New addition to the family on the way? This chapter will discuss how to manage a family budget when you have children. Discover the pros and cons of returning to work once you have a baby, and whether paying for childcare makes sense for you.

Story highlights

- Learn financial planning for the arrival of a baby

- Should the mother return to work post-baby? Read about a family budget with one breadwinner

- Learn about Junior ISAs

By the time you decide to start a family, you’ve probably already worked out a budget that works well for you as a couple. You may have chosen to have all your accounts in your joint names, or perhaps you opted to keep your finances completely separate. You may even have put household accounts in a joint account (for the payment of bills and common expenditure) but paid for your personal spending from your own current account. There’s no correct way to handle money in a relationship. So long as it works well for you and neither of you feels resentful.

However, once you decide to have a child together, everything changes. At Cashfloat, we want to help you manage your finances.

In order to avoid needing payday loans UK, we’ve put out this mini-guide to help you. We wanted to emphasise that your budget isn’t set in stone but needs to adapt to take account of your own changing personal circumstances. And there can’t be a more radical change in your lives than having a baby!

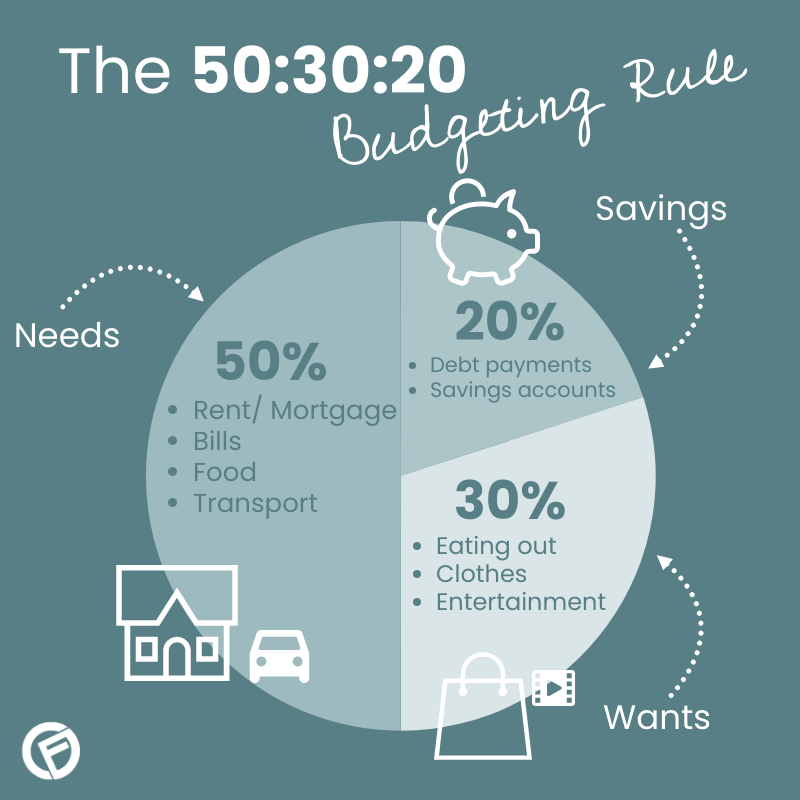

The 50-20-30 rule

If you’ve been following the 50-20-30 Rule (50% for living expenses and essential expenditure, 20% saved and 30% for leisure andentertainment), then you should already be in pretty good financial shape. However, things in life don’t always go according to plan. You might have fallen short of the target with unexpected emergency expenses, taking out same day funding quick loans. Or you may have made a major purchase like taking out a mortgage.

If you find yourself in this situation, don’t panic. You should start putting money by for the birth as soon as you decide to start a family or at least as soon as you learn you’re pregnant. Your goal should be to save at least a third of your salaries or income per month for your piggy bank. This should see you through the first year of the baby’s life. This means that your family budget must be completely overhauled. How can this be done?

Use price comparison websites

Your priority debts give you much less leeway to reduce expenditure although some savings can be made. If you haven’t done so recently, visit some price comparison sites. See how much you can save by changing the tariff and supplier of both your energy providers and your phone/internet company. Do the same for any insurance policies which are up for renewal. Every little helps.

The biggest changes, however, will be made in the category of leisure and entertainment. With a pregnancy, you may find yourself less enthusiastic about socialising. Perhaps other friends have reached the same stage as you and are also more ready to enjoy (cheaper) home-based entertainment. Maybe you could cut down on the clothes you buy or forego a fortnight’s holiday and go for a week instead.

