Are you or a loved one struggling with a gambling addiction? Do you feel helpless watching your debt pile up when you can’t fight the urge to place that bet?

Loans for gambling debt could be the answer… or the enemy. Cashfloat explores the causes and effects of problem gambling, and suggests support groups and advice agencies that can help.

Gambling Defined

Gambling is an age-old source of entertainment, which is unfortunately highly addictive. It often starts as an innocent and cheap bet; sadly though, it usually develops into a full-fledged addiction. The addict amasses huge expenses which they cannot afford, causing them major financial problems. In many cases, the addict will turn to gambling debt loans to cover the costs of their lost bet debt.

Is There Anything Wrong with Gambling?

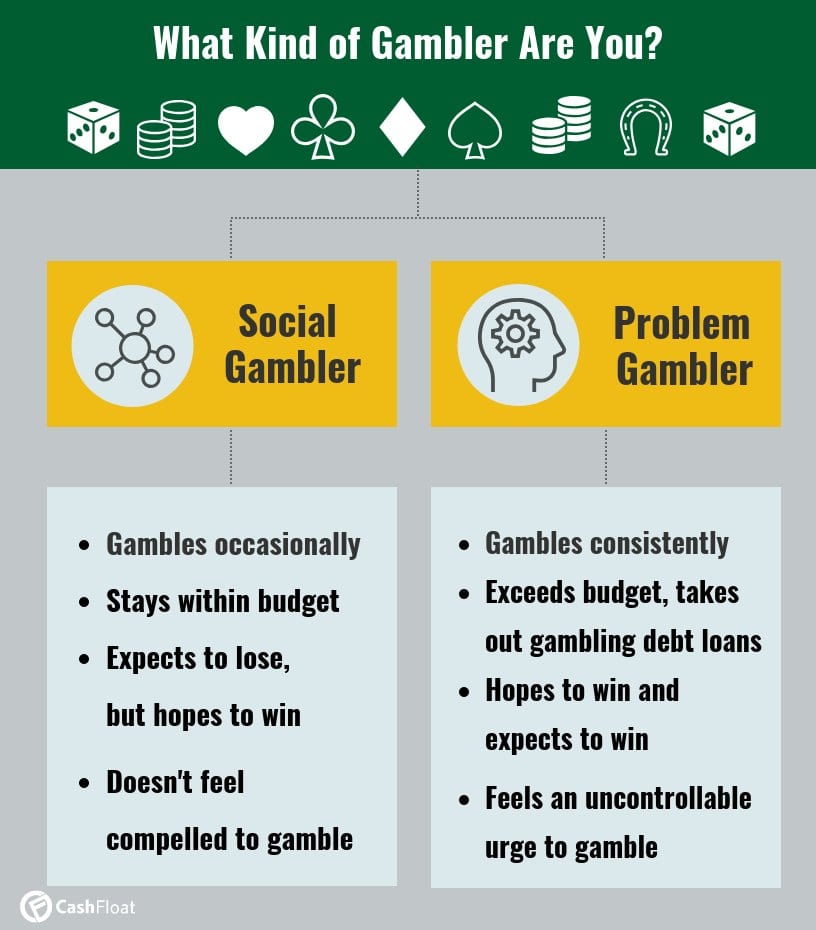

It depends. Gambling as a one-off activity need not come to any harm. However, when it becomes a consistent habit, it can quickly deteriorate into ‘problem gambling’. Gambling is typically a progressive addiction that can cause highly damaging physical, psychological and social repercussions.

Addicts can suffer from migraines, stress, depression and other anxiety-related problems. Eventually, severe problem gambling can even lead to suicide. Gamblers can rack up serious debts in lost bets but are addicted to the thrill of winning the game of chance. Addicted gamblers fall into a continuous spiral of debt and find it extremely difficult to stop gambling.

Compulsive gamblers cannot control the urge to gamble. Often this comes at the expense of hurting themselves or their loved ones. Gamblers will often use the money they desperately need to cover basics like rent, food, and electricity to fund their addiction. Previously kind and caring husbands and wives, mothers and fathers often shock themselves as they transform into entirely different people.

