In today’s fast-paced and competitive job market, conducting a successful job search can be both thrilling and challenging. Whether you’re a recent graduate, a seasoned professional looking for a career change, or someone in between, navigating the job search landscape requires a strategic approach and a keen understanding of the latest trends and techniques. In this article from Cashfloat, we’ll explore invaluable tips, insightful advice, and the latest industry insights to help you embark on a job search journey that leads to the career of your dreams!

Lost Your Job? What Can You Do? – Chapter Nine

This table provides you with valuable information where you can begin your job hunt.

| Online platform | Features | Limitations |

|---|---|---|

| Indeed is a widely used and user-friendly job search engine that aggregates job listings from various sources, offering a wide range of job categories to cater to a diverse audience. | Indeed presents an overwhelming number of job listings, which can be challenging to navigate due to their sheer volume, and some listings lack detailed company information. |

| Reed offers a range of additional services, including career advice, courses, and a salary checker. They also provide a CV builder tool to assist users in enhancing their resumes and offer employer insights to aid job seekers in gaining deeper knowledge about prospective employers. | Reed offers a smaller job pool compared to larger platforms like Indeed, and its primary focus on the UK job market may not suit those seeking international opportunities. |

| Monster primarily focuses on featuring job listings from larger companies, offering valuable career advice and resources to enhance job search strategies, as well as providing users with a platform to build and store their resumes. | Monster primarily features job listings from larger corporations, limiting opportunities at smaller companies or startups, and some users find its interface and user experience less user-friendly. |

| Totaljobs is focused on the UK job market, offering a diverse selection of job listings within the country and providing salary information to assist candidates in evaluating job suitability. Additionally, Totaljobs hosts a user community section where individuals can engage in discussions, seek advice, and share insights with fellow job seekers. | Totaljobs operates in a highly competitive UK job market, leading to many users competing for the same positions, and the quality and detail of job listings can vary, necessitating additional research. |

| Jobsite specializes in job search options, including contract roles and temporary positions. It also equips job seekers with a salary checker tool to estimate expected earnings for specific roles, while also featuring dedicated pages for various industries to streamline job searches within specific sectors. | Jobsite’s specialised search options, while helpful in some cases, may limit the diversity of job listings, and like Reed, it primarily focuses on the UK job market, potentially not meeting the needs of international job seekers. |

| Glassdoor is renowned for its comprehensive company reviews and employee-generated content, offering valuable insights into company culture and salary details, while also providing salary information and job listings, alongside interview insights where users can access firsthand accounts of interview experiences and questions shared by candidates who have interviewed with specific companies. | Glassdoor’s reliance on user-generated content can result in varying reliability for company reviews and salary information, and it may have fewer job listings compared to other major job boards. |

Job Hunting

Picking yourself up after redundancy and looking for a job can feel daunting at first. However, it is necessary to secure yourself financial stability in your life if you don’t want to have to resort to the help of online loans to pay your bills. Most potential employers will want to know the reason for your redundancy. Decide on the field you want to work in. Perhaps you want to go for something different to what you were doing before your redundancy.

Here are some steps to take when looking for a new job:

- Nowadays, most jobs available are posted online, so searching online for a job is probably the best way to start. If you are looking to work at a specific company, it is best going onto their website or by contacting them directly. If you are looking for a job in a particular field, then sites like indeed.co.uk and monster.co.uk can be perfect in helping you in your search.

- Only apply for jobs that match the skills and the experience you have. Don’t waste your time applying for jobs you won’t get. If you match most of the job specifications, apply for the job.

- If you need a job fast, apply for a job at a company that has a few positions to fill. You are more likely to get a job there than at a company that only has one job opening.

- Tell people that you are looking for a job.. Networking is one of the best ways to find a job as people who know you can recommend you to potential employers. You never know who will have a good job lined up for you.

