Looking for debt advice? StepChange Debt Charity is now the leading debt help company in the UK. Cashfloat explores it’s history, and what they can help with.

- StepChange began in 1992, inspired by similar organisations in the USA

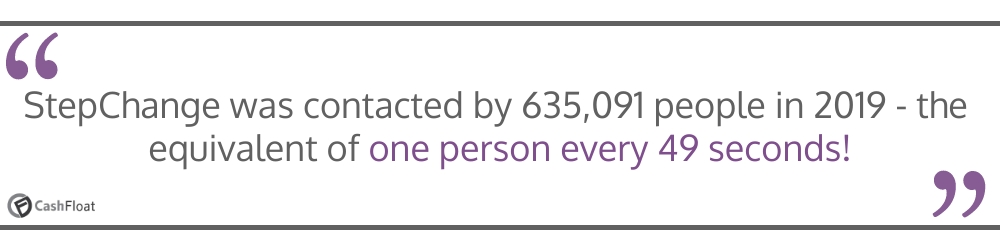

- Today, StepChange help over 600,000 people per year

Cashfloat is a leading payday loan direct lender in the UK. Our loans are not designed to solve long-term money problems. If you are experiencing a long term debt problem, there are many organisations in the UK that can help. One of them is StepChange Debt Charity. In this article, we’ll explain how they could help you.

A Short History of StepChange

If you’ve read Cashfloat’s Guide to Credit Cards you will know that the US was the first country to have widely available consumer credit. As a result, they were also the first country to experience widespread consumer debt. In order to help people who were struggling with debt, the National Foundation For Credit Counselling was set up in America in 1951. This pioneering organisation was quick to spot the need for consumers to be helped with debt and has done a lot to do so right up to today.

As the use of consumer credit became more common in the UK, it was natural that debt was not far behind. While the UK was slower to introduce charitable help for people who were struggling with debt, it did eventually come when the Consumer Credit Counselling Service (which is now known as StepChange) was founded in 1992. This charity was founded by Vic Ware and Malcolm Hurlston after they were inspired by the example set in America.

In 1992, Stepchange became the first dedicated debt charity in the UK and since then they have helped millions of people to overcome debt. Not only were they pioneers in introducing free debt help, but in 1993 they were also the first organisation in the UK to use debt management plans (DMPs), which this guide discusses. StepChange have a long history of helping people to deal with debt and are a great organisation to go to if you are struggling with it.

StepChange’s Expanding Service

Since their foundation in 1992, StepChange have expanded their services enormously. The unprecedented amount of easily available credit in the 90s and the financial crisis of 2008 have meant that their services were always in high demand. Since their foundation, they have opened new offices in the UK, introduced online services, become FCA authorised and even introduced their services to Ireland. The services they provide are now more comprehensive and as time has passed they have been able to help with more than just debt management plans, by assisting with individual voluntary arrangements, debt relief orders, equity release and a very wide range of other debt matters.

The Change Of Name

Before 2012, StepChange was known as the Consumer Credit Counselling Service (CCCS). While this has caused some confusion, they hope that by rebranding themselves more people will become aware of the free help and advice that they can offer.

StepChange is a charity that began with a small pilot scheme in Leeds, but has now become so large that in 2019 they helped over 635,000 people to deal with debt. Read on to find out more about how StepChange could help you to overcome debt.

Stepchange Debt Charity |

Contact Information |

| Website | https://www.stepchange.org/ |

| contactus@stepchange.org | Via Online Tool | Online Debt Advice Tool |

| Telephone | 0800 138 1111 |

| In Writing | StepChange Debt Charity, 123 Albion Street, Leeds, LS2 8ER |

What Services Do StepChange Provide?

The many years of experience that StepChange have allows their advisors to find the best way for a person to deal with their debts. As well as providing advice, they are able to provide practical help and support, while people work their way out of debt, through a debt management plan or an alternative debt solution.

StepChange Provide Professional and Impartial Advice

Dealing with consumers who have had debt problems for over 25 years has allowed the advisors at StepChange to accumulate a wealth of knowledge about debt and the knock on effects it has. StepChange’s advisors are able to provide good free, professional and impartial advice on the best way to tackle any debt problem.

For people who have financial problems, it is often very difficult to deal with the situation by themselves. The stress it can cause and the lack of knowledge that most people have about how to approach debt makes it essential that they are given good, clear advice on how to deal with it. Where people receive bad advice, they can end up in an even worse situation or can end up losing more money.

StepChange dedicate themselves to providing free expert help and advice and are only concerned with helping an individual to best deal with the situation.

