If you are having problems with your Universal Credit claim, you are not alone. The roll-out of Universal Credit has been far from smooth and many people find themselves in financial difficulties, sometimes very severe, due to these problems. Find out how to solve your problems and sort out your benefits.

- Universal credit system and how to solve any problems that you might have.

- What can you do if there are delays in receiving your payment?

As of June 2023, the Universal Credit System is still being rolled out across the UK. As the system develops, numerous problems have developed alongside it. Many people have had problems with their Universal Credit claim, and have had delays in their payments. Furthermore, the estimated costs of administrating Universal Credit have ballooned to more than seven times the original estimate.

In this article we discuss the problems with the Universal Credit claim system. Although there is not always an easy solution to these problems, we advise UK citizens what they can do to help their situation.

Universal Credit Claim

Universal Credit has faced a number of difficulties in its implementation and administration. We will be looking at these problems as well as examining the reason for this welfare reform and how it has affected the claimants.

- You can appeal any decision regarding Universal Credit within 1 month

- If Universal Credit claimants need an emergency loan, they can apply for a Budgeting Advance at their local Job Centre.

- The roll-out phase of Universal Credit has faced both delays and rising costs.

- There has been criticism about the IT used and the fact claimants can only apply online.

- Delays in receiving benefit means claimants cannot cover their basic day-to-day living costs, are unable to look for work and will have rent arrears.

- A monthly benefit payment is more difficult for low-paid workers who do not have money in hand from their last monthly salary to tide them over.

- Some claimants might have problems in budgeting for the month.

- Joint payments for couples make victims of domestic violence less financially independent.

Making a Universal Credit Complaint

When you make a Universal Credit claim, the relevant party will review your application and your circumstances. They will then allocate a specific amount that you will recieve in benefits. If you are not happy with this decision, you can appeal.

You can appeal as regards Universal Credit for three main reasons:

- Their refusal to award you the benefit

- The amount you receive

- Any sanctions

You should appeal within a month asking for a ‘mandatory reconsideration of the decision’. You will then receive a letter telling you if they uphold your appeal. If they deny your request, the letter will tell you whether you can refer the matter further to the Social Security & Child Support Tribunal.

Budgeting Help/Advance For Universal Credit Claimants

Apart from being entitled to an advance on your first month’s Universal Credit payment, you can also receive a short term loan to cover any emergency household expenses, such as buying a new cooker. You then repay this loan gradually through your regular Universal Credit payments.

Eligibility & Claiming a Budgeting Advance

To be eligible for the Budgeting Advance loan, you must have been getting Universal Credit (or previously other benefits) for at least six months. The only exception is if you need the money to start a new job or to keep an existing one. Also, you must have earned less than £2,600 (individuals) or £3,600 (couples) in the past six months and have repaid any other Budgeting Advance. A Budgeting Advance loan is a great alternative to no guarantor small loans.

The amount you can receive as a loan depends on your ability to pay it back and any savings over £1,000. If you wish to take advantage of this loan system, you should apply to your work coach at your local JobCentre Plus.

| Maximum Payments for Budgeting Advance Loans | |

|---|---|

| Single | Up to £348 |

| Couple | Up to £462 |

| With Children | Up to £812 |

Universal Credit Contact

One of the biggest problems Universal Credit has faced has been in its administration. This has meant that its roll-out phase to cover the whole of Great Britain keeps being delayed. In fact, the government’s Major Projects Authority report on Universal Credit, gave it a red-amber rating in 2012 to reflect their lack of confidence that the government could deliver this project effectively. From the prediction of 2017 for a full transition to Universal Credit, it now looks as if this will not happen until 2020.

The main reason why this delay has happened is because of problems with the senior management involved in this single-payment scheme. Additionally, difficulties with the IT system has delayed the roll-out of Universal Credit. Approximately, £300 million worth of IT work had to be scrapped to be replaced by a new digital service.

Furthermore, the estimated costs of Universal Credit have also ballooned along with its delays. From an initial estimation that its administration would cost £2.2 billion, this was later amended to £12.8 billion for its lifetime. Now the latest estimates predict that it could have final running costs of £15.8 billion.

The online application system for Universal Credit was meant to save on administration costs. It was also meant to prevent paperwork being lost. However, critics of the system say that face-to-face applications are cheaper and faster. Also, vulnerable people are more likely to understand both their entitlements and obligations better if they are explained in a conversation. The further problem is that claimants have 45 minutes to complete their Universal Credit claim. However, there is no reset button. So, if they take longer, they will have to start all over again.

