is the national minimum wage from April 2024?

| National Living Wage 21 and over | £11.44 |

| 18 – 20 | £8.60 |

| Under 18 | £6.40 |

| Apprentice | £6.40 |

| Accommodation Offset | £9.99 |

National Minimum Wage Abuse

The Department for Business and Trade released details of these companies in June 2023 as part of their “naming and shaming” policy. The department exposes company corruption to the wider public.

Retail chain WH Smith Retail Holdings topped the list having failed to pay a whopping £1,017,693.36 to 17,607 workers. Employers within the retail, hospitality and hairdressing industries were the most prolific offenders of all.

Companies Shamed in Published Report

The thorough report named businesses both large and small that underpaid their employees. Some had failed to pay vast sums to multiple employees, while others failed to pay a single worker as much as £502.37.

In a statement released by the Government, Minister for Enterprise, Markets and Small Business Kevin Hollinrake said the following:

“Paying the legal minimum wage is non-negotiable and all businesses, whatever their size, should know better than to short-change hard-working staff.

“Most businesses do the right thing and look after their employees, but we’re sending a clear message to the minority who ignore the law: pay your staff properly or you’ll face the consequences. “

Many have spoken out in favour of the government’s decision to name and shame companies. Others have described those named in the list as “just the tip of the iceberg.”.

Massive Companies not Paying Employees the Minimum Wage

While W H Smiths topped this record-breaking list, many other exposed companies had underpaid their workers. These included Lloyds Pharmacy Limited, Marks and Spencer P.L.C, Argos, and Buzz Group Limited to name a few.

Some of the businesses named and shamed in this report have chosen to issue statements in response.

An M&S spokesperson said that the company’s mention stemmed from an inadvertent technical glitch dating back over four years, emphasizing that it was promptly rectified upon discovery.

He then added,

“ Our minimum hourly pay has never been below the national minimum wage, it is currently above it and no colleagues were ever underpaid because of this.”

Companies Responses to the Negative Publicity

A spokesperson from Sainsbury’s revealed that a payroll discrepancy dating back to 2012, prior to its acquisition of Argos, was identified in 2018, impacting certain Argos store employees and drivers. They further stated that the issue had been addressed, with Argos worker hourly rates now in line with those of Sainsbury’s.

Regarding WH Smith’s response, the company admitted to misinterpreting statutory wage regulations concerning its uniform policy for in-store staff. They clarified it was a genuine mistake promptly rectified in 2019, with all affected colleagues reimbursed accordingly.

Many of the other firms named in the report declined to comment.

Minimum Wage not adhered to for Outrageous Reasons

The excuses that many of these companies gave for not paying minimum wage were largely pathetic. These included using tips to top up pay, docking wages to pay for workers’ Christmas party, and making employees pay for uniforms out of their own salary. This may explain the rise in payday loans online taken each year over the Christmas period. Some businesses even claimed that they were unaware that the minimum wage applied to foreign workers. According to the Department for Business, Energy and Industrial Strategy, certain companies claimed that “It’s part of UK culture not to pay young workers for the first three months as they have to prove their ‘worth’ first.” Some outrageously claimed about certain workers that “she doesn’t deserve the national minimum wage because she only makes the teas and sweeps the floors.”

The Government has released statements in the past specifically noting that tips do not count towards the National minimum wage and even provide a voluntary “Code of Best Practice” for employers.

HM Revenue and Customs has now recovered arrears for many of the UK’s lowest paid workers and also has issued penalties worth around £800,000.

HMRC Naming and Shaming Policy

This list marks a record-breaking number of companies named and shamed for not paying employees the minimum wage. Since the HMRC introduced its “naming and shaming” policy, more than 1000 companies have been found to be underpaying their staff by a total of £4.5 million. Not only that but the HMRC are now examining another 1500 companies.

When announcing the new campaign, the government also released some of the worst excuses by employers for failing to pay their workers properly. These included:

There have been those who are critical of the HMRC in the light of this recent report. UNISON general secretary Dave Prentis said,

“This list fails to shame the larger care firms who are equally guilty of denying staff a fair wage. Those in the spotlight today are just the tip of the iceberg. HM Revenue & Customs needs to get much tougher with more inspections to identify Scrooge employers. “When a care firm breaks wage laws, the chances are it’s likely to cheating more than just a handful of its workers. We must check pay records thoroughly, so all employees get the money they are owed. The government must insist that bosses stop duping staff with bafflingly complex payslips. Care companies must show workers how they calculate their pay and prove that at the very least they’re earning a legal wage.”

Minimum Wage UK

The current national minimum wage (as of April 2024) sits at £11.44 per hour for those aged 21+. For those under 24, the minimum wage decreases incrementally depending on your age.

The issue of a living wage in the UK is something that has been hotly debated by economists, with many believing that it will increase productivity as well as make the UK a more fair and equal place overall. In a 2016 poll among economists carried out by the Financial Times, the results were split almost evenly down the middle.

The Wage Debate

Those in favour:

Those in favour claimed that it offers a more fair and stable distribution of wealth and makes capitalism for sustainable. Paul de Grauwe, professor of economics at the London School of Economics said,

“A minimum wage is a way to turn the tide. It will make capitalism more sustainable in the long run. It is a way to show a more human face of capitalism. In the long run, it will strengthen the system.”

Many employees who currently earn the existing minimum wage work in sectors that do not trade internationally, something many economists argue reduces any downside to raising the cost of labour in these areas thanks to the lack of international competitiveness. Professor of economics, David Cobham said,

“In popular terms, you and I can expect to pay a bit more for our espressos, and the people who make and serve them can expect to get a better standard of living, and that’s fine.”

Those not in favour:

However, there are those who say that a national living wage would be less beneficial to the nation as a whole, claiming that it would end up costing jobs, particularly outside London.

Nick Bosanquet, a professor at Imperial College, London said

“It will have less impact in London and much more in northern conurbations where there are the greatest productivity problems and the lowest rates of new firm creation. It is, in fact, a rise in compulsory costs on employers with the least ability to pay.”

To read about zero hour contracts and the pros and cons, click here.