Credit card fraud is very common. How can you stop it from happening to you? In this chapter we’ll explain what the common types of credit card fraud are and what you can do to keep your money safe.

- Find out where the UK ranks in global fraud scales

- Find out what phishing and skimming are all about

- Learn what you can do to keep yourself safe from fraudsters

Even in the early days of credit cards, card holders and card providers have been victims of fraud. If you read Chapter 2 of this guide, you will remember the Chicago debacle, where a whole shipment of credit cards was stolen before they reached their intended destination.

This chapter will explore the prevalent forms of credit card fraud, and safety measures you can take to protect yourself.

Credit Card Fraud

In the early days, and still today, payments made to shops and restaurants, cash withdrawals and balance transfers have all been made fraudulently. Towards the end of the 20th century, there was an increase in online fraud and nowadays many instances of fraud take place online.

This change has necessitated a change in security measures as hackers have found new ways to access the details of credit card accounts either by online phishing, by creating fake online stores or by other methods. Phishing fraudsters often use convincing company logos and many people fall for scams. Not only do these email messages cause losses by card fraud, but they can also infect people’s computers with viruses. And, while new methods of online fraud are created, the old methods, such as card cloning or creating false applications still exist as well.

Credit card fraud is a continual problem for banks and credit card companies. It also causes severe difficulties for any cardholder who is a victim of a scam. Security measures for online shopping have been standardised, but fraud is still a problem and it is important to be vigilant.

If you have already been a victim of credit card fraud take a look at the Money Advice Service’s advice on what to do about it and what you can expect to be covered for.

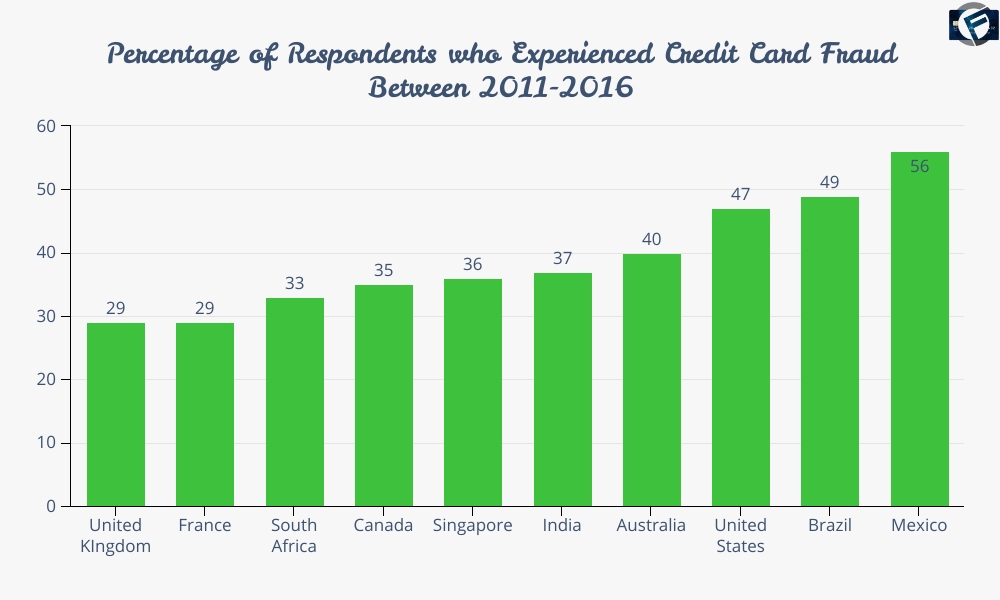

The UK is One of the Worst Places for Card Fraud in the World

A survey conducted in 2016 identified the ten worst countries for card fraud in the world. The United Kingdom just made it onto the list, coming in at number 10. The reliance that people in the UK put on card payment and the strength of the economy makes card users a target to, both, con artists in the UK and internationally operating scams. Although India, Brazil and Mexico were all in the top ten as well it is generally the wealthy nations like the UK, Canada and the US who suffer the most from card fraud.