Gambling Debt Loans

What Are the Gambler’s Options When the Money Runs Out?

Addicts regularly feel the strong urge to place a bet, but they already owe money and don’t have the cash. What will they do now?

Many will empty their bank accounts, at times even selling valuable belongings to get cash quick. But even then, it won’t be enough. Many addicts will take out gambling debt loans to cover their bad bets. However, the nature of problem gambling is that the addict will try ‘just once more’ to place a winning bet. They may honestly expect that ‘final’ bet to win all their money back.

When all else fails, it’s not uncommon for gamblers to apply for a payday loan to fund their gambling habits. In fact, in October 2013 the media released a major story about footballers using payday loans for gambling. Colin Bland of the Sporting Chance rehabilitation clinic remarked: ”We are working with a lot more current football players. We have had players who have got caught up in the scenario of taking out payday loans to place bets.”

Misusing Payday Loans as Gambling Debt Loans

Payday loans can be a useful tool for emergencies, but only if borrowers ensure they can repay promptly and responsibly. People with gambling addictions are not capable of taking out a payday loan responsibly for a number of reasons.

According to their budget, they might technically have the money to pay back the loan on time. Nevertheless, they are not addressing the root of the issue, and are still tied to their addiction. Before long they will have spent the available money and be looking to borrow money again.

Good news: There is help available

Here at Cashfloat, we care about your well-being. Therefore, we have compiled a list of organisations and suggestions available to help you break the cycle of addiction. Gambling addiction is a serious matter which can cause severe debt problems. We want to help you avoid gambling debt loans and get back on the path of financial health. Whether you are suffering from this addiction, or you know someone who is, this list can benefit you.

GamCare – GamCare is an organisation that assists those with gambling problems. They give support through advice and treatment and minimise gambling-related harm through education, prevention and communication.

GamCare provides live, confidential, one-on-one counselling, information, and emotional support.They can also direct individuals to further sources of specialist help, including debt advice and mental health experts. In addition, GamCare runs an online forum and chat room for people to share their experiences and provide peer support.

For citizens of England or Wales over the age of 16, there is a specialised NHS clinic for problem gamblers stuck with gambling debt loans. Some of the services they offer include individual and group treatment, a regular support group, and money management workshops and counselling.

Gamblers Anonymous – Gamblers Anonymous follows the same 12-step approach as Alcoholics Anonymous to break the vicious cycle of addiction. They provide mentoring and support for addicts, and also offer a sister support group for relatives called Gam-Anon. Hearing about others’ experiences and knowing you are not alone in your struggle can be a great source of inspiration.

Additional Resources

Another available option is to install Gamblock onto your computer. The software can block gambling websites on your device to keep you on track in a moment of weakness. Additionally, it sends an email to a close friend or family member if you attempt to log on. This way, you can have someone you trust giving you further support when you need it most.

Stepchange Debt Charity is an excellent resource to help recovering gamblers deal with severe debt problems. Click here to see the many services that they offer.

Avoiding Gambling Debt Loans and Problem Gambling

The Gambling Commission works tirelessly to minimize both problem gambling and its many unfortunate and unintended outcomes. We have briefly outlined their goals below, but visit their website to read more and see how they achieve this.

Among their aims are keeping crime out of gambling and ensuring that gambling is conducted openly and fairly. They work on protecting children and other vulnerable people from being harmed or exploited by gambling. Additionally, they advise both the national and local government on the impact of gambling and the importance of regulation.

Conclusion

Online gambling websites are getting smarter and improving their ways of luring you into their world. They often post enticing advertisements that make their rounds through social media and anywhere else you are likely to see them. It is important to be aware of the dangers of gambling and not to be fooled by false ads.

Consistently placing harmless bets can turn into a gambling addiction, eventually pushing you to seek gambling debt loans. Cashfloat, your responsible direct lender, urges you to take the necessary precautions to keep your mental health and your pocket safe.