Universal Credit Payments

Delays in Payments

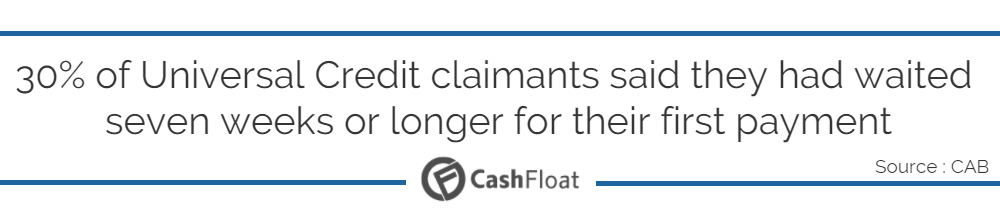

You should receive your first Universal Credit payment within six weeks. However, there have been complaints that admin problems have delayed some claimants from receiving money for much longer. This leads them to face enormous difficulties in covering their basic living costs such as food and transport costs. How can they keep to their ‘Claimant Commitment’ to look for a job if they do not have the money to pay for their bus fare?

Another problem is that they are now supposed to pay their housing costs out of this single payment. What happens is that claimants start to fall behind in paying their rent. Which private landlord will wait over six weeks for their money? Which council can cope with the strain on their budget if tenants are not paying their rent?

This could have repercussions for what is already seen as a housing crisis. Private landlords are already beginning to refuse to rent to anyone who is on benefits. If evictions rise because of these delays, the council will have to put people up in emergency accommodation. Consequently, this will put further strain on already shrinking council budgets.

In a survey carried out by NFA (National Federation of ALMOs), whose members manage 500,000 council homes in England, it was found that 89% of Universal Credit claimants in social housing had fallen into rent arrears.

Universal Credit Pay Dates

With most previous benefits, claimants had the option to have their money paid on a weekly or fortnightly basis. The TUC has been particularly critical of monthly payments saying that most low-paid workers are familiar with receiving wages on a weekly basis and living hand-to-mouth. This gives them no cushion to fall back on when they face delays in receiving their benefits.

Another problem with the monthly benefits is that it requires more skill in being able to budget so that the money is sufficient to cover the claimant for the whole of the month. Some social welfare interest groups worry that this will be a problem for some vulnerable claimants. Many claimants have never dealt with such large sums of money and allocating them, so they meet all their financial obligations as well as having enough to last the entire month.

Summary of Universal Credit Claim

According to the IFS report on Universal Credit, under the previous system of benefits, 2.1 million people keep less than 30% of what they earn when they work due to loss of benefits. Under Universal Credit, the estimates are that only 700,000 will face this problem.

Another problem with this welfare reform is that couples receive a joint benefit payment under Universal Credit. Concern has been voiced that this could make victims of domestic violence less likely to be able to escape an abusive relationship. One of the reasons that women remain in such a situation is that they find it difficult to get away if there is not a degree of financial independence.

FAQs about Universal Credit claim problems

Are Universal Credit claimants the only ones to be eligible for Budgeting Advance?

No. Budgeting Advance loans are also available if you are claiming Employment & Support Allowance, Income Support, Jobseeker’s Allowance or State Pension Credit. They can help anyone in need of a short term quick loan UK.

Why isn’t Universal Credit available in Northern Ireland?

Estimated show that Universal Credit will start in Northern Ireland in 2018. The delay was partly due to worries about its initial administrative difficulties and partly because of delays in the Fresh Start agreement.

Why did this welfare change (to Universal Credit) take place?

According to the Welfare Reform Bill of 2012, the idea behind Universal Credit is to improve claimants’ incentive to work. The new system makes it easier for people who have temporary, low-paid work to move in and out of employment without losing their benefits. The other reason was to simplify welfare provision in the UK so that everything was covered by one single payment.

Are claimants better or worse off with the new welfare system of Universal Credit?

Evidence is contradictory and we will probably not know until there is a full transition to Universal Credit. The other problem is that it seems to be affecting claimants in different circumstances in different ways. According to Citizen’s Advice, 450,000 disabled people and families are worse off under Universal Credit. The Institute for Fiscal Studies (IFS) estimates 3.2 million claimants face an average loss of £1,800 per year whilst 2.2 million people on benefits will have an average annual gain of £1,400.