In the survey, respondents were asked if they had experienced card fraud (on any form of payment card) in the last 5 years. In the UK, 29% of people said they had. That is almost 1 in 3 people. This statistic should give you an indication of just how likely you are to have money stolen from your credit card.

What are the Common Types of Credit Card Fraud?

We are all familiar with the possibility that our credit card could be lost or stolen and then used fraudulently by someone else. Indeed, this is a common way that card fraud is committed. However, many people won’t be aware of other fraudulent scams that take place. Here are some of the other ways that card fraud is committed:

Credit card skimming happens when criminals steal the details of someone’s card and then use them to make a clone or copy card. This can happen anywhere that someone is making a payment with a card. In order to capture a person’s card details, fraudsters use a device which is able to read the details of the person’s card. The device will be placed where the card is put to make a normal transaction, such as over the insertion point of an ATM. When the card is put in the device reads the card details and the criminals are able to use them to create a clone of their victim’s card. Victims are left completely unaware that their details have even been taken. To avoid this, card users should inspect any devices they use to make a transaction for skimming equipment before they present their card.

Another more basic form of skimming is when cards are taken out of sight during payment. Cashiers, waiting staff and anyone who takes card payment could possibly photograph the details of someone’s card and use them to make a clone card. You should always make sure that payments are taken from your card where you can see.

Phishing is the criminal act of contacting cardholders by email, post or phone in order to collect their card details. Fraudsters will often pretend to be a member of staff at the bank and will say that they need to take their victim’s card details for administrative purposes. Alternatively, they could pretend to be anyone who needs to take card details as a form of payment. After obtaining a person’s card details, they can then use them to create a clone or copy of their card and can steal money from it.

You should always be aware of the risk of phishing and should make sure that you are absolutely sure of the identity of anyone you reveal your card details to. Genuine callers from a bank will never ring their customers and ask for their card details and very few businesses will do this as well. You should be very wary of anyone who contacts you either by phone, email or post and asks for your card details.

If you do get calls from someone claiming to be from your bank, energy supplier, or another company, it is always a good idea to ring them back before you make any form of payment or provide your card details. For example, let’s say you get a phone call offering you instant loans without a credit check from Cashfloat. A quick phone call to us will verify that this is a scam, as we do not offer no credit check loans, nor will we ever call you up to offer you a loan unless you have applied.

An old form of credit card fraud which still exists today is application fraud. This is when a fraudster obtains a person’s personal details and then uses them to make an application for a credit card on their behalf. After obtaining a credit card registered to their victim’s name, they can then use it to make fraudulent purchases, cash withdrawals or to transfer money.

This form of fraud is known as identity theft and can happen to people who don’t even own credit cards. Often, the first that someone will hear of it is when they are contacted by a bank or credit card provider to say that they have reached their credit limit!

The common ways that credit card details are stolen online are by hacking and through the use of viruses and malware. Computer hackers are sometimes able to gain access to customer information stored on legitimate websites and then to steal credit card details from there. These details are then either used directly by the hackers or sold on to people who will pay for them. Viruses and malware act in a similar way, but are more likely to target the personal computers of individual people. After infecting a person’s computer, they are able to search for any stored card information and to pass this back to the people who created the virus or malware.

Another way that card fraud is committed online is by the creation of fake online stores. Criminals may create a legitimate looking new website to lure their victims into making a purchase. After someone enters their card details to pay for an item, they are stolen and then cloned or payments that someone makes for an item are never fulfilled. A more advanced version of this is where criminals create a copy of a legitimate website. People seeking to pay for the goods or services of a legitimate business are tricked into entering their card details into a website which is not actually owned by the legitimate company that they were trying to make a payment to.

How to Prevent Yourself from Becoming a Victim of Credit Card Fraud

During the first year of the coronavirus pandemic there was a rise in credit card fraud, as more people did their shopping online and fell victim to the latest online scams. In recent years, there have also been several high-profile breaches of security where major websites have been hacked, and customer’s data has been stolen. With the rise in online scams and with the traditional scams still existing there has never been a time to be more careful.

