Did you know that, even if Experian has given you a low credit score, you could still qualify for a loan from a specialist bad credit loan provider like Cashfloat?

Read this article to find out how Experian makes credit files and calculates credit scores. Find out why they do this as well and how you can get a free credit report from Experian. If you’ve got a poor credit score, taking a look at your credit report on Experian could help you find ways to improve it.

- Find out what factors determine your Experian credit score

- Find out how to get your Experian credit report and score for free

- Find out how your credit score compares to other people in the UK

Experian is one of the three biggest credit reference agencies (CRAs) in the UK. Their job is to gather information on the credit histories of people in the UK and convert this into a credit score. They collect information on things like what debts people hold and how good they are at making payments towards them.

Creditor providers, such as payday loan companies, banks and car finance providers, use CRAs a lot. This is because they need the information they provide to help to determine if people who apply for loans can afford to pay them back. They need to know how reliable potential customers are with money. Often, creditors rely quite heavily on the information Experian provides because it provides a level of insight into people that can’t be found anywhere else.

Experian credit scores explained

Experian has been serving the UK since 1996 and are based in Dublin, Ireland. The company operates all over the world, with operations in 37 countries and information on over one billion people.

Experian’s credit reporting system makes it easier to identify how good someone is at handling their finances. As we said, credit providers find this information very useful when it comes to making decisions about customers. As well as creditors like lenders and utility companies, other parties like employers and landlords may also access credit reports to gather information on people.

Financially savvy people also look at their credit reports to see if they need to do anything to improve their credit score. Having a low credit score may mean things like having a higher-interest rate on loans or lower borrowing limits. So it’s best to try and maintain a good credit score. You might find it beneficial to find out what your credit score is with Experian and see if there is anything you should do to improve it.

How do Experian calculate credit scores?

Experian generates credit scores from the information that is stored in people’s credit histories. The actual process of calculating a credit score from this information involves the use of credit scoring models. These are complicated algorithms that have been developed over many years. Fico scores are created by one type of credit scoring model, and you can get your Fico score from Experian.

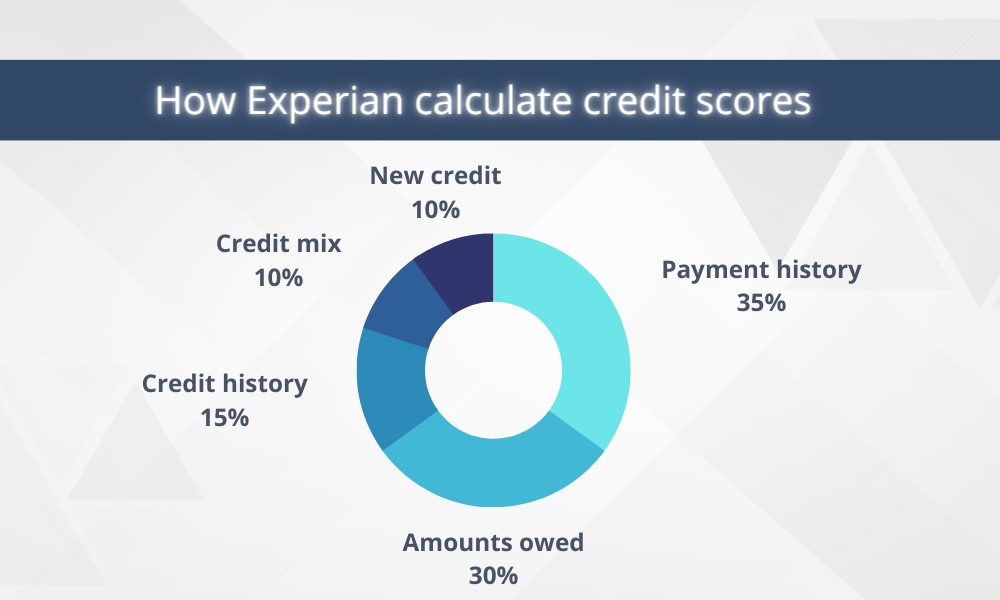

The factors that Experian take into account when they generate a credit score are as follows:

- A person’s payment history – This is how well you’ve handled debt in the past and includes things like previous on-time payments, late payments or loan defaults. It may also include information in public records like bankruptcies or county court judgements (CCJs).