Normally when someone contacts StepChange, an advisor will talk through their budget, income and debts to get an overall view of their situation. After having a clear understanding of a person’s situation, their advisors will be able to ensure that any advice they offer and solutions they suggest will be correctly suited to their needs.

After getting a clear picture of a person’s debt problem, they will give advice as to what they think is the best solution. On top of this, when it’s needed, they will do whatever work is needed to make arrangements for a debt solution to happen, such as by negotiating a debt management plan. After this, they will provide practical support and advice for as long as it’s needed. For more information on how they set up debt solutions and on what practical support they provide, look further on in this article.

Make a Call

To receive debt advice from StepChange, you can call them on 0800 138 1111. It usually takes around 40 minutes to complete a call.

Use StepChange’s Online Tool

StepChange’s online Debt Remedy tool allows people to work through their personal circumstances, including their budget, income and debts and to find an appropriate solution to their debt problem. They will recommend the next steps that you should take, tell you what debt solutions are suitable for you and suggest other ways that you can manage your money.

They Try to Help Everyone

Debt advice from StepChange is available to virtually everyone and they aim to help everyone they can. The majority of people will be able to get help from StepChange. While this is the case, for people who are self-employed or people who have business debts, it may be better to contact Business Debtline (in England, Wales or Scotland) or Advice NI (in Northern Ireland), which are charities dedicated to business debts.

By setting up the Debt in Mind collaboration with the Mental Health Foundation, StepChange has also been instrumental in helping many people with debt related stress to keep it at a manageable level.

How StepChange Could Lead You Out Of Debt

As we already mentioned, as well as giving advice to people who are struggling with debt, StepChange are able to provide ongoing practical support while people overcome debt. This is done by helping people to work through debt solutions.

Debt solutions are routes by which people who are in debt are able to tackle the problem in an organised manner. There are a number of ways of tackling debt and the experience that StepChange have means that they are able to help people to work their way through a number of possible solutions. Debt solutions can range from simply selling an asset to pay off a debt to going through a formal legal agreement, such as a debt relief order. There is much to think about with every debt solution, not only can StepChange tell you whether a solution is right for you, but they can also provide the practical support to make sure that a solution is successful.

StepChange DMP (Debt Management Plan)

This Cashfloat guide is dedicated to debt management plans, which are a very commonly used debt solution in the UK. By negotiating lower payments and, usually, a freeze of interest and charges from their creditors, someone who is in debt is able to pay off their debts at a rate that they can afford. The flexibility, simplicity and affordability of debt management plans is why they are such an important tool in the fight to solve debt problems. These were originally developed in the US, and StepChange was the first organisation to promote their use in the UK.

While the basic idea behind a debt management plan is relatively simple, setting one up can be difficult as it requires making negotiations with creditors, as well as careful planning and a certain amount of ongoing management. While a few people are able to organise their own debt management plan, the vast majority of people do it through a third party, such as StepChange. Using StepChange Debt Charity to set up one of these plans is free and they have a large amount of experience, which helps them to handle the complete process of paying off debts under a debt management plan.

Debt management plans are one example of a debt solution that StepChange are able to give good advice about and to provide in depth practical support for. While they are a commonly used debt solution in the UK, they are by no means the only one and there are many others that StepChange are able to help with as well. Read on to see what other debt solutions they are able to help with.

Other Ways To Deal With Debt

Other debt solutions that StepChange are able to help with include:

- Individual Voluntary Arrangements (IVAs)

- Debt Relief Orders

- Bankruptcy (for very serious debt)

- Equity Release and Mortgages

- Administration Orders

- Payment Arrangements

- Debt Arrangement Schemes

- Debt Consolidation Loans

- Minimal Assets Process Bankruptcy

- Protected Trust Deeds

- Equity Release

- Remortgaging

- Selling Assets

- Surrendering Property

- Settlement Offers

- Sequestration

- Temporary Repayment Plans

All of these debt solutions are complicated and require careful consideration before someone embarks on one. Seeing them through to their completion can also be difficult. Getting expert advice on which one to choose and lengthy, in-depth, practical support from StepChange can mean the difference between success and failure.

In Summary…

StepChange are the UK’s leading debt charity and have helped millions of people to overcome even the most serious debt problems. If you are struggling with debt and are wondering where the best place is to go, then StepChange is a great choice. They are able to offer professional and impartial advice and to provide invaluable practical support while people clear themselves of debt. On top of this, as a charity, all the services they provide are free.

If you believe that a debt management plan could help you to overcome a debt problem, then you can go directly to StepChange or you can read the rest of this guide to find out more about how they work.

Chapter 24:

FCA Regulations for Debt Managment Plan Providers

Chapter 26:

Who Are the Debt Advice Foundation?