Next up, Cashfloat will look at the simple ways in which you can make sure that your credit card details are kept safe and that you don’t end up falling victim to credit card fraud.

While the threat of credit card fraud is always with us, this shouldn’t necessarily mean that you should be reluctant to use or even own a credit card. If you follow some basic precautions, you should be able to keep your money safe. Here’s what to do:

- Keep your Card Safe

- Never Share your Card Details Unless you are Sure it’s Okay

- Shop Safely Online

- Beware of Skimming Devices

- Check your Credit Card Statement and be Careful with Paperwork

- Shredding Documents And Statements

- Receipts For Purchases And Cash Withdrawals

- Keep your PIN Number Safe

- Lost Or Stolen Cards

- Keep your Personal Details Up To Date

- Watch Out for Email Scams

- Stay Alert to SMS Alerts

Keeping your card safe is the most important action you can take for credit card security and to prevent any fraudulent transactions. Make sure you know where your card is at all times and don’t let anyone take it out of your sight. When using your card at an ATM make sure that, when you are typing in the PIN number, you keep the details away from anyone else who is around. NEVER give your PIN number to anyone else. After making a withdrawal from an ATM, take away the receipt. Always shred or otherwise destroy old statements and receipts containing your card number. Always make sure that the card is returned to you after making a purchase and don’t leave it anywhere that someone else could find it.

Criminals can be very ingenious and have learned plenty of ways to persuade people to reveal their credit card information. As we said earlier, phishing is a big problem. Always make sure that you are absolutely certain of the identity of anyone that you reveal your card details to.

Never give your credit card details to anyone over the phone unless you have confirmed their identity and made the call for payment yourself. The same applies to contact that you receive by email or post. Make sure that you contact the relevant company and confirm that they contacted you. After you have done so, make sure you contact them through the correct channel in order to make a payment. This applies equally to anyone who contacts you, whether they be finance companies, such as banks, credit card companies, payday lenders or brokers, or whether they are utility providers or private companies, such as Sky TV.

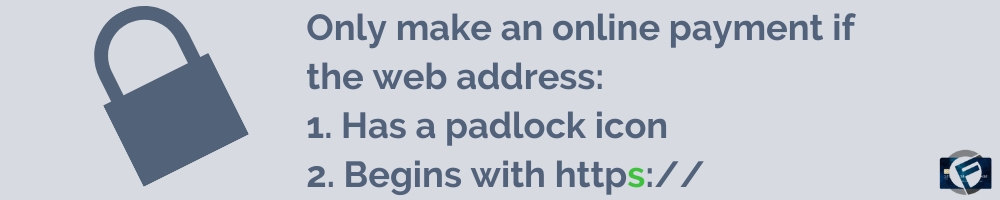

With online fraud being such a danger, it is important that everyone adopts safe online credit card habits. Before shopping online, you should research the company that you are buying from and make sure that they are legitimate. Trustpilot is a good place to check website legitimacy. After ensuring that a website is legitimate, make sure that payments are secure when you make them. Secure payments should have a padlock in the address bar, next to the web address and the address should start with https:// (with the ‘S’ standing for ‘secure’). It is also important to make sure that your antivirus and computer software are up to date. If your antivirus is not functioning properly, you could have your card details stolen by a virus or malware. On top of this, make sure that the Wi-Fi you use is secure when you make a payment. Wi-Fi provided in public places, such as cafes, is generally not safe to use.

As we said earlier, skimming is a common method by which fraudsters are able to copy people’s card details in order to make clone or copy cards. Skimming is normally done with devices which are attached to other legitimate devices which accept payment by card. Card users should keep an eye out for these. Skimming devices will often protrude unnaturally from the device that the cardholder is trying to use. Before you insert your card into anything, make sure that you check it first and if you suspect anything, then make your payment in another way.

This is one of the boring parts of credit card security, but it is very important to check your credit card statement for any transactions that you did not make.

