Looking for a cheaper alternative to renting? Become a property guardian and get cheap rent! Cashfloat provides a step by step guide to becoming a guardian and explores everything you need to know…

- Rent in the UK is more expensive than ever!

- Property guardians pay cheap rent for cool places.

- Guardians can be evicted with short notice.

What is a Property Guardian?

A property guardian is someone who gets cheap rent in return for looking after the property in which they live. In effect, they’re a type of unofficial security guard. They monitor buildings and ensure that they’re not taken over by squatters.

The property guardian industry has exploded over recent years, and it’s not hard to see why. The current average rent in the UK is more than £764 per month. Prices in the capital are much higher, standing at more than £1,543 a month, a 7.7% rise from a year ago.

Step by Step Guide to becoming a Property Guardian:

You can become a property guardian with Dot Dot Dot by:

- Filling out the application form

- If your application is successful, you will emailed a lists of viewings held each week.

- When you find a property you like, you will have a matching call to confirm that you are a compatible tenant

- If this is successful you will need to pay your deposit and provide some details

- The last step is to sign the contract and get the keys.

Rising House Prices – Increasing Property Guardianship

For first time home buyers, the situation is arguably worse. If interest rates stay where they are, first time home buyers can expect to pay a deposit of approx £45,000 on the average first home. Economists have calculated that this means that they will have to earn a combined income of more than £64,000 just to pay the mortgage by 2020. If interest rates go up, incomes will have to rise even more to cover the additional interest payments. It’s a shocking situation.

On top of that, home and rental prices are still rising according to the Nationwide. The building society found that house prices have risen a further 4.9 percent over the course of the year. The average house price in the UK now stands at more than £202,000.

These dramatic increases in the cost of living are now propelling people into the property guardian sector. The promise of lower-than-market rents is alluring and driving ever greater interest. There are some concerns about property guardianship. But these appear manageable and are outweighed by the financial benefits.

What Does a Property Guardian Do?

The basic idea is that property guardians stay in a building while the fate of the building is decided. Often, tenants will remain in buildings through the course of a planning permission application.

You should note that property guardians don’t just stay in other people’s homes. They live in all sorts of buildings, ranging from police stations to hotels to schools. Even churches and medical clinics want people to guard their property from time to time.

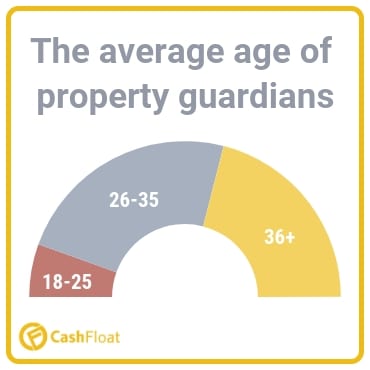

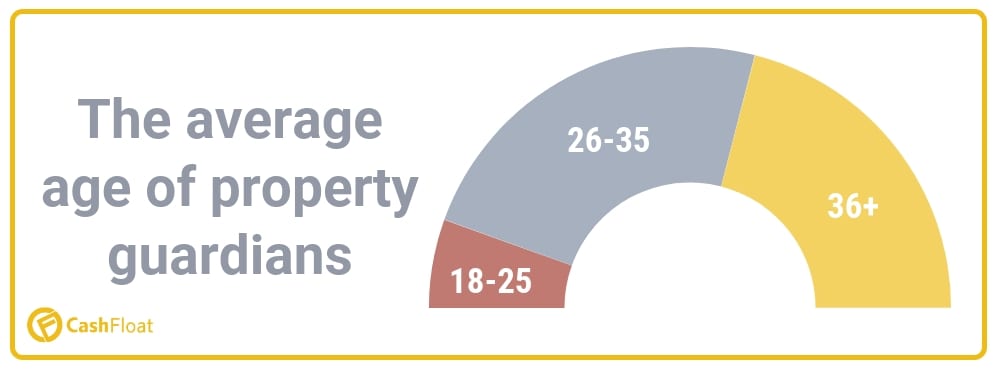

The mainstream perception of property guardians is that they are either students or hippies. But that perception isn’t borne out by the data. A property guardian agency in the UK recently investigated the demographics of property guardians. They found that only 11 percent were between the ages of 18 and 25. 47 percent were between the ages of 26 and 35 and 42 percent were over the age of 36.