Writing an Effective CV

Job applications can be hard work and shouldn’t be taken lightly. We all know that a key factor in applying for a job is writing an effective CV (Curriculum Vitae). A CV is how you introduce yourself to employers; it tells them about you and your skills/experience. To apply for most jobs, you must have a CV. What’s more, your CV may have to compete with many others from rival applicants. As such, the way you create your CV is imperative. It can be the difference between you getting a job or not. Read this useful and practical guide for writing an effective CV.

How to write a CV

When writing your CV, keep it to the point, no employer wants to read all the waffle about your life history. The standard size for a CV is two pages, but there are no fixed rules, and sometimes one or three pages may be the correct amount.

Employers aren’t interested in how great you think you are. They’re more concerned with things that are factual. Writing that you have excellent team-working skills won’t get you anywhere. Anyone can say that it doesn’t make it a fact. What you have to do is back things up by providing facts. When listing your skills and qualities, talk about past experiences. Let’s say you received top marks in a university group presentation. You can use this fact to show that you work well with a team. Apply this idea to every skill you wish to list; it makes your CV more sincere when looking for a job.

Make your CV specific to the job you’re are applying for, for example, if you are applying for a customer service job make sure you show you have excellent communication skills. Another example is if you are applying for a teaching job, there is no need to include all your accounting qualifications and vice versa. An accounting firm will not care if you have had five years of teaching experience.

Time gaps in your CV may have your potential employer thinking, what was s/he doing during those two years. It looks suspicious, who knows what you were up to? If you were travelling around the world during that year, write it! Employers like to see you’re human too.

The way your CV looks is also essential. Many people believe CV’s have to follow a particular format. You have your personal information, skills, experience, and additional info. However, this isn’t true for every CV out there. The layout may depend on the job you’re applying for. If you’re applying for a job in the creative industry, then your CV needs to look a little creative. This showcases your talents rather than having a strict and formal layout. A formal layout is still useful when you’re applying for specific jobs. Traditional business jobs need to have a formal CV, or you’ll look unprofessional. It’s all about looking at the job you’re applying for, and deciding what layout will work best.

One thing you must do for every CV is to ensure all headings are clear and the font is easy to read. A pro tip is not to use lines to separate sections. Some people think this makes their CV look neater. The problem is, some companies scan CVs on the computer. They run a scan and search for certain keywords, etc. This is normally done by companies that have an incredibly high volume of applicants. When the scan sees a straight line, it assumes it’s the end of the CV. So, if you have a line under your personal details, that’s all the scan will pick up.

The most important advice is to tell the truth on your CV. You may think it’s clever to write a few white lies here and there. A lot of people do this as they think it helps give their CV a boost. You lie about something to make your application look better. The problem is, employers will check your curriculum vitae to ensure you’re telling the truth. If they find a lie, then your chances of getting the job are over. Most people tell lies because they’re worried their application isn’t strong enough. In this scenario, you’re better off going out and getting more experience before looking for a job. Do voluntary work to give yourself something to shout about. Don’t lie, it will get you in trouble, and you won’t get hired.

A picture is worth a thousand words, right? When it comes to writing an effective CV, you shouldn’t include any images. Not of yourself, not of anything. Employers are interested in what you have to say, not what pictures you can take. You might be asked to include formal headshots with your application. In which case, you’ll need to do this as it’s an application requirement. But, unless stated, don’t add images to your CV.

Free CV templates to download

There are many websites out there with free cv templates you can download and personalise. You can also find templates which are specific to different jobs. Here are 3 CV templates you can download for free. Just replace the text with your own.