The most important thing to check is that all the transactions listed are ones that you recognise. Sometimes a transaction may show under a different name to that of the shop that you bought an item from and this can make things confusing. This might be because the shop is part of a larger group of companies. However, if you are aware of or have a record of what things you bought and when, then you should be able to work things out. Ideally, you should keep all credit card receipts and check the amounts against the ones listed on the statement.

If there are any invalid transactions, you should ring your credit card company and find out what has happened. Banks and card companies have a dedicated team of credit card security staff who will be able to answer your queries and resolve any problems.

Shredding documents and statements that hold account numbers, names and addresses or other personal details can help prevent not only credit card fraud, but identity theft as well. Fraudsters may be able to steal enough of your credit card information from your paperwork in order to steal money from you. Alternatively, thieves who steal people’s personal information may be able to clone someone’s identity and use this to commit other crimes, such as application fraud.

Have you ever been to an ATM and seen the last customer’s receipt sticking out of the machine? This is common practice but one that you should avoid. Receipts do not hold the full account number of the card. Nevertheless, they can be useful to sophisticated criminals who can extract information from the details held on the paper slip.

Therefore, as a further means of keeping a credit card account secure, you should keep all receipts until the end of the month. Then, check them off against the monthly statement, and then either file them away safely or shred them.

The PIN (Personal Identification Number) for your card will usually arrive in a separate postal envelope to your card when you receive it. This is one of the security measures that card companies take. You will also receive advice that you should always keep your card and PIN number separate.

Ideally, you should memorise the PIN and destroy the paper it came on, but if you find this too difficult, the two items should still be kept separate. That is, keep the PIN and card in separate wallets or pockets so that if the card is stolen or lost no one else will be able to make cash withdrawals from the account.

Never give your PIN number to anyone else, and this includes close family and friends. When using a card online, you should never be asked for your PIN, so if this happens, it should set off alarm bells. The PIN is only required at an ATM or when making a purchase with a card reader.

It goes without saying that you should immediately report any card that is lost or stolen. This is when good planning comes into play. Keep a record of all card accounts you have and the emergency number to call for them. This will allow you to report the problem and get the card cancelled if you lose it.

When you lose a credit card, speed is of the essence. After you have reported a card as missing, any fraudulent transactions are the responsibility of the card company and you will be able to reclaim any money that you have lost.

When you move to a new address, always make sure that your bank or card company is informed immediately. Any statements or other information which go to a former address are in danger of falling into the wrong hands.

Consider using the mail redirection service so that you can be sure that all mail comes to your new address when you move. This will prevent you losing mail from any senders that you have forgotten about.

We all use email, and while most will be rightly suspicious when we receive an email to say that we have won the lottery in a far flung corner of the earth and that we need to give our credit card details in order to claim it, many financial frauds are still conducted through email. While many frauds are easy to spot, many are not. Always consider the possibility that emails you receive could be fraudulent.

Therefore, to stay safe, do not answer any email that asks for your card details or any other personal information that could result in the theft of your identity or funds. Banks and other companies frequently send out messages advising customers that they will never ask for account details by email so if you do receive one of these requests it is highly likely to be a scam designed to gain access to your account details. As with phone scams, only make payments or give out your card details after you have confirmed the identity of the company who is trying to contact you and after you have contacted them yourself through the correct channel.

One of the advantages of new technology is the way in which it assists both the customer and the banks to help secure accounts against credit card fraud. Most card companies now have an alert system available that can be activated should there be unusual activity on an account. This might be multiple cash withdrawals or multiple purchases made in unusual locations. If you receive an SMS from your credit card company alerting you that a fraud may have been committed on your account make sure that you answer it immediately.

Summary: Credit Card Fraud

Hopefully, having read this article you will be more aware of the dangers of credit card fraud. Fraud is a risk that all credit card owners need to be aware of and to take steps to avoid. Knowing even the basics of credit card security can save you a great deal of money and stress.

If you have been a victim of credit card fraud look at the Money Helper website on what to do about it.

The next chapter in this series by Cashfloat looks at how to deal effectively with credit card debt.

To read about loan management software for financial companies, click here.