- The amounts someone owes – This is how much someone owes in credit and how many of their accounts have balances. It also looks at a person’s credit utilisation. This is what amount a person is using of the total credit that’s available to them. The more of your available credit you’re using, the more likely your score is to be negatively affected.

- The length of a person’s credit history – Credit reference agencies can’t give someone a good credit score if they don’t have much information about them. The longer your credit history and the more on time payments there are, the better.

- Recent credit activity – If you’ve recently applied for credit, the companies you’ve applied to should make a ‘hard enquiry’ on your credit file. These hard enquiries can lower your credit score on certain occasions. Opening new accounts may also temporarily lower your score slightly. While new credit activity can be seen as unfavourable by creditors, this is not always the case.

- The types of credit someone has – Having a mixture of credit account types is usually good for your credit score. If you’ve previously had a mixture of revolving credit (such as a credit card) and instalment credit (such as a loan), this could be good for your credit score.

The MoneyHelper website shows the typical information that a credit report contains.

The amount of information and data that Experian is able to gather on people is quite immense. Experian try to get as good an insight into every person they monitor as possible.

How to see your credit information for free on Experian

If you want to see your credit score and information, the easiest ways are to either request a statutory credit report or create a free Experian account. If you choose to create a free Experian account, your credit score will be updated every 30 days, and you’ll be able to track how it changes. Alternatively, you can sign up to Experian’s CreditExpert to get in-depth information for a 30 day free trial.

Free Experian account

If you sign up to a free experian account, you’ll get to see your credit score straight away, and you won’t have to pay anything.

Once you’ve signed up, you’ll get monthly updates to your credit score as well. If you need to improve it, getting monthly updates will help you track your progress. The information you get is fairly basic. You don’t get to look at the information in your credit history, for example. But knowing your score can still be helpful.

To get more information from Experian, you’ll need to either request a copy of your statutory credit report or sign up to CreditExpert. Read on to find out more.

Experian CreditExpert

If you get an Experian CreditExpert account, you’ll get to see your credit history in depth, and you’ll get access to a wide range of Experian services. The downside is that it’s only free for the first month. After that, it costs £14.99 per month.

With Experian CreditExpert, you can see your credit history, use ongoing reporting services, check your eligibility for credit offers, get a wide range of anti-fraud services and much more.

Experian statutory credit report

Everyone is entitled to receive a free statutory credit report from Experian and the other credit reference agencies in the UK, according to Article 15 of the Data Protection Act 2018.

With an Experian statutory credit report, you’ll get to see what information Experian keep about you from the previous six years. This will include information on your borrowing history and credit applications as well as the other basic information in your credit file.

You can order a statutory credit report online, or you can even do it by post.

Experian UK FAQs

Experian provides credit scores as a number between 0 and 999. Within this range, scores are banded into categories, as you can see below. Any score between 881 and 960 is considered good.

- Very Poor Credit Score

- between 0-560

- Poor Credit Score

- between 561-720

- Fair Credit Score

- between 721 and 880

- Good Credit Score

- between 881 and 960

- Excellent Credit Score

- between 961 and 999

More information is available here.

The last UK average credit score that Experian reported for the UK was 797.

Experian shows the average credit score in the UK by location and age on their interactive map.

Experian usually updates their information about people every month. This is because the companies they get their data from usually provide updates at the end of every month. On some occasions, updates happen more frequently.

Experian is used by a huge number of businesses in the UK, including banks, loans companies, landlords, utility providers and insurers. Some prominent names that use Experian are:

- Barclays

- Halifax

- Lloyds

- American Express

- Nationwide

- EE

- O2

Conclusion

Lots of businesses, including banks, payday lenders, phone companies and utility providers, rely on the information that Experian keeps about people in the UK. They need this information to understand how potential customers are likely to handle credit if they give it to them. It may seem intrusive, but these companies need this information to do business responsibly and effectively.

It’s a good idea to find out what information is in your credit file and to get on top of your credit score. If you find out what is in your credit history and what your credit score is, you can take steps to improve it. Having a higher credit score will make you eligible for more lending options with better conditions.

Have a look at some of the things you can do to improve your credit score here.

We think you’ll enjoy these articles too:

Why Didn’t the Experian-ClearScore Merger Go Ahead?

Interesting Factors That Affect Your Credit Score