The research indicates that young professionals are the most likely to exploit guardianship schemes. Agency managers argue that young professionals choose to be property guardians for two main reason. The first is that it helps them to save for a deposit on their first property. The second is that they avoid spending 80 percent of their income on rent and bills. In fact, there are plenty of benefits of becoming a property guardian. Let’s take a look now.

Advantages of Being a Property Guardian

- Cheaper Rent

- Gain More Space

- The Properties are Unique

- Better Community Life

- You May Protect Heritage Buildings

- You Get to Live in Interesting New Areas

The biggest advantage of being a property guardian is the reduced rent. According to the evidence, it’s possible for renters to save up to 60 percent on their leases by moving to a guardian scheme. Some programs will also include council tax and bills, making the overall saving even greater versus renting privately.

It should be noted, however, that guardianship plans can end at any time. If you do decide to become a property guardian, make sure that it is easy to move out once the tenancy comes to an end. Guardians can be given as little as a week’s notice to find a new property. Most agencies, however, will be able to locate a property for you before you’re due to move out.

If your gaurdianship has come to an end suddenly and you need some cash to pay for rent until you locate another suitable property you apply for a loan with cashfloat to help you pay for this emergency expense.

Crowded cities, like London, are notoriously short on space. Just to get a reasonably sized flat, you can often end up spending more than £2,000 a month. But if you become a property guardian, you potentially avoid all of that claustrophobia. Guardian properties tend to be spacious and excellent value for the price. The amount of rent you pay on each square foot could be as little as 10 percent of the price you’d pay in the private market.

Most of the privately rented accommodation in London is relatively generic. Broadly speaking, you’ve got three categories of properties from which to choose. Either you go for a Victorian style terraced house, with all the problems that come with renting old properties. Or you go for a new build in a block which lacks personality. Or you use a converted local authority building that, again, is short on space and character.

But as a property guardian, you get to live in a much wider range of properties, all with interesting and unique features. Guardians stay in office buildings, fire stations, libraries and many other non-residential properties. Many of these properties are large, highlighting the fact that being a property guardian is one of the cheapest ways that you can get more living space.

Typically, property guardians don’t live all by themselves in enormous offices and fire stations. Instead, they live with other people, sharing out the cost of rent. The cool thing about this is that guardians get to meet and live with new people all the time, which is particularly great for extroverts who love getting to know people from all walks of life.

The guardian community tends to be very friendly, especially if you go through the right agencies. Top agencies always vet their guardians before placing them in buildings alongside other people. They ensure that their guardians are working professionals with stable incomes.

There’s a great community spirit in many guardian properties too. As a result, there are opportunities to get involved in community events. Guardians often volunteer to help charities, like Age UK.

Property guardians don’t just protect buildings that have commercial value. They’re also vital in making sure that society protects its most historically significant buildings. Often buildings that are important from a heritage perspective are in danger of being vandalised. Property Guardians are needed to protect these buildings from damage and attack by vandals. Many property guardians and agencies see what they do as a form of civic duty. They’re stewards, looking after the history of the nation.

Because rents for property guardians are so much lower than for regular folks, they have more choice about where to live. They often get to live in places that would have been unaffordable otherwise. Suppose, for instance, you’ve always wanted to live out in the country but could never afford it. Property guardianship offers you a quick way to do this. Stately homes and country mansions are often vacant and frequently in need of people to stay in them.

What about if you want to live in expensive areas of town? Property guardians get the opportunity to do this too. Rents in places like Leicester Square are astronomical for private renters. But as a property guardian, you can live in the most exciting areas of town, all for a fraction of the cost.

Should You Become a Property Guardian?

Being a property guardian has plenty of advantages, but to do it successfully, you need to be prepared. Research your agency first to make sure that they are a quality outfit. Make sure you live light, and that you are ready to move at any time. Becoming a property guardian can help you save up to 80 percent of your income instead of spending it on rent and bills. this can help you to avoid and relying on small loans online to cover unexpected expenses.

We think you’ll enjoy this article too:

I need to pay my rent and I have no money!