If you are making economising decisions jointly, as a couple, act without pressure and with an element of compromise. Expecting just one half of the couple to make sacrifices for the child you’re both expecting is unfair – it can lead to resentment and even arguments.

Cost of having a baby

Starting a family is one of the most momentous events in life, and it can change every aspect of financial stability. A baby is a huge responsibility. In addition to normal living costs, there is also a looming list of new necessities that are going to need paying for, and for many years.

Although you don’t need to be financially comfortable to start a family, it is essential that you budget for it. In this article, Cashfloat explores financial considerations you must take into account before starting your family.

Budgeting for a baby

It is essential that you really understand exactly how much is coming in and going out every month. Once you do, you can find ways to cut costs that will accommodate the extras needed when you bring your new baby home.

A good budget will help you to know exactly how much income you have and how much you spend every month on bills and other expenses. Use a budget planner that is available online or use the traditional method using a pen and paper to note down your income and expenditure. You can also do some research into how much it will cost for everything you will need for the baby. (Read our post on how to spend less than £2000 on your baby.)

Many people underestimate the true costs of having and raising a child, although there are some benefits available from the government.

Cut down on spending

If you know that your income is going to be curtailed after the baby is born you should try to cut down on your expenditure as soon as possible. Split your expenses into essential and non-essential sections and then see where you can make savings.

For example, there are some simple ways to cut down on shopping by looking for two-for-one offers or shopping at budget supermarkets. Here are some ways to reduce food bills:

- Take advantage of special offers, especially when it is toiletries and cleaning products, which can be safely stored for a long time

- Buy the fruit that is in season

- Buy supermarket own brand products

- Make healthy, filling carbohydrates a staple: rice, pasta, noodles, potatoes

- Note that heavily processed and ‘junk’ food and drink, e.g. soft drinks, tend to be expensive, as provide minimal nutrition

Is there a cheaper alternative to the non-essentials? A latte in the morning can be substituted with something else, and if a gym membership is not used extensively, why not run in the local park, instead? Unfortunately, many couples overestimate the amount of money they have at their disposal and this can lead to a big shock later.

Consider the upfront and ongoing costs of having a baby

There are endless tips for new parents on dedicated websites like Mumsnet, so take the time to explore, and you can soon cut the costs of starting a family.

The best thing to do is to talk to family and friends who have had a baby recently. Ask them what you really need for your baby. Yes, Moses baskets look very cute but as your baby will soon outgrow it, why not make do with a cot instead? Avoid buying many clothes for a newborn. They’ll grow so fast that they probably won’t wear an outfit more than twice before it’s too small. Also, remember that many of your family or friends may like to buy a gift for the baby as well.

Alternatives when you’re on a family budget are to borrow equipment or to buy some things second-hand on reselling websites. Many second-hand shops and websites sell baby furniture for a considerably lower price. You should also wait for sales before buying the most expensive baby items, like a pram and cot.

Friends and family will want to give presents, so ask for larger clothes as well as newborn sizes and don’t be afraid of taking second-hand items which may have only been worn once or twice.

Here are a few upfront baby costs to consider:

- Pram/buggy

- Cot and mattress

- Car seat

- Baby essentials – e.g. nappies, bottles, clothes etc.

- High-chair

- Childcare

It is easy to get carried away with buying cute clothes, fancy changing tables and enticing baby trends, etc. However, it is important that you shop for your baby with a budget. A budget will put the temptation of attractive baby luxuries into perspective. Believe me, your baby will not know the difference and your bank account will thank you for it later.

Top Tip:

Keep the boxes sold with the baby furniture! It will help you sell your equipment when your baby outgrows it.

Parental leave and government benefits

Make sure you claim for all the benefits and allowances that you’re entitled to, both during the pregnancy and

after the baby is born. Don’t forget that you’re also eligible for free prescriptions and dental care. If you’re

employed or have recently stopped working, you are eligible for the Maternity Allowance, and this depends on your National

Insurance contributions. However, even if you are eligible for the full amount, it still won’t be as high as your salary.

This is when you’ll be glad that not only do you have your savings to fall back on but that your budget has been reduced

to take account of your changing circumstances. New parents are entitled to paid parental leave but for some this is not enough to live on. Your partner might also be eligible

for joint leave but it depends on how long you have each been working and how much you are paid. You can read all about

maternity and paternity leave and pay on the

government’s website. Maternity leave is: After birth the new mother must take off 2 weeks (or 4 weeks if you work in a factory). It is very possible that you may not be able to manage on £145.18 a week financially. It is important to consider

the length of your maternity leave and how it is financially going to affect you. You may be able to receive a one-off

£500 grant after you have your first baby (or for multiple births when it is not your first child).