How to Prepare for a Job Interview

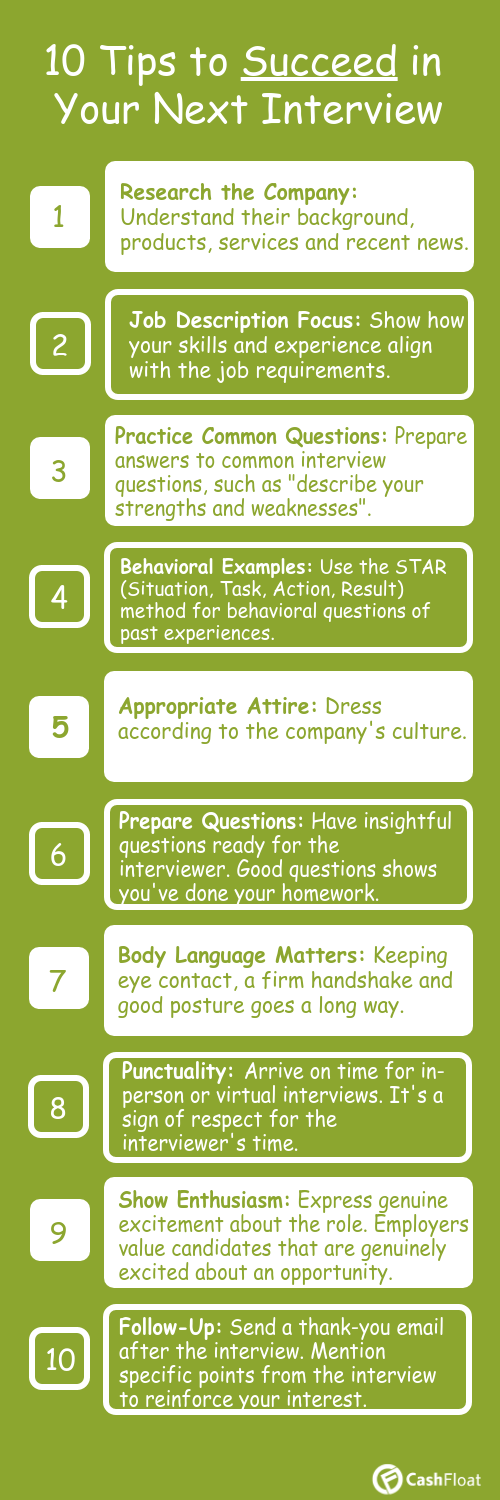

Getting ready for a job interview is super important because it makes you more likely to succeed. When you prepare, you can show the company why you’re a great fit. It also boosts your confidence and helps you handle tough questions. Basically, getting ready for an interview is like getting ready for a big game—it gives you the best shot at winning the job you want. Here are seven tips to help you prepare:

- Dress appropriately

- Research the company and role

- Practise the interview

- Prepare questions

- Prepare for the day-of-interview

- During the Interview

- Post-Interview Follow-Up

One of the first considerations when preparing for a job interview is choosing the right clothes. Dressing professionally, in line with the company culture, is crucial. This includes wearing clean and well-fitting clothes and minimal accessories. Wearing a t- shirt if you’re applying for a plumber’s job may be ok, but wearing a t- shirt for an administrative role will not likely convey the level of professionalism they want to see.

Thoroughly researching the company and the position you’re applying for is essential. Familiarise yourself with the company’s values, mission, products, recent news, and developments. This knowledge will demonstrate your genuine interest during the interview.

Practice is key to interview success. Prepare answers to common interview questions that highlight your skills, experiences, and achievements. Practise your responses with a friend or in front of a mirror to build confidence.

Prepare thoughtful questions to ask the interviewer. These inquiries can cover topics like company culture, team dynamics, and expectations for the role. Asking questions shows your genuine interest in the position.

On the day of the interview, ensure you arrive early to the location, allowing extra time for unexpected delays. Bring multiple copies of your resume and any relevant documents, such as references or certifications. The best interviewee arrives 5 minutes early!

During the interview itself, maintain good eye contact, offer a firm handshake, and greet the interviewer with a friendly smile. Be attentive, listen carefully to their questions, and provide clear and concise responses.

After the interview, send a thank-you email or note to express your gratitude for the opportunity and reaffirm your interest in the position. This small gesture can leave a positive impression and set you apart from other candidates.

Conclusion

Looking for a job must be done correctly from the beginning. When looking for a job, make sure you know which area you want to specialise in and where your skills lie. Don’t write your CV in a rush and ask for professional help in writing it if you think it will be helpful. When attending your interview, keep yourself calm and poised to give potential employers a great first impression. Good luck with your job search!