Consider life insurance

Now that you are planning to start a family, it is time to take your responsibility for your children to the next level. There is one essential financial element of life that should never be ignored, yet often is, and that is insurance to cover the mortgage and the possibility of the death of a partner. You should also consider what would happen should you become too ill to work and how your family would cope with bills, so take out adequate ill health and disability policies.

Make it a priority to reduce your debt

One of the biggest mistakes that you can make when starting a family is incurring too much debt. If your overall take-home salary is going to be reduced for an extended period then getting rid of as much debt as possible before your baby is born is the ideal target to aim for. Once payments on overall debts – including mortgage or rent, interest on personal loans and credit cards – take up more than 30% of your salary, you will find it difficult to manage. This is especially true once you have to buy all the extras that come with a little one.

Borrowing money to buy a car may look like an easy option but you are just paying interest for something that is depreciating in value. So, keep your car for as long as it is viable, i.e. until repair costs outweigh the benefits of a new loan. If possible save some money towards a new car so that your overall borrowing is reduced.

After the baby is born, should the mother go back to work?

The decision about whether the mother should return to work when maternity leave concludes is entirely personal. There isn’t a right or wrong answer. If you’re raising the child as a couple, it’s something you’ve probably spoken about during pregnancy, but maybe it didn’t feel ‘real’ until the baby was born. It’s a decision which you should make jointly and whatever you decide will have a direct effect on your budget. Let’s look at this in more detail.

A two-parent household with one parent employed or self-employed

If you decide not to return to work, then you’ll probably need to cut down on expenditure, a routine already in place if

you were saving up during your pregnancy. Surviving on one salary will require sacrifices, but that’s part and parcel of

being a parent. It will also change the dynamics of your relationship. You might have to re-organise your finances so that the partner who

stays at home is paid an amount of money as an ‘allowance’ to cover their personal expenditure. It should be clear that

this sum of money isn’t a favour but is part of your commitment to sharing your lives. The one who stays at home provides

an invaluable service for the entire family unit. This should be recognised and rewarded with some financial independence.

A two-parent household with both parents employed or self-employed

If a two-parent unit and you both decide to return to work, then your most pressing problem will be arranging childcare. Whatever solution you find, it’s essential that you take advantage of government help to pay for this as it will be one of the most expensive additions to your family budget.

Some parents find that a compromise solution is for one of the parents to return to work on a part-time basis. This will help you with the payment of bills. You could also arrange your hours so that you both look after the child and don’t need to pay extra for childcare either. Ultimately, whether this is possible depends on your profession and the possibility (if necessary) of flex-hours.

Budgeting for baby no.2

It has to be said that a second baby usually works out much cheaper than the first. You’ll have all the major equipment already such as the cot, high-chair, etc. as well as clothes. Hopefully you’ll be experienced enough not to purchase non-essentials.

How soon after the first baby to have a second is, again, a personal decision. It depends on how ready you are as a couple both emotionally and financially. Some people prefer to have their children close together to get all the expenses over and done with. Other working women prefer to return to the workplace so that they can once again build up their entitlement to Maternity Allowance.

Savings account for baby

One of the best things you can do for your children is to open a savings account for them as soon as they’re born. This will teach them the value of saving from a very young age. If you choose to open a Junior Individual Savings Account (or Junior ISA), then other family members can also make contributions. It’s tax-free up to a certain limit, and this money is locked away until they’re 18. When they become an adult, they’ll have a nest-egg which will help them financially as they start adult education or a career, and give them greater independence.

Retirement planning

If you haven’t done so already, now would be a good time to start contributing to a pension. If you can max out your contributions towards your pension while you are still young, you will reap the rewards with a healthy pension instead of relying on the small state pension that will probably be available in 30 years.

Most couples will make some financial mistakes, and some will find it hard to adjust to the more restricted lifestyle that being a parent inevitably brings. Being conscious of what those mistakes can help you to avoid becoming financially derailed and taking out short term loans with a direct lender when your baby is born.

We think you’ll enjoy these articles too:

How to Live Frugally

The Best Ways to Pay Bills and Save Some Money!

Chapter 1:

Financial advice for couples moving in together

Chapter 3:

How to feed a family on a small budget